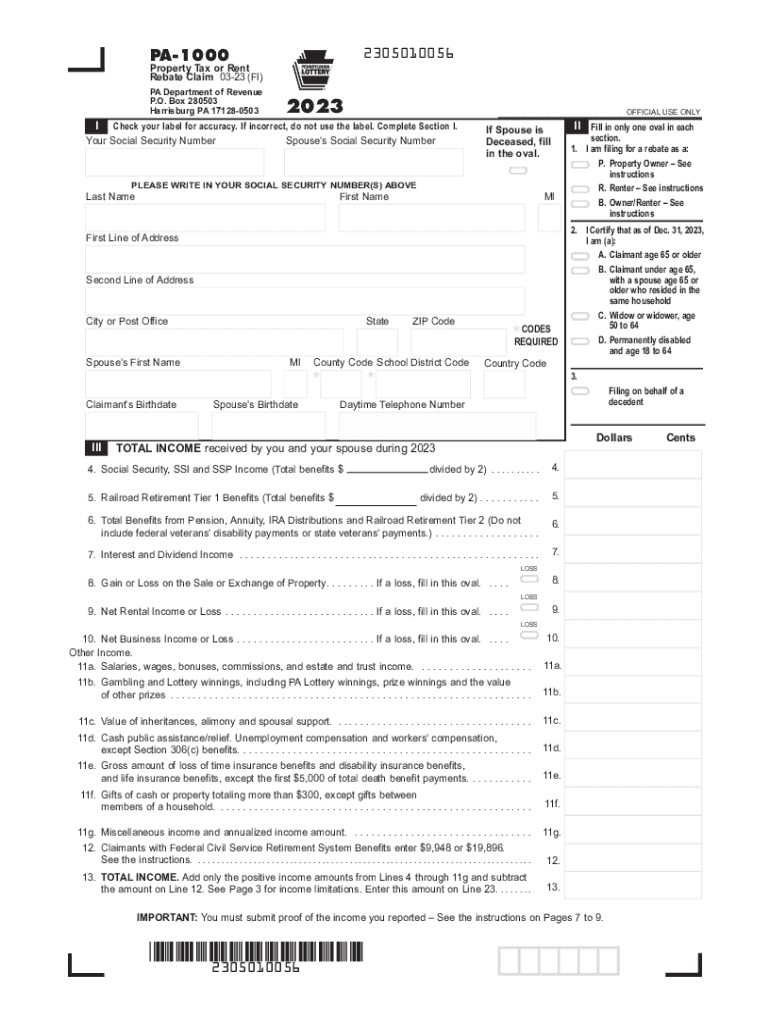

Property Tax or Rent Rebate Claim PA 1000 FormsPublications 2023-2026

Understanding the Pennsylvania Rent Rebate Application

The Pennsylvania Rent Rebate Application, commonly referred to as the PA-1000 form, allows eligible residents to claim rebates on rent paid. This program is designed to assist low-income individuals, particularly seniors and people with disabilities, by providing financial relief. The rebate amount is based on the amount of rent paid and the applicant's income level, with specific income thresholds established by the state.

Eligibility Criteria for the Rent Rebate Application

To qualify for the rent rebate, applicants must meet certain criteria:

- Applicants must be residents of Pennsylvania.

- Applicants must be at least sixty-five years old, or be a widow/widower aged fifty-one or older, or be permanently disabled.

- Income must not exceed the limits set by the state, which are adjusted annually.

It is essential to review the current income limits and age requirements to ensure eligibility before applying.

Steps to Complete the Rent Rebate Application

Completing the PA-1000 form involves several key steps:

- Gather all necessary documentation, including proof of income and rent payments.

- Obtain the PA-1000 form, which can be filled out online or printed for manual completion.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form by the specified deadline, either online, by mail, or in person.

Following these steps carefully can help streamline the application process and reduce the likelihood of errors that may delay processing.

Required Documents for the Rent Rebate Application

When applying for the rent rebate, specific documents are required to support the application:

- Proof of income, such as tax returns or Social Security statements.

- Receipts or statements showing the total rent paid during the year.

- Identification documents, which may include a driver's license or state ID.

