Kentucky Income Tax Payment Options Online by Check 2023

Understanding Kentucky Income Tax Payment Options

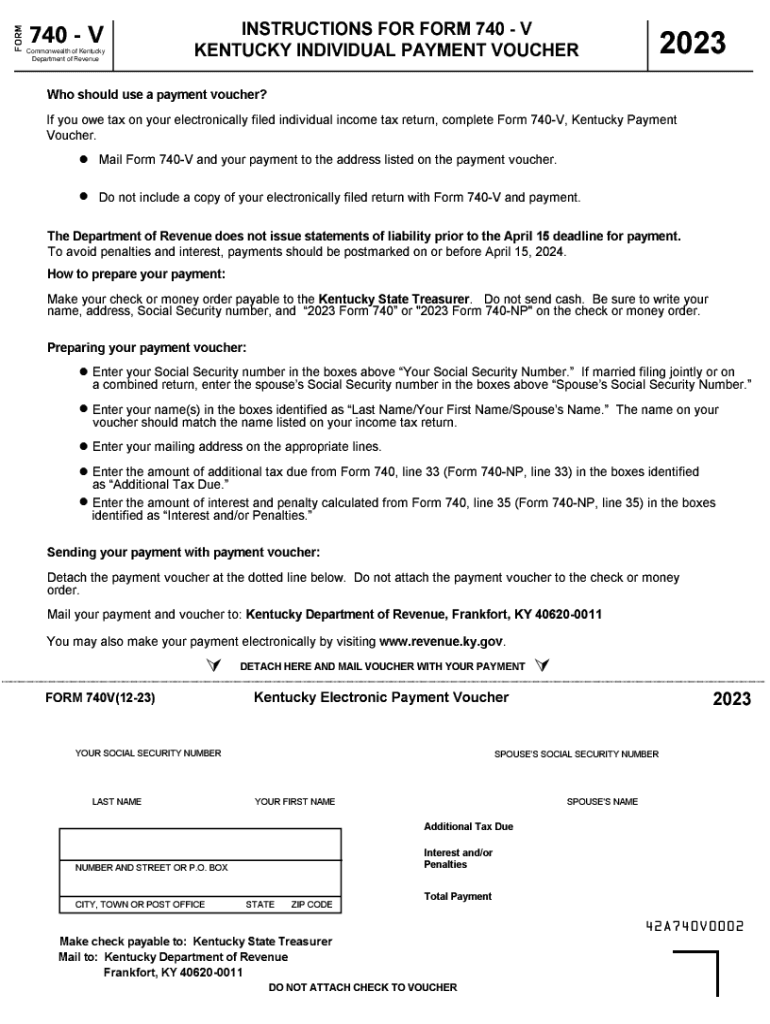

The Kentucky income tax payment options allow taxpayers to settle their tax obligations conveniently. One of the primary methods is the online payment system, which enables individuals to pay their taxes using a checking account. This method is secure and efficient, ensuring that payments are processed quickly. Taxpayers can access this service through the Kentucky Department of Revenue's official website.

Steps to Complete the Kentucky Income Tax Payment Online

To successfully complete your Kentucky income tax payment online, follow these steps:

- Visit the Kentucky Department of Revenue's website.

- Navigate to the payment section and select the option for online payments.

- Enter your personal information, including your Social Security number and the amount due.

- Provide your checking account details for the transaction.

- Review the information for accuracy and submit your payment.

After submission, you will receive a confirmation of your payment, which is essential for your records.

Required Documents for Payment

When preparing to make your Kentucky income tax payment online, ensure you have the following documents ready:

- Your most recent tax return.

- Information on any deductions or credits you may be claiming.

- Your bank account details for the payment transaction.

Having these documents at hand will streamline the payment process and help avoid any potential issues.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for Kentucky income tax payments. Generally, the state tax return is due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also note any specific deadlines for estimated payments, which are typically due quarterly.

Legal Use of Online Payment Options

The online payment options provided by the Kentucky Department of Revenue are legally sanctioned methods for fulfilling tax obligations. Taxpayers are encouraged to use these options to ensure timely payments and compliance with state tax laws. Utilizing the online system helps maintain accurate records and can simplify future tax filings.

Penalties for Non-Compliance

Failure to comply with Kentucky tax payment deadlines can result in penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to stay informed about their obligations and to make payments on time to avoid these consequences.

Quick guide on how to complete kentucky income tax payment options online by check

Complete Kentucky Income Tax Payment Options Online By Check effortlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Handle Kentucky Income Tax Payment Options Online By Check across all platforms using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to alter and eSign Kentucky Income Tax Payment Options Online By Check with ease

- Obtain Kentucky Income Tax Payment Options Online By Check and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature utilizing the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Kentucky Income Tax Payment Options Online By Check to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky income tax payment options online by check

Create this form in 5 minutes!

How to create an eSignature for the kentucky income tax payment options online by check

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the 2017 Kentucky 740 instructions?

The 2017 Kentucky 740 instructions provide detailed guidance on filing state income taxes, including necessary forms and schedules. Key features include clear explanations of deductions, credits, and filing requirements specific to Kentucky residents. This ensures that users can confidently complete their tax returns while taking full advantage of available benefits.

-

How can I access the 2017 Kentucky 740 instructions?

You can find the 2017 Kentucky 740 instructions on the Kentucky Department of Revenue's official website. The instructions are available for download in PDF format for easy viewing and printing. This makes it convenient for taxpayers to refer to the instructions while preparing their returns.

-

Are there any fees associated with filing using the 2017 Kentucky 740 instructions?

Generally, there are no direct fees for accessing the 2017 Kentucky 740 instructions themselves, as they are provided online for free. However, if you choose to use tax preparation software or professional services, there may be associated costs. It's important to factor these into your overall tax filing budget.

-

How does airSlate SignNow integrate with the 2017 Kentucky 740 instructions?

airSlate SignNow seamlessly integrates with the 2017 Kentucky 740 instructions by allowing users to eSign their documents securely and efficiently. This means that once you've prepared your tax forms using the instructions, you can easily send them for signatures electronically. This not only speeds up the process but also ensures compliance and security.

-

What benefits does airSlate SignNow offer when dealing with the 2017 Kentucky 740 instructions?

Using airSlate SignNow with the 2017 Kentucky 740 instructions enhances document management and signing processes. The platform is user-friendly and provides a cost-effective solution for eSigning forms, eliminating the need for printing and mailing. This signNowly reduces time spent on tax filing.

-

Can the 2017 Kentucky 740 instructions help me with deductions?

Yes, the 2017 Kentucky 740 instructions include comprehensive information on various deductions available to taxpayers. Understanding these deductions can signNowly reduce your taxable income and potentially increase your refund. It's crucial to review these instructions to ensure you are maximizing your tax benefits.

-

Is it easy to follow the 2017 Kentucky 740 instructions for beginners?

Absolutely! The 2017 Kentucky 740 instructions are designed to be user-friendly, even for those who may not have prior tax filing experience. Each section provides step-by-step guidance, making it accessible for beginners to understand and follow along easily.

Get more for Kentucky Income Tax Payment Options Online By Check

Find out other Kentucky Income Tax Payment Options Online By Check

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe