Plain Language Security Instrument Freddie Mac Single Family 2021-2026

Understanding the Texas Home Equity Affidavit and Agreement

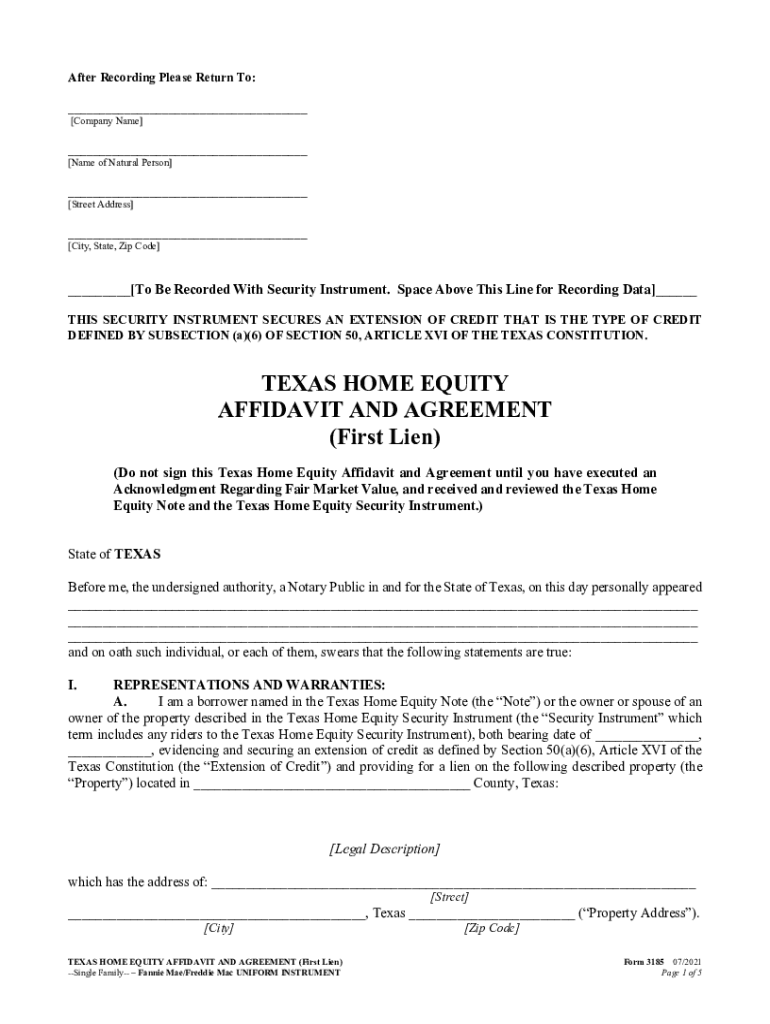

The Texas home equity affidavit and agreement is a crucial legal document used in home equity lending. It outlines the terms and conditions under which a homeowner can access equity in their property. This document ensures compliance with Texas laws governing home equity loans, which are designed to protect borrowers. The affidavit typically includes details about the loan amount, interest rates, and repayment terms, as well as the rights and responsibilities of both the lender and the borrower.

Key Elements of the Texas Home Equity Affidavit and Agreement

Several key components are essential in the Texas home equity affidavit and agreement. These include:

- Borrower Information: Names, addresses, and other identifying details of all borrowers.

- Property Description: A detailed description of the property being used as collateral.

- Loan Terms: Specifics regarding the loan amount, interest rate, and repayment schedule.

- Affidavit Statement: A declaration confirming that the borrower understands the terms and conditions of the agreement.

- Signatures: Required signatures of all parties involved, including witnesses if necessary.

Steps to Complete the Texas Home Equity Affidavit and Agreement

Completing the Texas home equity affidavit and agreement involves several steps:

- Gather Necessary Information: Collect all required personal and property information.

- Fill Out the Affidavit: Accurately complete the affidavit form, ensuring all details are correct.

- Review the Document: Carefully review the completed affidavit for accuracy and completeness.

- Obtain Signatures: Ensure all required parties sign the document, including witnesses if applicable.

- Submit the Document: Provide the signed affidavit to the lender as part of the loan application process.

Legal Use of the Texas Home Equity Affidavit and Agreement

The Texas home equity affidavit and agreement serves a legal purpose in securing home equity loans. It is essential for ensuring that both lenders and borrowers adhere to Texas laws regarding home equity transactions. This document must be executed in compliance with the Texas Constitution, which mandates specific provisions to protect homeowners. Failure to comply with these legal requirements can result in penalties or the invalidation of the loan agreement.

Eligibility Criteria for Home Equity Loans in Texas

To qualify for a home equity loan in Texas, borrowers must meet certain eligibility criteria. These typically include:

- Homeownership: The borrower must own the property outright or have sufficient equity.

- Creditworthiness: Lenders will assess the borrower’s credit history and score.

- Income Verification: Proof of stable income is often required to ensure the borrower can repay the loan.

- Debt-to-Income Ratio: Lenders may evaluate the borrower’s existing debts relative to their income.

Common Mistakes to Avoid with the Texas Home Equity Affidavit and Agreement

When completing the Texas home equity affidavit and agreement, it is important to avoid common pitfalls, such as:

- Incomplete Information: Failing to provide all required details can delay the loan process.

- Incorrect Signatures: Not having all necessary signatures can render the document invalid.

- Ignoring Legal Requirements: Not adhering to Texas laws regarding home equity can lead to legal complications.

Quick guide on how to complete plain language security instrument freddie mac single family

Complete Plain Language Security Instrument Freddie Mac Single Family seamlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Plain Language Security Instrument Freddie Mac Single Family on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Plain Language Security Instrument Freddie Mac Single Family effortlessly

- Find Plain Language Security Instrument Freddie Mac Single Family and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact confidential information with tools that airSlate SignNow specifically provides for this purpose.

- Formulate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within just a few clicks from any device you choose. Modify and eSign Plain Language Security Instrument Freddie Mac Single Family to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct plain language security instrument freddie mac single family

Create this form in 5 minutes!

How to create an eSignature for the plain language security instrument freddie mac single family

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas home equity affidavit and agreement?

A Texas home equity affidavit and agreement is a legal document that outlines the terms and conditions of a home equity loan in Texas. It specifies the borrower's rights and responsibilities, ensuring compliance with Texas law. This document is vital for protecting both lenders and borrowers during a home equity transaction.

-

How can airSlate SignNow assist with the Texas home equity affidavit and agreement?

airSlate SignNow provides a simple and efficient platform for creating, sending, and signing Texas home equity affidavits and agreements. Our eSignature solution is legally compliant, ensuring that your documents are valid and secure. By using airSlate SignNow, you can streamline the document management process, saving both time and money.

-

What are the pricing options for using airSlate SignNow for document signing?

airSlate SignNow offers a variety of pricing plans designed to suit different business needs, whether you require basic features or advanced options for creating Texas home equity affidavits and agreements. Our plans are cost-effective, providing excellent value for businesses looking to manage document signing efficiently. For specific pricing details, please visit our website.

-

Is airSlate SignNow compatible with other software for integrations?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow when handling Texas home equity affidavits and agreements. Our platform supports popular tools like Google Drive, Salesforce, and Dropbox, allowing for easy document management and collaboration. Check our integrations page for a full list of compatible applications.

-

What security measures does airSlate SignNow implement for document signing?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the Texas home equity affidavit and agreement. We use industry-standard encryption and secure servers to protect your data throughout the signing process. Additionally, we comply with legal regulations to ensure that all signatures are valid and secure.

-

Can multiple parties sign the Texas home equity affidavit and agreement using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple parties to eSign the Texas home equity affidavit and agreement conveniently and securely. The platform facilitates easy collaboration, making it simple for all involved parties to sign from anywhere, whether in-person or remotely.

-

What are the benefits of using airSlate SignNow for my Texas home equity documents?

Using airSlate SignNow for your Texas home equity affidavit and agreement offers numerous benefits, including increased efficiency, cost savings, and enhanced security. Our easy-to-use interface ensures that your document workflow is smooth and hassle-free. Moreover, our legally binding eSignatures make the entire process quicker and more reliable.

Get more for Plain Language Security Instrument Freddie Mac Single Family

- Fc 029 form

- Angle of elevation and depression trig worksheet form

- Beneficiary nomination form template

- Self declaration form for scholarship 443896256

- Fast food nutrition web quest answers form

- Palkkatodistus malli word form

- Skillbridge training plan example form

- New patient welcome kit family medicine centers of south form

Find out other Plain Language Security Instrument Freddie Mac Single Family

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document