Ensuring that all required documents are included can help facilitate a smoother review process by the state.

Form Submission Methods

Applicants have several options for submitting the PA-1000 form:

- Online: The form can be completed and submitted through the official state website.

- By Mail: Completed forms can be mailed to the appropriate state office, with attention to the correct address for processing.

- In-Person: Applicants may also choose to submit their forms in person at designated state offices.

Choosing the right submission method can depend on personal preference and the urgency of the application.

Filing Deadlines for the Rent Rebate Application

It is crucial for applicants to be aware of the filing deadlines for the rent rebate application. Typically, applications must be submitted by June 30 of the year following the tax year for which the rebate is claimed. Late submissions may not be accepted, so timely filing is essential to ensure eligibility for the rebate.

Quick guide on how to complete property tax or rent rebate claim pa 1000 formspublications 704712625

Complete Property Tax Or Rent Rebate Claim PA 1000 FormsPublications effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Property Tax Or Rent Rebate Claim PA 1000 FormsPublications on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Property Tax Or Rent Rebate Claim PA 1000 FormsPublications effortlessly

- Obtain Property Tax Or Rent Rebate Claim PA 1000 FormsPublications and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to store your changes.

- Select your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Property Tax Or Rent Rebate Claim PA 1000 FormsPublications to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property tax or rent rebate claim pa 1000 formspublications 704712625

Create this form in 5 minutes!

How to create an eSignature for the property tax or rent rebate claim pa 1000 formspublications 704712625

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a rent rebate application?

A rent rebate application is a formal request submitted by tenants to receive a reduction in their rental payments based on certain qualifying criteria. This application typically requires specific documentation to justify the request. Understanding the process can help tenants effectively utilize the airSlate SignNow platform for efficient submissions.

-

How can airSlate SignNow assist with the rent rebate application process?

airSlate SignNow streamlines the rent rebate application process by allowing users to create, send, and eSign documents easily. Our platform helps track the status of applications and ensures that all required documents are securely signed and submitted. This simplifies the overall process, making it more efficient for both tenants and property managers.

-

What features does airSlate SignNow offer for managing rent rebate applications?

airSlate SignNow provides features such as customizable templates, real-time tracking, and audit trails for rent rebate applications. Users can also automate reminders for important deadlines and securely store documents in the cloud. These features ensure that the rent rebate application process is organized and stress-free.

-

Is there a cost associated with using airSlate SignNow for rent rebate applications?

Yes, there is a pricing structure for using airSlate SignNow, which is designed to be cost-effective for both individuals and businesses. Our plans offer various features to suit different needs, ensuring that anyone needing to submit a rent rebate application can do so without breaking the bank. Check our pricing page for detailed information on available plans.

-

Can I integrate airSlate SignNow with other tools for rent rebate applications?

Absolutely! airSlate SignNow supports various integrations with tools like CRM systems, document management software, and cloud storage platforms. This allows users to incorporate the eSigning capabilities seamlessly into their existing workflows for rent rebate applications, enhancing productivity.

-

What benefits do I gain by using airSlate SignNow for my rent rebate application?

Using airSlate SignNow for your rent rebate application provides numerous benefits, such as time savings, improved accuracy, and enhanced security. The platform ensures that all documents are signed electronically, reducing paperwork and the chances of errors. Additionally, you can access your applications from anywhere, making it highly convenient.

-

How secure is the data submitted with a rent rebate application through airSlate SignNow?

Security is a top priority at airSlate SignNow. All data related to your rent rebate application is encrypted and protected by advanced security protocols. This ensures that sensitive information remains confidential and secure throughout the signing and submission process.

Get more for Property Tax Or Rent Rebate Claim PA 1000 FormsPublications

- Guest ride along policy amp application city of mountlake terrace form

- Field trip form for rehearsal highline public schools highlineschools

- Vipassana igatpuri form

- Donation form for a team

- Vilas county zoning form

- Context clues worksheet 2 humanities answer key form

- West salem police department statement form case voluntary arrested mirandized westsalempolice

- Certification for safe transport of refrigeration equipment and tax id form form 4530 100 facility identification air pollution

Find out other Property Tax Or Rent Rebate Claim PA 1000 FormsPublications

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement