Form T2042

What is the Form T2042

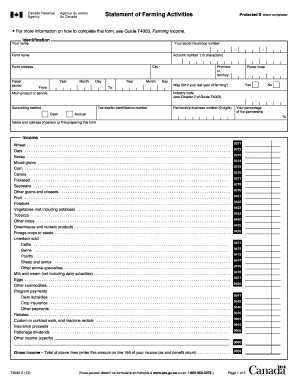

The Form T2042 is a Canadian tax document specifically designed for farmers to report their income and expenses related to farming activities. This form is crucial for individuals engaged in agricultural operations, as it helps them accurately calculate their taxable income. The T2042 statement of farming activities captures various aspects of farming, including income from sales, expenses incurred, and other relevant financial information. Proper completion of this form ensures compliance with tax regulations and aids in financial planning for farming businesses.

How to use the Form T2042

Using the Form T2042 involves several steps that guide farmers through the process of reporting their financial activities. First, gather all necessary documentation, including records of income from sales, receipts for expenses, and any other relevant financial data. Next, fill out the form by entering the required information in the designated sections. It is important to accurately report all income and expenses to avoid discrepancies. Once completed, the form can be submitted electronically or by mail, depending on the preference of the taxpayer.

Steps to complete the Form T2042

Completing the Form T2042 requires careful attention to detail. Here are the steps to ensure accurate submission:

- Gather Documentation: Collect all financial records related to your farming activities.

- Fill Out Income Section: Report all income earned from farming operations.

- Detail Expenses: List all allowable expenses, including equipment, supplies, and labor costs.

- Calculate Net Income: Subtract total expenses from total income to determine taxable income.

- Review for Accuracy: Double-check all entries for correctness before submission.

- Submit the Form: Choose your preferred submission method, either electronically or by mail.

Legal use of the Form T2042

The legal use of the Form T2042 is essential for compliance with Canadian tax laws. Farmers must ensure that the information provided is accurate and complete to avoid potential penalties. The form serves as a formal declaration of income and expenses, and any discrepancies can lead to audits or legal issues. It is advisable to retain copies of the submitted form and supporting documents for future reference and to maintain compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form T2042 are crucial for farmers to adhere to in order to avoid penalties. Generally, the form must be submitted by April 30 of the year following the tax year being reported. However, if the farmer or their spouse carries on a business, the deadline may be extended to June 15. It is important to keep track of these dates to ensure timely submission and compliance with tax obligations.

Required Documents

To complete the Form T2042 accurately, several documents are required. These include:

- Income Records: Sales receipts and records of income generated from farming activities.

- Expense Receipts: Documentation of all farming-related expenses, such as invoices and receipts.

- Financial Statements: Any additional financial statements that provide insight into the farming operation's performance.

Having these documents organized and readily available will facilitate a smoother completion process.

Quick guide on how to complete form t2042

Complete Form T2042 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Form T2042 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form T2042 without any hassle

- Locate Form T2042 and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Highlight essential parts of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the anxiety of lost or misplaced documents, tiresome form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form T2042 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t2042

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t2042 document type and how can airSlate SignNow help?

The t2042 is a tax form used in Canada for personal income tax reporting. airSlate SignNow provides a seamless solution to eSign and manage these documents, making it easy for users to complete their tax filing process efficiently.

-

How much does airSlate SignNow cost for t2042 eSigning?

The pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective, especially for handling important documents like t2042 forms. Enjoy flexible pricing tiers that cater to individual users and businesses alike.

-

Can I integrate airSlate SignNow with other software for managing t2042 documents?

Yes, airSlate SignNow offers integrations with a variety of applications to streamline your workflow. This includes popular CRM and document management systems, allowing for easy handling of t2042 documents and related paperwork.

-

What features does airSlate SignNow offer for t2042 document management?

airSlate SignNow includes features like customizable templates, document tracking, and secure eSigning specifically for documents like t2042. These features help ensure your tax documents are managed accurately and securely.

-

Is it easy to automate t2042 signing processes with airSlate SignNow?

Absolutely! airSlate SignNow allows users to automate their t2042 signing processes, reducing the time spent on manual tasks. This automation ensures timely submission of vital documents, contributing to a smoother tax filing experience.

-

What benefits does using airSlate SignNow provide for handling t2042 forms?

Using airSlate SignNow for t2042 forms offers numerous benefits, including enhanced security, reduced turnaround times, and the ability to access documents from anywhere. It simplifies the eSigning process, making tax season stress-free.

-

How secure is it to send and eSign t2042 documents with airSlate SignNow?

Security is paramount at airSlate SignNow. The platform employs industry-standard encryption and authentication measures to ensure that your t2042 documents are protected during transmission and storage, keeping your data safe.

Get more for Form T2042

- Application for readmission to be considered for r form

- Remote worku s department of the interior form

- University of namibia mature age entry form

- All steps outlined on this form to appeal your financial aid ineligibility

- Official transcript request chemeketa community college form

- Registration adddrop form complete and submit to

- Transfer student clearance form

- Hourly biweekly time sheet form

Find out other Form T2042

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT