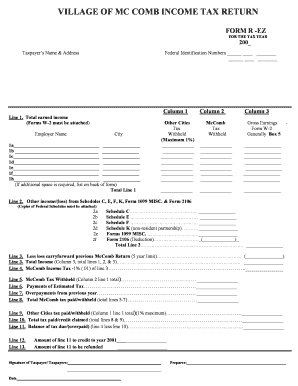

Village of Mccomb Ohio Income Tax Form

What is the Village of McComb Ohio Income Tax

The village of McComb, Ohio, imposes an income tax on residents and businesses to fund local services and infrastructure. This tax is typically calculated as a percentage of earned income, including wages, salaries, and business profits. Understanding this tax is essential for compliance and financial planning.

Steps to Complete the Village of McComb Ohio Income Tax

Completing the village of McComb Ohio income tax involves several key steps:

- Gather necessary financial documents, including W-2 forms, 1099s, and records of any additional income.

- Determine your filing status, whether you are single, married, or head of household.

- Calculate your total income and apply any deductions or exemptions applicable to your situation.

- Use the current tax rate set by the village to compute your tax liability.

- Complete the income tax form accurately, ensuring all information is correct.

- Review your completed form for any errors before submission.

- Submit the form by the designated deadline through the chosen submission method.

Legal Use of the Village of McComb Ohio Income Tax

The village of McComb Ohio income tax is legally binding when completed and submitted in accordance with local regulations. Compliance with the tax laws ensures that residents contribute to community services. It is important to maintain accurate records and adhere to filing deadlines to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the village of McComb Ohio income tax are crucial for compliance. Typically, the tax return is due by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Residents should also be aware of any quarterly estimated tax payment deadlines if applicable.

Required Documents

To successfully complete the village of McComb Ohio income tax, you will need several documents:

- W-2 forms from employers, detailing annual earnings and withholdings.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for any deductions or credits you plan to claim.

Form Submission Methods

Residents can submit the village of McComb Ohio income tax form through various methods:

- Online submission via the village's official tax portal.

- Mailing a printed form to the designated tax office address.

- In-person submission at the local tax office during business hours.

Penalties for Non-Compliance

Failure to comply with the village of McComb Ohio income tax regulations can result in penalties. These may include late fees, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential for residents to file on time and pay any owed taxes to avoid these consequences.

Quick guide on how to complete village of mccomb ohio income tax

Effortlessly prepare Village Of Mccomb Ohio Income Tax on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary forms while securely storing them online. airSlate SignNow equips you with all the features required to swiftly create, modify, and eSign your documents without any delays. Handle Village Of Mccomb Ohio Income Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

The easiest method to modify and eSign Village Of Mccomb Ohio Income Tax seamlessly

- Obtain Village Of Mccomb Ohio Income Tax and select Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and eSign Village Of Mccomb Ohio Income Tax while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the village of mccomb ohio income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the village of McComb Ohio income tax rate?

The village of McComb Ohio income tax rate is currently set at 1% for residents and non-residents who earn income within the village limits. This means that if you live or work in McComb, you'll contribute 1% of your income to the local tax fund. It's important to stay updated on any changes to this rate, as local tax laws can evolve.

-

How do I file my village of McComb Ohio income tax?

Filing your village of McComb Ohio income tax involves submitting the necessary forms to the local tax office, which can often be completed online for convenience. Ensure you have all required documentation, such as W-2s and other income statements, ready for submission. You may also want to consult a tax professional to ensure accurate filing.

-

What deductions are available for village of McComb Ohio income tax filers?

Residents may be eligible for various deductions on their village of McComb Ohio income tax, including deductions for certain business expenses and contributions to retirement accounts. It's advisable to review the specific requirements and allowances outlined by the village tax department. Keeping thorough records can help maximize your eligible deductions.

-

Are there penalties for late village of McComb Ohio income tax payments?

Yes, there are penalties for late village of McComb Ohio income tax payments. If you fail to pay your taxes by the due date, you may incur additional fees and interest that accumulate over time. To avoid these penalties, make sure to file and pay your taxes promptly, or consider setting up a payment plan if necessary.

-

How can I access help for my village of McComb Ohio income tax queries?

If you have questions regarding your village of McComb Ohio income tax, you can signNow out to the local tax office directly. They provide assistance via phone and email, and often have walk-in hours for in-person consultations. Additionally, the village's official website may offer helpful resources and FAQs for quick reference.

-

What are the benefits of using software for village of McComb Ohio income tax preparation?

Using software for village of McComb Ohio income tax preparation can streamline the process signNowly. It helps organize your income and deductions efficiently and reduces the chances of errors in your filings. Many programs also offer integration with e-signing services, making submission even easier.

-

Can I file my village of McComb Ohio income tax online?

Yes, you can file your village of McComb Ohio income tax online through the local tax department's website. This option enhances convenience by allowing you to submit your forms and payments electronically, which can save time and effort. Make sure your documents are ready before starting the online filing process.

Get more for Village Of Mccomb Ohio Income Tax

Find out other Village Of Mccomb Ohio Income Tax

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later