LLC Tax Return in the State of KY TurboTax Support Intuit 2023-2026

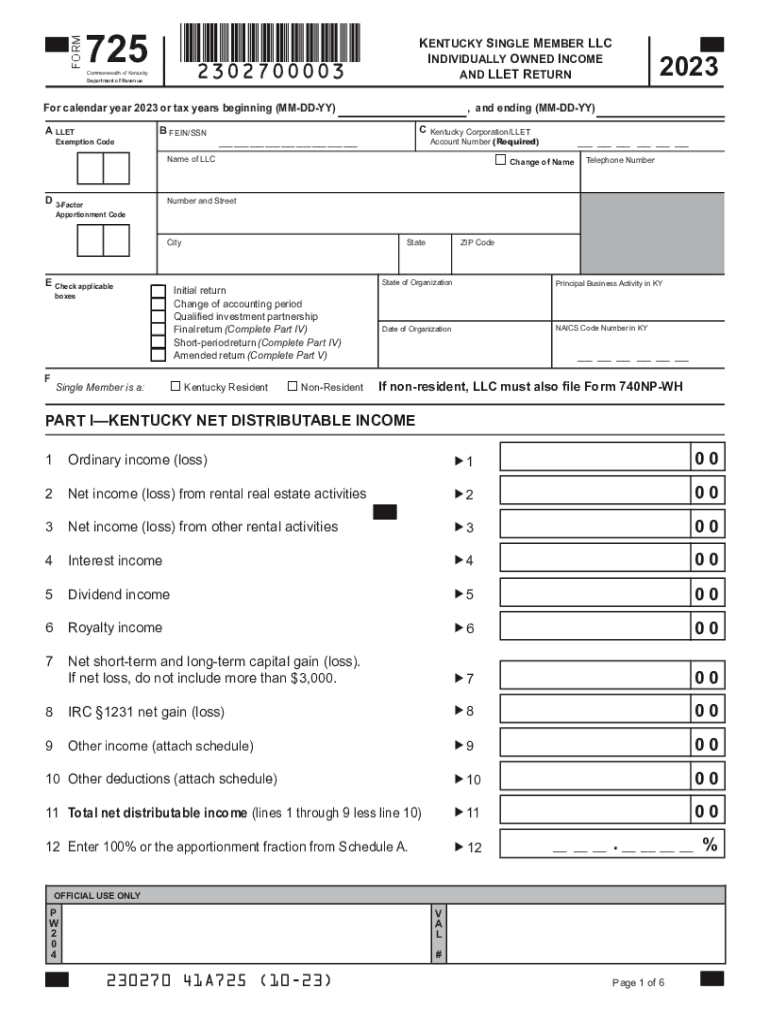

Understanding the 2006 Kentucky 725 Tax Form

The 2006 Kentucky 725 tax form is essential for individuals and businesses in Kentucky to report their income and calculate their tax liability. This form is specifically designed for certain types of entities, including limited liability companies (LLCs) and partnerships. Understanding its purpose and requirements can help ensure accurate and compliant tax reporting.

Key Elements of the 2006 Kentucky 725 Tax Form

The 2006 Kentucky 725 form includes several critical components that taxpayers must complete. Key elements include:

- Identification Information: Taxpayers must provide their name, address, and identification number.

- Income Reporting: The form requires detailed reporting of all income sources, including business income, dividends, and interest.

- Deductions and Credits: Taxpayers can claim various deductions and credits to reduce their taxable income.

- Tax Calculation: The form includes a section for calculating the total tax owed based on reported income and applicable tax rates.

Steps to Complete the 2006 Kentucky 725 Tax Form

Filling out the 2006 Kentucky 725 tax form involves several steps:

- Gather Required Documents: Collect all necessary financial documents, including income statements and receipts for deductions.

- Fill Out Identification Section: Enter the required identification information accurately.

- Report Income: Carefully list all sources of income, ensuring to include all relevant details.

- Claim Deductions: Identify and enter any deductions or credits you are eligible for.

- Calculate Tax Liability: Use the provided calculations to determine the total tax owed.

- Review and Sign: Double-check all entries for accuracy before signing and dating the form.

Filing Deadlines for the 2006 Kentucky 725 Tax Form

It is crucial to be aware of the filing deadlines for the 2006 Kentucky 725 tax form to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year. However, if you require additional time, you may file for an extension, which grants you an extra six months to submit your return.

Penalties for Non-Compliance with the 2006 Kentucky 725 Tax Form

Failing to file the 2006 Kentucky 725 tax form on time or inaccurately reporting information can result in significant penalties. Common penalties include:

- Late Filing Penalty: A percentage of the unpaid tax amount may be assessed for each month the return is late.

- Accuracy-Related Penalty: Additional charges may apply if the IRS finds discrepancies in reported income or deductions.

Form Submission Methods for the 2006 Kentucky 725 Tax Form

Taxpayers can submit the 2006 Kentucky 725 tax form through various methods:

- Online Submission: Many taxpayers opt to file electronically using tax preparation software.

- Mail: The completed form can be mailed to the appropriate tax office, ensuring to allow sufficient time for delivery.

- In-Person: Some may choose to deliver their forms in person at designated tax offices.

Quick guide on how to complete llc tax return in the state of ky turbotax support intuit

Complete LLC Tax Return In The State Of KY TurboTax Support Intuit effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it on the internet. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents promptly without any holdups. Handle LLC Tax Return In The State Of KY TurboTax Support Intuit on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to edit and electronically sign LLC Tax Return In The State Of KY TurboTax Support Intuit with ease

- Locate LLC Tax Return In The State Of KY TurboTax Support Intuit and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details using tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign LLC Tax Return In The State Of KY TurboTax Support Intuit and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct llc tax return in the state of ky turbotax support intuit

Create this form in 5 minutes!

How to create an eSignature for the llc tax return in the state of ky turbotax support intuit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 2006 725 tax in business operations?

The 2006 725 tax is crucial for businesses as it details specific tax obligations from 2006. Understanding this tax can help businesses avoid penalties and ensure compliance. Utilizing tools like airSlate SignNow can streamline the process of signing and submitting relevant documents.

-

How can airSlate SignNow assist with documents related to the 2006 725 tax?

airSlate SignNow simplifies the signing and management of documents tied to the 2006 725 tax. The platform allows you to easily eSign tax-related documents, ensuring timely submissions. You'll benefit from a cost-effective and efficient solution that saves time and resources.

-

What features does airSlate SignNow offer for tax management, specifically for the 2006 725 tax?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage. These features are perfect for managing documents associated with the 2006 725 tax. You'll enjoy a seamless experience that enhances document accuracy and compliance.

-

Is airSlate SignNow pricing competitive for managing the 2006 725 tax documentation?

Yes, airSlate SignNow offers competitive pricing tailored for businesses managing the 2006 725 tax documentation. With different plans to suit various needs, businesses can find a cost-effective solution. The affordability combined with extensive features makes it an attractive option.

-

Are there collaboration tools available in airSlate SignNow for the 2006 725 tax?

Absolutely! airSlate SignNow includes collaboration tools that facilitate teamwork around documents related to the 2006 725 tax. You can invite team members to review and sign documents in real-time, ensuring everyone is on the same page and compliant with tax obligations.

-

Can airSlate SignNow integrate with other software for managing 2006 725 tax-related tasks?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications, enhancing its functionality for the 2006 725 tax management. This integration allows for streamlined workflows, reducing the likelihood of errors. It's essential for businesses looking to optimize their tax processes.

-

What benefits does airSlate SignNow provide for individuals dealing with the 2006 725 tax?

Individuals can benefit from airSlate SignNow by accessing a user-friendly platform designed for easy eSigning of documents related to the 2006 725 tax. The solution helps reduce the hassle of paperwork and makes tax preparation more efficient. Its straightforward interface ensures that you can focus on your tax obligations without distraction.

Get more for LLC Tax Return In The State Of KY TurboTax Support Intuit

- Fashion show registration form sample

- 1755 lake cook road form

- Appeal uniformity

- Irocc form

- International club twinning recognition application twin_formpdf lionsclubs

- Pta certificate of recognition form

- Cpd 44112 summary report chicago police department form

- Driver license renewal options nevada dmv form

Find out other LLC Tax Return In The State Of KY TurboTax Support Intuit

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS