Form T1223

What is the Form T1223

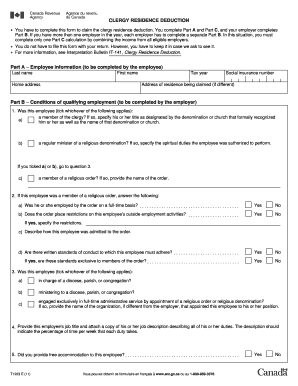

The Form T1223 is a tax document used primarily for reporting specific financial information to the IRS. It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The form serves various purposes depending on the taxpayer's situation, including reporting income, deductions, and credits. Understanding the function of the Form T1223 is crucial for effective tax management and compliance.

How to use the Form T1223

Using the Form T1223 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and expense receipts. Next, fill out the form by entering the required information in the designated fields. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the taxpayer's preference.

Steps to complete the Form T1223

Completing the Form T1223 can be broken down into a series of clear steps:

- Collect all necessary financial documents.

- Download the Form T1223 from an official source.

- Fill in personal information, including name, address, and Social Security number.

- Report all income sources accurately.

- Detail any deductions or credits applicable to your situation.

- Review the form for any errors or omissions.

- Submit the form according to the chosen method.

Legal use of the Form T1223

The legal use of the Form T1223 is governed by IRS regulations. It is important to ensure that the form is filled out truthfully and accurately, as any discrepancies may lead to penalties or audits. The form must be submitted by the appropriate deadlines to maintain compliance with federal tax laws. Utilizing a reliable eSignature solution can enhance the legal standing of the form by ensuring proper authentication and security during the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Form T1223 vary based on the taxpayer's situation. Generally, individual taxpayers must submit their forms by April 15 of the following tax year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes in deadlines to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submission of the Form T1223.

Required Documents

To complete the Form T1223 effectively, several documents are typically required:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any relevant financial statements.

Having these documents ready will streamline the process of filling out the Form T1223 and help ensure accuracy in reporting.

Quick guide on how to complete form t1223

Effortlessly Prepare Form T1223 on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Form T1223 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Form T1223 with Ease

- Find Form T1223 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, either via email, text (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or errors that require the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form T1223 and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t1223

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form t1223?

The form t1223 is a specific document used for tax purposes in a variety of business transactions. By utilizing airSlate SignNow, users can easily fill out, send, and eSign the form t1223, ensuring that all parties involved have a smooth and efficient process. This digital solution not only saves time but also enhances accuracy in completing the form t1223.

-

How can airSlate SignNow help with completing form t1223?

AirSlate SignNow streamlines the process of completing the form t1223 by allowing users to fill it out digitally and include electronic signatures. The platform provides a user-friendly interface that guides you through the necessary fields, ensuring compliance and correctness. By using airSlate SignNow, you can simplify your workflow and reduce the possibility of errors in form t1223.

-

Is there a cost associated with using airSlate SignNow for form t1223?

Yes, airSlate SignNow offers a range of pricing plans tailored to meet the needs of businesses of all sizes. Depending on your requirements for eSigning and document management, you can select a plan that best suits your needs while ensuring that handling the form t1223 remains cost-effective. For extensive usage, volume discounts may also be available.

-

What features does airSlate SignNow provide for managing form t1223?

AirSlate SignNow includes various features that enhance the management of form t1223, such as customizable templates, audit trails, and automated workflows. These functionalities not only streamline document handling but also improve compliance and security. Users can easily track the status of their form t1223 to ensure timely processing.

-

Can I track the status of my form t1223 once it is sent?

Yes, airSlate SignNow allows users to track the status of their form t1223 in real-time. You will receive notifications when the form t1223 is viewed and signed, providing you with peace of mind and ensuring timely follow-ups. This tracking capability enhances transparency in your business operations.

-

Does airSlate SignNow integrate with other software for form t1223 processing?

Absolutely! AirSlate SignNow offers seamless integrations with popular business applications and CRM systems, which makes processing form t1223 more efficient. Integrating these tools allows for better data management and smoother workflows, ensuring that document handling aligns with your overall business strategy.

-

What benefits does eSigning provide for the form t1223?

ESigning the form t1223 with airSlate SignNow provides numerous benefits, including faster turnaround times and reduced paperwork. It eliminates the need for physical signatures, which can delay processes, thus enhancing the efficiency of your operations. Additionally, eSigning ensures a legally binding agreement, giving you confidence in the validity of the form t1223.

Get more for Form T1223

- Form ssa 561 u2 printable

- Nc 210 nc 310 declaration of physician attachment to petition courts ca form

- Sae proficiency areas part 1 crossword answers form

- Consent for emergency medical treatment child care centers form

- Application for title to a manufactured home when ownership is at form

- The warranty and parts request richeson form

- Instructions for form ct 636 alcoholic beverage production

- Edgewater park dog license form attention

Find out other Form T1223

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors