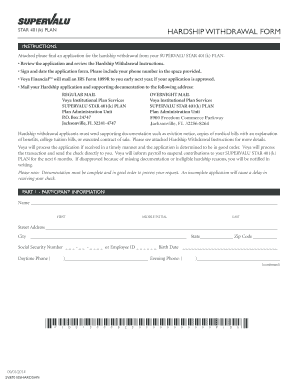

Supervalu 401k Form

What is the Supervalu 401k

The Supervalu 401k is a retirement savings plan offered by Supervalu Inc., designed to help employees save for their future. This plan allows participants to contribute a portion of their salary on a pre-tax basis, which can grow tax-deferred until withdrawal. The Supervalu 401k may include various investment options, such as mutual funds and company stock, allowing employees to diversify their retirement savings. Understanding the specifics of this plan is crucial for making informed decisions about retirement savings.

How to use the Supervalu 401k

Using the Supervalu 401k involves several steps to ensure that employees maximize their benefits. First, employees should review the plan documents to understand contribution limits, investment options, and withdrawal terms. Next, employees can enroll in the plan through the Supervalu benefits portal, where they can select their contribution percentage and investment choices. Regularly monitoring account performance and making adjustments as needed can help employees stay on track with their retirement goals.

Steps to complete the Supervalu 401k

Completing the Supervalu 401k involves a straightforward process:

- Review the plan details and eligibility criteria.

- Access the Supervalu benefits portal to enroll.

- Select your desired contribution rate and investment options.

- Submit your enrollment form electronically or via mail.

- Confirm your enrollment and monitor your account regularly.

Following these steps can help ensure that employees effectively participate in the retirement plan.

Key elements of the Supervalu 401k

Several key elements define the Supervalu 401k, including:

- Contribution Limits: Employees can contribute a percentage of their salary, up to the IRS-defined limit.

- Employer Match: Supervalu may offer a matching contribution, enhancing the employee's savings potential.

- Investment Options: Participants can choose from a variety of investment vehicles to align with their risk tolerance and retirement goals.

- Withdrawal Terms: Understanding the conditions under which funds can be accessed is essential for planning.

These elements are crucial for managing retirement savings effectively.

Legal use of the Supervalu 401k

The Supervalu 401k must comply with federal regulations, including the Employee Retirement Income Security Act (ERISA). This legislation ensures that the plan operates fairly and transparently, protecting the rights of participants. Employees should be aware of their rights regarding contributions, withdrawals, and the management of their accounts. Legal compliance also includes adhering to tax regulations that govern retirement accounts, ensuring that all contributions and distributions are handled correctly.

Eligibility Criteria

Eligibility for the Supervalu 401k typically depends on factors such as employment status and duration of service. Generally, full-time employees who have completed a specified period of service are eligible to participate. Part-time employees may also have access to the plan, but criteria can vary. It is important for employees to check the specific eligibility requirements outlined in the plan documents to ensure they can take advantage of this retirement savings opportunity.

Quick guide on how to complete supervalu 401k

Complete Supervalu 401k effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents quickly without delays. Manage Supervalu 401k on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to adjust and eSign Supervalu 401k without hassle

- Obtain Supervalu 401k and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Supervalu 401k and maintain exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the supervalu 401k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Supervalu Inc retirement plan?

The Supervalu Inc retirement plan is a comprehensive retirement savings program designed for employees of Supervalu Inc. It offers a range of investment options and enables employees to save for their future while benefiting from employer contributions.

-

How can I enroll in the Supervalu Inc retirement plan?

To enroll in the Supervalu Inc retirement plan, you need to speak with your HR representative who will guide you through the enrollment process. Typically, the enrollment occurs during onboarding or open enrollment periods.

-

What are the benefits of the Supervalu Inc retirement plan?

The Supervalu Inc retirement plan provides numerous benefits, including tax-deferred growth on investments, employer matching contributions, and various plan investment options. This allows employees to build a substantial retirement nest egg over time.

-

How much does the Supervalu Inc retirement plan cost?

The Supervalu Inc retirement plan typically has low administrative fees, making it a cost-effective solution for employees looking to save for retirement. Additionally, employer contributions and investment returns over time can further enhance savings.

-

What features does the Supervalu Inc retirement plan offer?

Key features of the Supervalu Inc retirement plan include automatic enrollment, a variety of investment choices, online account management, and educational resources for employees. These features help employees make informed decisions about their retirement savings.

-

Can I manage my Supervalu Inc retirement plan online?

Yes, you can manage your Supervalu Inc retirement plan online through a secure portal. This platform allows you to check your account balance, adjust your investment options, and track your savings growth conveniently.

-

Are there any penalties for early withdrawal from the Supervalu Inc retirement plan?

Yes, early withdrawals from the Supervalu Inc retirement plan may incur penalties and tax implications. It's essential to consult the plan’s terms and conditions and speak to a financial advisor before making any withdrawals.

Get more for Supervalu 401k

Find out other Supervalu 401k

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer