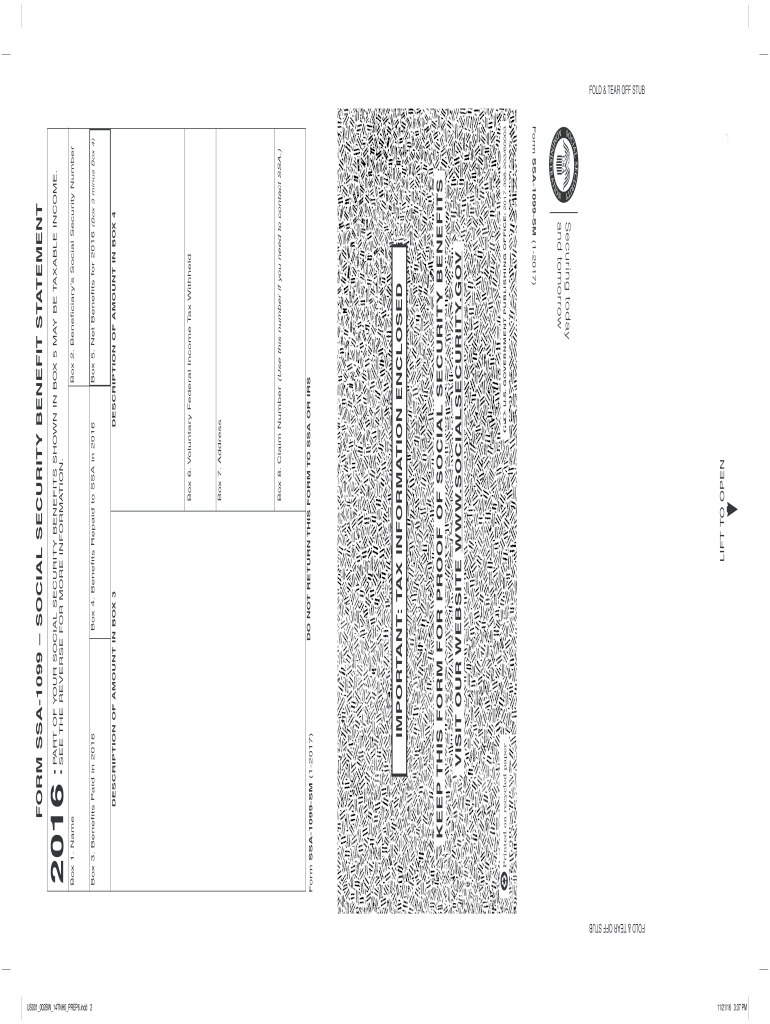

1099 Sm Form

What makes the 1099 sm form legally binding?

Because the society takes a step away from office work, the execution of paperwork more and more takes place electronically. The 1099 sm form isn’t an any different. Dealing with it utilizing electronic tools differs from doing so in the physical world.

An eDocument can be considered legally binding provided that particular needs are fulfilled. They are especially crucial when it comes to stipulations and signatures related to them. Entering your initials or full name alone will not ensure that the institution requesting the sample or a court would consider it accomplished. You need a reliable tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your 1099 sm form when completing it online?

Compliance with eSignature laws is only a fraction of what airSlate SignNow can offer to make form execution legitimate and secure. Furthermore, it offers a lot of opportunities for smooth completion security smart. Let's rapidly run through them so that you can stay assured that your 1099 sm form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: key privacy standards in the USA and Europe.

- Dual-factor authentication: provides an extra layer of security and validates other parties identities through additional means, such as a Text message or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data safely to the servers.

Completing the 1099 sm form with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete 1099 sm form

Complete 1099 Sm Form effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 1099 Sm Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to adjust and eSign 1099 Sm Form with ease

- Acquire 1099 Sm Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign 1099 Sm Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099 sm form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does SM mean on SSA-1099?

Additional Information. Form SSA-1099 (or SSA-1099-SM) shows the total amount of social security benefits you received during the tax year. Social security benefits include monthly retirement, survivor, and disability benefits.

-

What is a 1099 SM form?

Form SSA-1099 (or SSA-1099-SM) shows the total amount of social security benefits you received during the tax year. Social security benefits include monthly retirement, survivor, and disability benefits.

-

Is the SSA worksheet taxable?

If your income is modest, it is likely that none of your Social Security benefits are taxable. As your gross income increases, a higher percentage of your Social Security benefits become taxable, up to a maximum of 85% of your total benefits.

-

Is SSA-1099 the same as SSA-1099 SM?

Form SSA-1099 (or SSA-1099-SM) shows the total amount of social security benefits you received during the tax year. Social security benefits include monthly retirement, survivor, and disability benefits.

-

Is a 1099 SM the same as a 1099-R?

Are they the same? No, the forms are different. The Form 1099-R may have been inadvertently added to the tax return. Please take the steps below to delete the Form 1099-R.

-

Where do I get my SSA-1099 SM?

If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online, call our toll-free number at 1-800-772-1213 or visit your Social Security office.

-

Is income from SSA-1099 SM taxable?

If you received Social Security benefits during the year, you should receive a Form SSA-1099, Social Security Benefit Statement, showing the amount of your benefits. If Social Security was your only income in that year, your benefits may not be taxable. You also may not need to file a federal income tax return.

-

Do I have to send SSA-1099 with my taxes?

If you e-filing, your tax return you don't need to send any documenation to the IRS. You do need to keep the forms with your tax returns. if you are filing by mail ,You would only need to mail the form if it showing any tax withheld.

-

What is the difference between SSA-1099 SM and SSA-1099 SM UD?

You will only need to report the SSA-1099-SM-UD. It is a updated version of the SSA-1099-SM and you do not report both versions. Just save both forms with the tax records. All SSA-1099 forms are entered in the same place in TurboTax.

-

What is a SSA-1099 SM?

If you received Social Security benefits during the tax year, you will receive a Form SSA-1099 from the Social Security Administration. The IRS will also receive a copy of your Form SSA-1099. This form shows your total Social Security benefits for the year and any taxes withheld.

Get more for 1099 Sm Form

Find out other 1099 Sm Form

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT