Orc 1311 04 Form

What is the Orc 1311 04

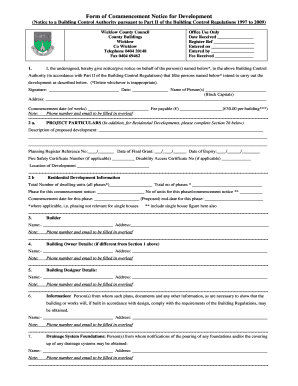

The Orc 1311 04 form is a specific document used for various administrative purposes, particularly in the context of compliance and reporting. It is essential for individuals and businesses to understand its function and relevance in their operations. This form typically requires detailed information about the entity or individual submitting it, including identification details and the nature of the request or report being filed. Understanding the Orc 1311 04 is crucial for ensuring proper compliance with relevant regulations.

How to use the Orc 1311 04

Using the Orc 1311 04 form involves several steps to ensure that all required information is accurately captured. Begin by gathering all necessary documentation that supports the information you will provide. It is important to fill out the form completely and accurately to avoid delays or rejections. After completing the form, review it for any errors or omissions. Once you are satisfied with the information provided, you can submit it according to the specified guidelines, whether online, by mail, or in person.

Steps to complete the Orc 1311 04

Completing the Orc 1311 04 form requires attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as identification and supporting materials.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the completed form for any errors or missing information.

- Submit the form according to the guidelines provided, ensuring you keep a copy for your records.

Legal use of the Orc 1311 04

The legal use of the Orc 1311 04 form is governed by specific regulations that ensure its validity and compliance. It is crucial to understand the legal implications of submitting this form, as improper use can lead to penalties or disputes. The form must be filled out truthfully and submitted within the required timeframes to maintain its legal standing. Compliance with all relevant laws and regulations is essential to avoid potential legal issues.

Who Issues the Form

The Orc 1311 04 form is typically issued by a designated governmental or regulatory body. This entity is responsible for overseeing the compliance and reporting requirements associated with the form. Understanding who issues the form can provide clarity on the regulations and guidelines that govern its use. Always refer to the official source for the most accurate and up-to-date information regarding the form's issuance.

Filing Deadlines / Important Dates

Filing deadlines for the Orc 1311 04 form are critical for compliance. Missing these deadlines can result in penalties or complications. It is essential to be aware of any specific dates related to the submission of this form, including initial filing dates and any potential extensions. Keeping a calendar of important dates can help ensure timely submission and adherence to all regulatory requirements.

Quick guide on how to complete orc 1311 04

Complete Orc 1311 04 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any hold-ups. Manage Orc 1311 04 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign Orc 1311 04 seamlessly

- Obtain Orc 1311 04 and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form hunting, or mistakes requiring the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Orc 1311 04 and ensure outstanding communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the orc 1311 04

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ORC 1311 04 and how does it relate to airSlate SignNow?

ORC 1311 04 is a specific compliance regulation that businesses must adhere to. By using airSlate SignNow, companies can ensure that their eSigning processes align with ORC 1311 04, providing a secure and legally binding way to manage documents.

-

How much does airSlate SignNow cost for businesses needing compliance with ORC 1311 04?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses seeking compliance with ORC 1311 04. Pricing is competitive, ensuring that even small businesses can afford to adopt electronic signing while meeting regulatory requirements.

-

What features of airSlate SignNow help comply with ORC 1311 04?

airSlate SignNow provides features like secure document storage, multi-factor authentication, and audit trails that are essential for compliance with ORC 1311 04. These features ensure that all transactions are tracked and recorded securely, enhancing legal validity.

-

Can airSlate SignNow integrate with existing systems while ensuring ORC 1311 04 compliance?

Yes, airSlate SignNow seamlessly integrates with various business applications such as CRM and project management tools. This integration helps maintain compliance with ORC 1311 04 by allowing users to manage their documentation processes effectively within their existing workflows.

-

What are the benefits of using airSlate SignNow for ORC 1311 04 compliance?

Using airSlate SignNow for ORC 1311 04 compliance has numerous benefits, including increased efficiency and reduced paper usage. Additionally, it simplifies the signing process, helps avoid delays, and provides a more secure method of handling sensitive documents.

-

Is airSlate SignNow user-friendly for meeting ORC 1311 04 regulations?

Absolutely, airSlate SignNow is designed with an intuitive interface that ensures ease of use for all team members. This user-friendliness is crucial for maintaining compliance with ORC 1311 04, as it allows all users to quickly learn and properly utilize the platform.

-

What support does airSlate SignNow offer for businesses dealing with ORC 1311 04?

airSlate SignNow offers extensive customer support, including resources and guides specifically focused on compliance with ORC 1311 04. Our support team is ready to assist with any queries or challenges that businesses may face during implementation.

Get more for Orc 1311 04

- Waiver of full administration affidavit form

- Free petition for small estate administration new hampshire form

- Iea petition new hampshire judicial branch courts state nh form

- Municipal court operations fines and fees new jersey form

- Nj assignment of counsel form

- Weights and measures application for appointment as certified weighmasterindd form

- Superior court of new jersey law division docket no atl form

- How to expunge your criminal anor juvenile nj courts form

Find out other Orc 1311 04

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast