It 182 Form

What is the IT 182?

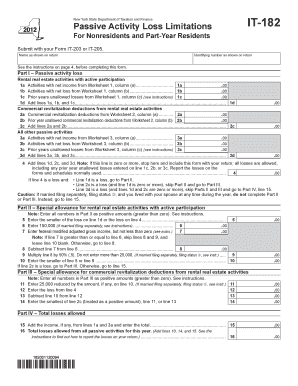

The IT 182 form is a specific document used in the United States for tax purposes. It is primarily utilized by individuals and businesses to report certain types of income or deductions. This form plays a vital role in ensuring compliance with federal and state tax regulations. Understanding its purpose is essential for accurate tax reporting and avoiding potential penalties.

How to use the IT 182

Using the IT 182 form involves several key steps. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form accurately, ensuring that all information is complete and correct. It is important to double-check calculations to avoid errors. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set by the IRS or state tax authorities.

Steps to complete the IT 182

Completing the IT 182 form requires careful attention to detail. Follow these steps for successful completion:

- Gather relevant financial documents, such as W-2s, 1099s, and expense receipts.

- Fill in personal information, including name, address, and Social Security number.

- Report income accurately in the designated sections of the form.

- Include any applicable deductions and credits to reduce taxable income.

- Review the form for accuracy and completeness before submission.

Legal use of the IT 182

The IT 182 form must be used in accordance with U.S. tax laws to ensure its legal validity. This includes adhering to the guidelines established by the IRS regarding the types of income and deductions that can be reported. Proper use of the form helps to maintain compliance and can protect taxpayers from audits or penalties. It is advisable to consult with a tax professional if there are uncertainties regarding its legal implications.

Filing Deadlines / Important Dates

Filing deadlines for the IT 182 form are crucial for compliance. Typically, the form must be submitted by April 15 of the tax year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, especially in light of evolving tax regulations. Marking these dates on a calendar can help ensure timely submission and avoid late fees.

Required Documents

To complete the IT 182 form, specific documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Any other relevant financial statements.

Having these documents ready will streamline the process of filling out the form and help ensure accuracy in reporting.

Quick guide on how to complete it 182

Prepare It 182 effortlessly on any gadget

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without any delays. Manage It 182 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign It 182 with ease

- Obtain It 182 and then click Get Form to begin.

- Leverage the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Alter and eSign It 182 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 182

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of using airSlate SignNow in relation to it 182?

airSlate SignNow is designed to streamline the document signing process, making it easier for businesses to send and eSign documents efficiently. With its user-friendly interface and powerful features, it 182 helps eliminate paperwork, saving time and reducing costs.

-

How much does airSlate SignNow cost for using it 182?

The pricing for airSlate SignNow varies based on the plan you choose. Users interested in it 182 can explore flexible pricing options that cater to different business needs, ensuring a cost-effective solution for eSigning documents.

-

What are the key features of airSlate SignNow for it 182?

airSlate SignNow offers several key features including customizable templates, advanced security measures, and real-time tracking of document status. These tools empower users within the it 182 framework to manage documents seamlessly and effectively.

-

What benefits does airSlate SignNow provide for businesses utilizing it 182?

By adopting airSlate SignNow, businesses can enhance their operational efficiency through faster document processing and improved collaboration. The benefits of using it 182 include better workflow management and the ability to integrate with various tools, leading to a more productive workplace.

-

Can airSlate SignNow integrate with other applications while using it 182?

Yes, airSlate SignNow supports numerous integrations with popular applications such as Google Drive, Salesforce, and Microsoft Office. This flexibility enables businesses using it 182 to create a cohesive digital ecosystem, facilitating easier document management and sharing.

-

Is airSlate SignNow user-friendly for individuals new to it 182?

Absolutely! airSlate SignNow is designed with a user-friendly interface that makes it accessible even for those unfamiliar with it 182. The platform provides clear instructions and support resources, ensuring a smooth onboarding experience.

-

What security measures does airSlate SignNow implement while using it 182?

airSlate SignNow prioritizes security with features such as data encryption, user authentication, and compliance with industry standards. By implementing these measures, it 182 ensures that your documents and signatures remain secure and confidential.

Get more for It 182

- Riding lawn mower maintenance log form

- Scout rank worksheetpdf orgsites form

- Sample letter to prosecutor to dismiss charges form

- Jdf1111ss pdf form

- Puppy health contract template form

- Puppy health guarantee contract template form

- Puppy of sale contract template form

- Puppy purchase contract template form

Find out other It 182

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney