Fact Finding Sheet for Life Insurance Form

What is the Fact Finding Sheet For Life Insurance

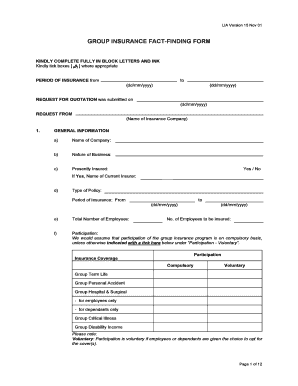

The fact finding sheet for life insurance is a comprehensive document designed to gather essential information from clients. This form serves as a foundational tool for insurance agents and financial advisors to understand their clients' needs, goals, and financial situations. It typically includes sections for personal information, financial assets, liabilities, and specific life insurance needs. By collecting this data, agents can tailor insurance solutions that best fit the client's circumstances.

How to Use the Fact Finding Sheet For Life Insurance

Using the fact finding sheet for life insurance involves several straightforward steps. First, the client should fill out their personal details, including name, age, and contact information. Next, they should outline their financial status, detailing income, expenses, and existing insurance policies. The agent then reviews this information to identify gaps in coverage or areas where additional insurance may be beneficial. This collaborative process ensures that both the client's needs and preferences are addressed effectively.

Steps to Complete the Fact Finding Sheet For Life Insurance

Completing the fact finding sheet for life insurance is a structured process that can be broken down into key steps:

- Gather Personal Information: Collect the client's name, date of birth, and contact details.

- Assess Financial Situation: Document income sources, monthly expenses, and existing assets.

- Identify Insurance Needs: Discuss the client's goals, such as family protection, debt coverage, or estate planning.

- Review Current Policies: Evaluate any existing life insurance to identify coverage gaps.

- Finalize the Document: Ensure all sections are completed accurately and thoroughly.

Legal Use of the Fact Finding Sheet For Life Insurance

The legal use of the fact finding sheet for life insurance hinges on its role in the insurance application process. This document is not only a tool for gathering information but also serves as a record that can be referenced in case of disputes or claims. For the form to be legally binding, it must comply with relevant regulations, ensuring that the information provided is accurate and truthful. Agents should inform clients of the importance of honesty in their responses, as discrepancies can lead to issues during claims processing.

Key Elements of the Fact Finding Sheet For Life Insurance

Several key elements are essential in a fact finding sheet for life insurance. These include:

- Personal Information: Basic details such as name, age, and marital status.

- Financial Overview: A summary of income, savings, investments, and debts.

- Insurance Objectives: Specific goals the client wishes to achieve through life insurance.

- Health Information: Relevant medical history that may affect insurance underwriting.

- Beneficiary Designations: Information on who will receive the policy benefits.

Examples of Using the Fact Finding Sheet For Life Insurance

Examples of using the fact finding sheet for life insurance highlight its practical applications. For instance, a young couple may use the form to assess their need for life insurance as they plan for a family. By detailing their current financial obligations and future goals, they can determine the appropriate coverage amount. Alternatively, an older individual nearing retirement might use the sheet to evaluate their existing policies and ensure they have sufficient coverage to protect their estate. Each scenario demonstrates how the fact finding sheet aids in making informed insurance decisions.

Quick guide on how to complete fact finding sheet for life insurance

Complete Fact Finding Sheet For Life Insurance effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a reliable eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents promptly without any holdups. Manage Fact Finding Sheet For Life Insurance on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest method to modify and eSign Fact Finding Sheet For Life Insurance without hassle

- Locate Fact Finding Sheet For Life Insurance and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you want to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form-finding, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Alter and eSign Fact Finding Sheet For Life Insurance to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fact finding sheet for life insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a life insurance fact finding questionnaire?

A life insurance fact finding questionnaire is a critical tool used by agents to gather essential information about a client's financial situation and insurance needs. This questionnaire helps to outline the best policy options and ensures that clients receive tailored advice based on their unique circumstances.

-

How can airSlate SignNow improve my life insurance fact finding questionnaire process?

airSlate SignNow simplifies the creation, sending, and eSigning of life insurance fact finding questionnaires. Its user-friendly platform allows agents to quickly draft and distribute questionnaires, making it easier to gather vital information from clients efficiently.

-

Are there any costs associated with using airSlate SignNow for my life insurance fact finding questionnaire?

airSlate SignNow offers a range of pricing plans tailored to fit various business needs. You can choose a plan that works best for you, allowing you to manage your life insurance fact finding questionnaire process without breaking the bank.

-

Can I customize the life insurance fact finding questionnaire in airSlate SignNow?

Yes, airSlate SignNow allows users to fully customize their life insurance fact finding questionnaire. You can add or modify questions, incorporate your branding, and ensure that the questionnaire meets the specific needs of your clients.

-

What integrations does airSlate SignNow support for life insurance fact finding questionnaires?

airSlate SignNow seamlessly integrates with various CRM systems and productivity tools. This enables agents to streamline their workflow by automatically transferring data from completed life insurance fact finding questionnaires into their client management systems.

-

How does airSlate SignNow ensure the security of my life insurance fact finding questionnaire?

airSlate SignNow prioritizes data security with industry-leading encryption and secure document storage. This means that your clients' information collected through the life insurance fact finding questionnaire is protected and confidential.

-

Can clients fill out the life insurance fact finding questionnaire on mobile devices?

Absolutely! airSlate SignNow is mobile-friendly, allowing clients to easily access and fill out the life insurance fact finding questionnaire on their smartphones or tablets. This flexibility enhances user experience and facilitates quicker responses.

Get more for Fact Finding Sheet For Life Insurance

- Payroll deduction uniforms09 colorado caterers

- Application form for scb erq account for basis org

- How to read a bank statement handout right track form

- Fill out the order form

- Foia request form city of myrtle beach the city of myrtle beach

- Chapter countdown form

- Agile contract template form

- Agency worker contract template form

Find out other Fact Finding Sheet For Life Insurance

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed