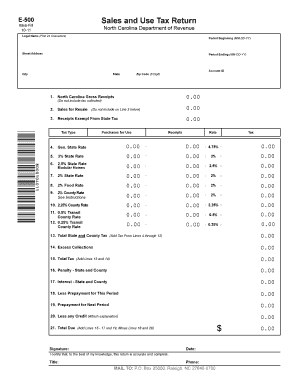

Sales and Use Tax Nc Form

What is the Sales and Use Tax in North Carolina?

The sales and use tax in North Carolina is a tax imposed on the sale of tangible personal property and certain services. This tax is collected by retailers at the point of sale and is a crucial source of revenue for the state. The current state sales tax rate is four and three-quarters percent, with additional local taxes that can vary by county. Understanding this tax is essential for businesses operating in North Carolina, as it impacts pricing, compliance, and overall financial planning.

Steps to Complete the North Carolina Sales Tax Application

Completing the North Carolina sales tax application involves several key steps. First, gather the necessary information, including your business details and federal Employer Identification Number (EIN). Next, access the North Carolina Department of Revenue website to locate the sales and use tax application form. Fill out the form accurately, ensuring all required fields are completed. After reviewing your application for accuracy, submit it online or via mail. It is important to keep a copy for your records and to monitor the status of your application.

Required Documents for Sales Tax Registration

When registering for sales tax in North Carolina, certain documents are necessary to ensure a smooth application process. These include:

- Your federal Employer Identification Number (EIN).

- Business formation documents, such as Articles of Incorporation or Organization.

- Proof of business address, which may include a utility bill or lease agreement.

- Identification for the business owner, such as a driver's license or state ID.

Having these documents ready will help expedite your registration process and ensure compliance with state regulations.

Who Issues the Sales and Use Tax Form?

The North Carolina Department of Revenue is responsible for issuing the sales and use tax form. This agency oversees the collection and enforcement of sales tax regulations in the state. Businesses can access the necessary forms and resources directly from the Department of Revenue's website, ensuring they have the most up-to-date information regarding tax rates and compliance requirements.

Penalties for Non-Compliance with Sales Tax Regulations

Failure to comply with North Carolina sales tax regulations can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and even legal action for persistent non-compliance. It is crucial for business owners to understand their responsibilities regarding sales tax collection and remittance to avoid these penalties. Regular audits and maintaining accurate records can help mitigate risks associated with non-compliance.

Eligibility Criteria for Sales Tax Registration

To be eligible for sales tax registration in North Carolina, a business must meet certain criteria. Primarily, any business selling tangible goods or taxable services within the state is required to register. This includes both physical storefronts and online retailers. Additionally, businesses must have a physical presence in North Carolina or make sales to customers in the state. Understanding these criteria is essential for compliance and to avoid potential legal issues.

Quick guide on how to complete sales and use tax nc

Prepare Sales And Use Tax Nc effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Sales And Use Tax Nc on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Sales And Use Tax Nc with ease

- Locate Sales And Use Tax Nc and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Sales And Use Tax Nc and ensure excellent communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax nc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an NC sales and use tax form?

The NC sales and use tax form is a state document used by businesses to report and remit sales tax collected on taxable sales. This form is crucial for compliance with North Carolina tax regulations. Understanding how to complete this form accurately helps businesses avoid penalties and ensure timely payments.

-

How can airSlate SignNow help with NC sales and use tax form submissions?

airSlate SignNow simplifies the process of completing and submitting the NC sales and use tax form by providing user-friendly eSignature capabilities. With our platform, businesses can easily fill out the form electronically and securely send it to the appropriate tax authority. This streamlines the workflow and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for NC sales and use tax forms?

Yes, airSlate SignNow offers competitive pricing plans designed to fit various business needs. The cost depends on the features selected, including eSigning the NC sales and use tax form. We provide a clear pricing structure with no hidden fees, ensuring you get great value for your investment.

-

Can I integrate airSlate SignNow with my accounting software for NC sales and use tax forms?

Absolutely! airSlate SignNow supports integrations with popular accounting software, allowing seamless management of your NC sales and use tax form. This integration helps streamline your document workflows and ensures all your financial records stay synchronized, enhancing your overall efficiency.

-

What features does airSlate SignNow offer for NC sales and use tax forms?

With airSlate SignNow, you can easily create, edit, and eSign your NC sales and use tax forms. Our platform provides templates, customizable fields, and real-time tracking, ensuring you never miss a deadline. These features help simplify your tax reporting process and enhance accuracy.

-

How secure is my information when using airSlate SignNow for NC sales and use tax forms?

Security is a top priority at airSlate SignNow. We implement robust encryption and compliance measures to protect all information related to your NC sales and use tax forms. This ensures that your data remains confidential and secure throughout the entire signing process.

-

Can multiple users collaborate on an NC sales and use tax form in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the same NC sales and use tax form. Team members can easily add comments, make changes, and track the document’s progress. This collaborative feature enhances teamwork and ensures that everyone is on the same page during the tax filing process.

Get more for Sales And Use Tax Nc

- Application for cover sheet please type or oswego county co oswego ny form

- Dnd 2893 form

- Infocomm international standards standard guide for audiovisual systems design and coordination processes form

- Tuition classification update form ga gwinnett

- City of tualatin form

- Shf truck and tractor pull forms and rules indd

- Bruun construction form

- Licenses and inspections homepage city of philadelphia form

Find out other Sales And Use Tax Nc

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will