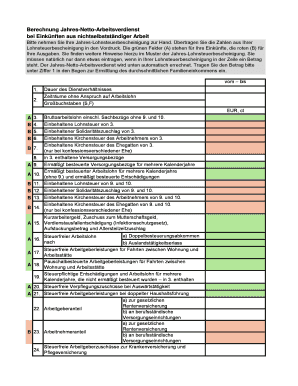

Jahres Netto Arbeitsverdienst Form

What is the Jahres Netto Arbeitsverdienst

The Jahres Netto Arbeitsverdienst refers to the net annual income earned from employment. This figure is crucial for various financial assessments, including tax filings and loan applications. It represents the total earnings after deducting taxes and other mandatory contributions. Understanding this concept is essential for individuals managing their finances, as it impacts budgeting and financial planning.

How to use the Jahres Netto Arbeitsverdienst

Using the Jahres Netto Arbeitsverdienst involves accurately calculating your net income to inform financial decisions. This figure can be used to assess eligibility for loans, determine tax liabilities, or evaluate personal budgets. To utilize this information effectively, individuals should gather all relevant income documents, including pay stubs and tax forms, to ensure an accurate calculation.

Steps to complete the Jahres Netto Arbeitsverdienst

Completing the Jahres Netto Arbeitsverdienst involves several steps:

- Gather all income sources, including wages, bonuses, and any additional earnings.

- Calculate gross income by summing all earnings before deductions.

- Deduct applicable taxes and contributions, such as federal and state taxes, Social Security, and Medicare.

- Review the final figure to ensure accuracy, as this will be your net income for the year.

Legal use of the Jahres Netto Arbeitsverdienst

The Jahres Netto Arbeitsverdienst is legally recognized in various contexts, particularly in tax filings and financial applications. It is important to report this figure accurately to comply with tax regulations and avoid penalties. In the United States, the Internal Revenue Service (IRS) requires individuals to report their net income on tax returns, making this figure essential for legal compliance.

Required Documents

To accurately determine your Jahres Netto Arbeitsverdienst, several documents are typically required:

- Pay stubs from your employer, reflecting your earnings and deductions.

- Tax forms, such as W-2s or 1099s, which summarize your annual income.

- Records of any additional income sources, including freelance work or investments.

Form Submission Methods

Submitting the Jahres Netto Arbeitsverdienst can be done through various methods, depending on the context. For tax purposes, individuals can file their returns online, via mail, or in person at designated IRS offices. Each method has its own requirements, so it's important to choose the one that best suits your needs and ensures timely submission.

Quick guide on how to complete jahres netto arbeitsverdienst

Effortlessly Prepare Jahres Netto Arbeitsverdienst on Any Device

Digital document management has become increasingly favored among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without any holdups. Manage Jahres Netto Arbeitsverdienst on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Jahres Netto Arbeitsverdienst effortlessly

- Find Jahres Netto Arbeitsverdienst and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with features offered by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you would like to send your form, whether by email, SMS, invitation link, or downloading it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign Jahres Netto Arbeitsverdienst while ensuring excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jahres netto arbeitsverdienst

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'jahresnetto arbeitseinkünfte' mean?

'Jahresnetto arbeitseinkünfte' refers to the annual net income derived from employment. Understanding this term is crucial for budgeting and financial planning, especially when using platforms like airSlate SignNow for document management and e Signing.

-

How can airSlate SignNow help with my 'jahresnetto arbeitseinkünfte' documentation?

airSlate SignNow simplifies the process of handling documents related to 'jahresnetto arbeitseinkünfte.' By providing secure electronic signatures and efficient document workflows, businesses can streamline their financial documentation processes.

-

What features does airSlate SignNow offer that relate to 'jahresnetto arbeitseinkünfte'?

airSlate SignNow offers features such as customizable templates and automatic calculations for financial documents, which can be particularly beneficial for managing 'jahresnetto arbeitseinkünfte.' These tools help ensure accuracy and efficiency in financial reporting.

-

Is there a pricing plan for airSlate SignNow suitable for freelancers dealing with 'jahresnetto arbeitseinkünfte'?

Yes, airSlate SignNow offers flexible pricing plans that cater to freelancers and small businesses. This makes it easy to manage 'jahresnetto arbeitseinkünfte' related documentation without incurring high costs.

-

Can I integrate airSlate SignNow with other financial software for tracking 'jahresnetto arbeitseinkünfte'?

Absolutely! airSlate SignNow integrates seamlessly with various financial and accounting software. This integration helps you effectively manage 'jahresnetto arbeitseinkünfte' while keeping all your financial documents organized.

-

What are the benefits of using airSlate SignNow for managing 'jahresnetto arbeitseinkünfte'?

Using airSlate SignNow for 'jahresnetto arbeitseinkünfte' provides benefits such as enhanced security, reduced paperwork, and improved compliance. These advantages facilitate a smoother workflow and minimized errors in your financial documentation.

-

Is airSlate SignNow user-friendly for individuals new to 'jahresnetto arbeitseinkünfte'?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible even for those unfamiliar with 'jahresnetto arbeitseinkünfte.' The intuitive interface helps users efficiently manage their documents and understand financial terms.

Get more for Jahres Netto Arbeitsverdienst

Find out other Jahres Netto Arbeitsverdienst

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement