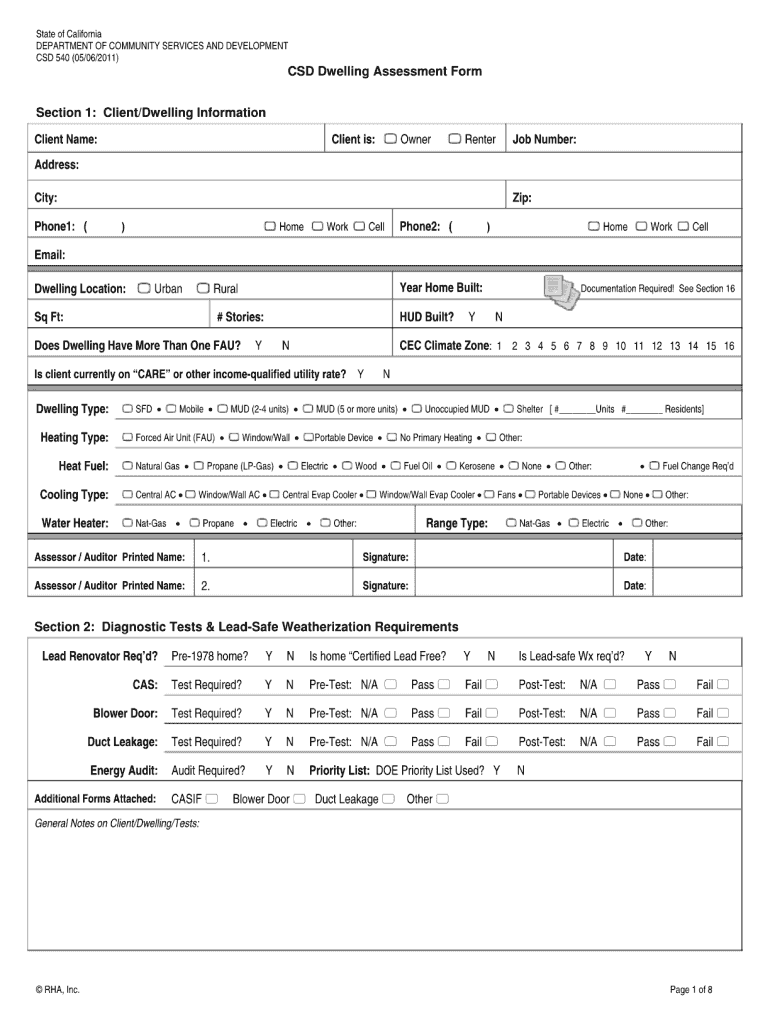

Csd 540 Form

What is the Csd 540 Form

The Csd 540 Form is a specific document used in the United States for tax purposes. It is primarily utilized by individuals to report their income and calculate their tax obligations. This form is essential for ensuring compliance with federal tax laws and is a key component of the annual tax filing process. Understanding the Csd 540 Form is crucial for taxpayers to accurately report their financial information and avoid potential penalties.

How to use the Csd 540 Form

Using the Csd 540 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow the instructions provided with the form to fill in your personal information, income details, and deductions. It is important to double-check all entries for accuracy before submission. Finally, submit the completed form to the appropriate tax authority, either electronically or by mail.

Steps to complete the Csd 540 Form

Completing the Csd 540 Form requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, report your total income from all sources, ensuring to include any taxable interest or dividends. After calculating your total income, apply any deductions or credits you qualify for, which can significantly reduce your tax liability. Finally, review the form for any errors and sign it before submission.

Legal use of the Csd 540 Form

The legal use of the Csd 540 Form is governed by federal tax regulations. To ensure that the form is legally valid, it must be completed accurately and submitted by the designated deadline. Electronic submissions are accepted, provided they comply with the standards set by the IRS. Additionally, the form must be signed, either physically or electronically, to confirm its authenticity. Adhering to these requirements helps avoid legal complications and potential fines.

Filing Deadlines / Important Dates

Filing deadlines for the Csd 540 Form are critical for compliance. Typically, the form must be submitted by April fifteenth of each year, unless this date falls on a weekend or holiday, in which case the deadline may be extended. Taxpayers should also be aware of any specific state deadlines that may apply. Filing on time is essential to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the Csd 540 Form, certain documents are required. These include income statements such as W-2 forms from employers, 1099 forms for freelance or contract work, and documentation for any other income sources. Additionally, records of deductions, such as receipts for medical expenses or charitable contributions, should be gathered. Having these documents ready will streamline the completion process and ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Csd 540 Form can be submitted through various methods. Taxpayers have the option to file online using approved e-filing software, which is often the quickest and most efficient method. Alternatively, the form can be mailed to the appropriate tax authority, ensuring it is postmarked by the filing deadline. In some cases, individuals may also submit the form in person at designated tax offices. Each method has its own advantages, so choosing the right one depends on personal preference and circumstances.

Quick guide on how to complete csd 540 form

Prepare Csd 540 Form effortlessly on any gadget

Online document management has become favored by enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without holdups. Manage Csd 540 Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centric procedure today.

How to modify and electronically sign Csd 540 Form with ease

- Obtain Csd 540 Form and then click Get Form to begin.

- Employ the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, through email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device of your choice. Modify and electronically sign Csd 540 Form and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the csd 540 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Csd 540 Form and how is it used?

The Csd 540 Form is a crucial document for filing California state income taxes. It helps users report their income, claim deductions, and calculate their tax liabilities efficiently. Using airSlate SignNow, you can easily eSign the Csd 540 Form, ensuring a quick and secure submission process.

-

How does airSlate SignNow assist with the Csd 540 Form?

airSlate SignNow simplifies the process of completing and eSigning the Csd 540 Form. With our platform, users can fill out the form digitally, invite others to sign, and store completed documents securely in one place. This eliminates the need for printing and physical signatures, streamlining tax filing.

-

Is there a cost involved in using airSlate SignNow for the Csd 540 Form?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. Regardless of the plan, you can manage and eSign the Csd 540 Form efficiently. Investing in our solution can save you time and resources during tax season.

-

Can I integrate airSlate SignNow with other software to manage the Csd 540 Form?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Microsoft Office. This means you can pull data directly into the Csd 540 Form from other tools, improving efficiency and productivity.

-

What benefits does eSigning the Csd 540 Form offer?

eSigning the Csd 540 Form with airSlate SignNow offers several benefits, including faster processing times and enhanced security. Digital signatures are legally binding, making your eSigned form compliant with state regulations. Plus, you can track the signing process in real-time.

-

How secure is my information when using airSlate SignNow for the Csd 540 Form?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption protocols to protect your information while completing the Csd 540 Form. This ensures that your sensitive tax information remains confidential throughout the entire process.

-

Can I access the Csd 540 Form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile use, allowing you to access and eSign the Csd 540 Form from your smartphone or tablet. This flexibility lets you manage your tax forms on the go, ensuring you never miss a deadline.

Get more for Csd 540 Form

- Firemarshal utah govstate boards councilsutahfire service certification councildps fire marshal form

- Smithville merit badge college fill online printable form

- Agreement telecommuting form

- Application for undergraduate admission university of maine system form

- Services office of libraries technology uofl libraries at form

- Employee bonusaward request form

- Medical history immunization and physical examination record ngu form

- Purchasing card account update request form

Find out other Csd 540 Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT