The STATE of MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST Form

What is the State of Maryland 401K Plan Financial Hardship Request

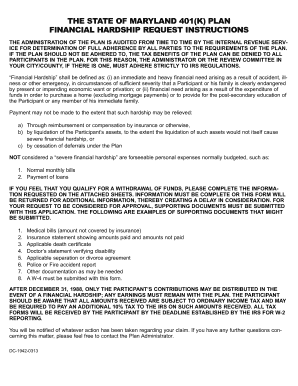

The State of Maryland 401K Plan Financial Hardship Request is a formal document that allows participants in the Maryland 401K retirement plan to request early access to their retirement funds due to financial difficulties. This form is designed to ensure that individuals experiencing significant financial hardship can withdraw funds from their 401K accounts without incurring penalties typically associated with early withdrawals. The request must be substantiated with evidence of the financial hardship, and it is subject to approval by the plan administrator.

Key Elements of the State of Maryland 401K Plan Financial Hardship Request

When completing the State of Maryland 401K Plan Financial Hardship Request, it is essential to include specific information to ensure a smooth processing experience. Key elements typically required include:

- Personal Information: Full name, address, and contact details.

- Account Information: Your 401K account number and plan details.

- Reason for Hardship: A clear explanation of the financial hardship, such as medical expenses, housing costs, or education expenses.

- Documentation: Supporting documents that validate the hardship claim, such as bills or letters from creditors.

Steps to Complete the State of Maryland 401K Plan Financial Hardship Request

Completing the State of Maryland 401K Plan Financial Hardship Request involves several important steps. Following these steps can help ensure that your request is processed efficiently:

- Gather necessary documentation to support your claim.

- Fill out the financial hardship request form accurately, ensuring all required fields are completed.

- Attach any supporting documents that validate your financial hardship.

- Review the form for accuracy and completeness before submission.

- Submit the completed form through the designated submission method, either online or by mail.

Eligibility Criteria for the State of Maryland 401K Plan Financial Hardship Request

To qualify for a financial hardship withdrawal from the State of Maryland 401K Plan, participants must meet specific eligibility criteria. Generally, these criteria include:

- The hardship must be a result of immediate and pressing financial needs.

- Participants must have exhausted all other available options, such as loans from the 401K plan.

- The amount requested must not exceed the amount necessary to satisfy the financial need.

Form Submission Methods

The State of Maryland 401K Plan Financial Hardship Request can typically be submitted through various methods to accommodate participants' preferences. Common submission methods include:

- Online Submission: Many plans allow participants to submit their requests electronically through a secure portal.

- Mail: Participants can send the completed form and supporting documents to the designated address provided by the plan administrator.

- In-Person Submission: Some participants may choose to deliver their requests directly to the plan administrator's office.

Legal Use of the State of Maryland 401K Plan Financial Hardship Request

The legal use of the State of Maryland 401K Plan Financial Hardship Request is governed by federal and state regulations. It is important to understand that:

- The request must comply with the Employee Retirement Income Security Act (ERISA) and other applicable laws.

- Participants must provide accurate information and documentation to avoid potential legal repercussions.

- Failure to comply with the legal requirements may result in the denial of the request or penalties.

Quick guide on how to complete the state of maryland 401k plan financial hardship request

Complete THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST effortlessly on any device

Online document management has become popular among organizations and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST with ease

- Locate THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST and ensure excellent communication at any stage of your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the state of maryland 401k plan financial hardship request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST?

THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST allows qualified employees to withdraw funds from their 401(k) plans in cases of financial necessity. This process is designed to alleviate financial burdens and support those facing unexpected challenges, ensuring you have access to your funds when you need them most.

-

How do I initiate a THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST?

To initiate THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST, you will need to complete a designated application form provided by your plan administrator. This process typically requires you to provide documentation of your financial hardship to substantiate your request.

-

What types of financial hardships qualify for a 401(k) withdrawal?

Common situations that qualify for THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST include medical expenses, purchasing a primary residence, tuition payments, and preventing eviction or foreclosure. Each case is evaluated based on its compliance with federal regulations, so it’s vital to have the necessary documentation.

-

Are there any penalties for withdrawing from my 401(k) due to hardship?

Yes, withdrawals made under THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST may incur penalties and taxes. It’s essential to understand the implications of early withdrawal, such as a 10% penalty for individuals under 59½ years old, in addition to regular income tax.

-

How will I receive my funds after submitting THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST?

Once your request for THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST is approved, funds are typically disbursed through direct deposit or a check sent to your address. The processing time can vary, so it's advisable to check with your plan administrator for specific timelines.

-

Is there a cost associated with filing a hardship request?

Filing THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST generally does not involve a direct fee; however, you may face withdrawal penalties and taxes. Always consult with your plan administrator to understand any potential costs associated with your financial hardship withdrawal.

-

Can I use airSlate SignNow to eSign my hardship request?

Absolutely! airSlate SignNow provides an efficient way to electronically sign your THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST. With its user-friendly platform, you can complete the signing process quickly and securely, ensuring your request is submitted without unnecessary delays.

Get more for THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST

- Arkansas odometer disclosure statement form

- How to notify the arkansas state board of nursing of a name change form

- Workers comp ar n form 2001

- Standardized permit application the city of san ramon sanramon ca form

- Mo dor 149dsa fill and sign printable template online form

- Corporate tax electronic filing form

- The auto rotate form

- M15 underpayment of estimated income tax for individuals m15 underpayment of estimated income tax for individuals 794112247 form

Find out other THE STATE OF MARYLAND 401K PLAN FINANCIAL HARDSHIP REQUEST

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe