Vat Challan Form

What is the VAT Challan Form

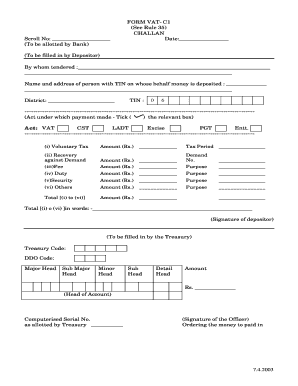

The VAT Challan Form is a crucial document used by businesses to report and pay Value Added Tax (VAT) obligations to the relevant tax authorities. This form serves as an official record of the VAT collected on sales and the VAT paid on purchases, facilitating accurate tax calculations. It is essential for maintaining compliance with tax regulations and ensuring that businesses fulfill their financial responsibilities. The VAT Challan Form typically includes details such as the taxpayer's identification number, transaction amounts, and applicable tax rates.

How to Obtain the VAT Challan Form

To obtain the VAT Challan Form, businesses can access it through the official website of their state’s tax authority. Most states provide a downloadable version of the form in PDF format, allowing users to print and fill it out. Additionally, some tax offices may offer physical copies of the form for those who prefer to complete it in person. It is advisable to check for any updates or changes to the form to ensure compliance with current regulations.

Steps to Complete the VAT Challan Form

Completing the VAT Challan Form involves several key steps to ensure accuracy and compliance. Begin by entering your business details, including the taxpayer identification number and contact information. Next, accurately report the total sales and purchases for the reporting period. Calculate the VAT collected and the VAT paid, ensuring that the figures align with your financial records. Finally, review the form for any errors before signing and submitting it to the appropriate tax authority. Proper completion of the form is essential to avoid penalties and ensure timely processing.

Legal Use of the VAT Challan Form

The VAT Challan Form is legally binding when completed correctly and submitted to the relevant tax authority. It serves as proof of tax payments and compliance with VAT regulations. To maintain its legal validity, ensure that all information provided is accurate and that the form is submitted by the required deadlines. Additionally, electronic submissions may be subject to specific regulations, so it is important to adhere to the guidelines established by the tax authority regarding e-filing.

Key Elements of the VAT Challan Form

Key elements of the VAT Challan Form include the following:

- Taxpayer Identification Number: A unique identifier for the business.

- Transaction Details: Information about sales and purchases during the reporting period.

- VAT Amounts: Calculated VAT collected on sales and VAT paid on purchases.

- Signature: Required to validate the form submission.

- Date of Submission: Indicates when the form is submitted to the tax authority.

Form Submission Methods

The VAT Challan Form can typically be submitted through various methods, including online filing, mail, or in-person submission at designated tax offices. Online submission is often the most efficient method, allowing for immediate processing and confirmation. When submitting by mail, ensure that the form is sent to the correct address and that it is postmarked by the submission deadline. In-person submissions may require scheduling an appointment, depending on the tax office's policies.

Quick guide on how to complete vat challan form 14886538

Easily Prepare Vat Challan Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary forms and store them securely online. airSlate SignNow equips you with all the tools required to swiftly create, edit, and eSign your documents without delays. Handle Vat Challan Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to Edit and eSign Vat Challan Form Effortlessly

- Obtain Vat Challan Form and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form—via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Vat Challan Form while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat challan form 14886538

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VAT challan form download process?

The VAT challan form download process typically involves visiting the official taxation website or utilizing a reliable e-signature platform. With airSlate SignNow, users can seamlessly download, fill out, and eSign the VAT challan form, ensuring compliance and accuracy without the hassle.

-

Is there a fee for downloading the VAT challan form?

Downloading the VAT challan form itself is usually free through government portals. However, airSlate SignNow offers a cost-effective solution for eSigning and managing the form more efficiently, ensuring a streamlined process for all your documentation needs.

-

Can I use airSlate SignNow for multiple VAT challan form downloads?

Yes, airSlate SignNow allows users to handle multiple VAT challan form downloads and manage them easily in one place. This feature simplifies the process, enabling you to organize and retrieve all your forms efficiently.

-

What are the benefits of using airSlate SignNow for VAT challan forms?

Using airSlate SignNow for your VAT challan forms offers numerous benefits including enhanced security, faster processing times, and the ability to eSign documents from anywhere. Additionally, it reduces the need for physical paperwork, making your workflow more efficient.

-

Does airSlate SignNow integrate with accounting software for VAT challan forms?

Yes, airSlate SignNow integrates with various accounting software solutions, allowing for a smooth workflow when managing your VAT challan form downloads. This integration enables users to easily upload and eSign their forms directly from their accounting platforms.

-

Is the VAT challan form download compatible with mobile devices?

Absolutely! The VAT challan form download feature of airSlate SignNow is fully optimized for mobile devices. This means you can conveniently download, complete, and eSign your forms on the go, ensuring accessibility wherever you are.

-

What features does airSlate SignNow offer for VAT challan form management?

airSlate SignNow provides features such as document templates, eSigning capabilities, and secure storage for all your VAT challan forms. These tools make managing your forms easier and more streamlined, enhancing productivity and compliance.

Get more for Vat Challan Form

- Ares registration form

- Client consultation card form

- Antrag auf erteilung eines nationalen visums 101189124 form

- Certificate of insurance request form template

- World war 1 in color video guide episode one catastrophe answers form

- Travel form ciee ciee

- Plumbing permit pdf nbc form no a 06 republic of

- Medical office lease agreement template form

Find out other Vat Challan Form

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation