Form W 8 Rev November Certificate of Foreign Status

What is the Form W-8 Rev November Certificate of Foreign Status

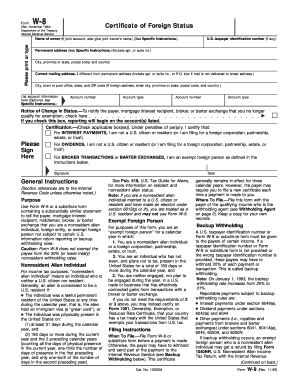

The Form W-8 Rev November Certificate of Foreign Status is a tax document used by foreign individuals and entities to certify their foreign status for U.S. tax purposes. This form is essential for non-U.S. persons receiving income from U.S. sources, as it helps to establish that they are not subject to certain U.S. tax withholding requirements. By submitting this form, foreign taxpayers can claim reduced withholding rates or exemptions under applicable tax treaties between their country and the United States.

How to Use the Form W-8 Rev November Certificate of Foreign Status

Using the Form W-8 Rev November involves several steps to ensure proper completion and submission. First, the individual or entity must determine their eligibility and the specific type of income they are receiving. Next, they should fill out the form accurately, providing all required information, including name, address, and taxpayer identification number, if applicable. Once completed, the form must be submitted to the U.S. withholding agent or financial institution that requires it, rather than to the IRS directly.

Steps to Complete the Form W-8 Rev November Certificate of Foreign Status

Completing the Form W-8 Rev November involves the following steps:

- Identify the type of entity or individual completing the form.

- Provide the full name and address of the foreign individual or entity.

- Include the country of citizenship or incorporation.

- Fill in the taxpayer identification number, if applicable.

- Sign and date the form to certify the accuracy of the information provided.

Legal Use of the Form W-8 Rev November Certificate of Foreign Status

The legal use of the Form W-8 Rev November is crucial for ensuring compliance with U.S. tax laws. By submitting this form, foreign individuals and entities can avoid unnecessary withholding taxes on income sourced from the United States. It is important to keep in mind that the form must be updated periodically, especially if there are changes in circumstances or if the form is set to expire. Failure to provide a valid form may result in higher tax withholding rates.

Eligibility Criteria for the Form W-8 Rev November Certificate of Foreign Status

Eligibility for using the Form W-8 Rev November is primarily determined by the individual's or entity's foreign status. Foreign individuals must not be U.S. citizens or residents, while foreign entities must be organized outside the United States. Additionally, the income received must be from U.S. sources, such as dividends, interest, or royalties. It is essential for applicants to review the IRS guidelines to confirm their eligibility before completing the form.

Form Submission Methods

The Form W-8 Rev November can be submitted through various methods, depending on the requirements of the withholding agent or financial institution. Common submission methods include:

- Electronic submission through secure portals.

- Mailing a physical copy of the completed form.

- In-person delivery to the relevant financial institution or agent.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form W-8 Rev November can lead to significant penalties. If a foreign individual or entity fails to provide a valid form, they may be subject to a higher withholding tax rate on U.S. income. Additionally, the IRS may impose fines or other penalties for failure to comply with tax regulations. It is essential for foreign taxpayers to ensure their forms are accurate and submitted timely to avoid these consequences.

Quick guide on how to complete form w 8 rev november certificate of foreign status

Prepare Form W 8 Rev November Certificate Of Foreign Status effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without any delays. Manage Form W 8 Rev November Certificate Of Foreign Status on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form W 8 Rev November Certificate Of Foreign Status seamlessly

- Obtain Form W 8 Rev November Certificate Of Foreign Status and then click Get Form to begin.

- Leverage the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form W 8 Rev November Certificate Of Foreign Status and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8 rev november certificate of foreign status

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 8 Rev November Certificate Of Foreign Status?

The Form W 8 Rev November Certificate Of Foreign Status is a tax document used by foreign individuals and entities to signNow their non-U.S. status for tax withholding purposes. This form is crucial for avoiding unnecessary tax withholdings on income received from U.S. sources.

-

How can airSlate SignNow help with the Form W 8 Rev November Certificate Of Foreign Status?

airSlate SignNow provides a seamless way to complete and eSign the Form W 8 Rev November Certificate Of Foreign Status. Our platform simplifies document management, ensuring that users can easily fill out and send this important tax document securely.

-

Is there a fee for using airSlate SignNow for the Form W 8 Rev November Certificate Of Foreign Status?

airSlate SignNow offers competitive pricing plans, making it a cost-effective solution for businesses needing to manage the Form W 8 Rev November Certificate Of Foreign Status. A free trial is available, allowing users to explore features before committing to a paid plan.

-

What features does airSlate SignNow offer for signing the Form W 8 Rev November Certificate Of Foreign Status?

With airSlate SignNow, users enjoy features such as customizable templates for the Form W 8 Rev November Certificate Of Foreign Status, automated reminders for signers, and the ability to track document status in real-time. These features enhance efficiency and organization.

-

Can I integrate airSlate SignNow with other applications for managing the Form W 8 Rev November Certificate Of Foreign Status?

Yes, airSlate SignNow offers robust integrations with popular applications like Salesforce, Google Drive, and Dropbox, allowing you to manage the Form W 8 Rev November Certificate Of Foreign Status alongside your other business tools. This integration streamlines your workflow.

-

What are the benefits of using airSlate SignNow for the Form W 8 Rev November Certificate Of Foreign Status?

Using airSlate SignNow for the Form W 8 Rev November Certificate Of Foreign Status provides several advantages, including enhanced security, quicker turnaround times, and access to a user-friendly interface. These benefits help improve overall document management efficiency.

-

How does airSlate SignNow ensure the security of the Form W 8 Rev November Certificate Of Foreign Status?

airSlate SignNow uses advanced encryption methods and follows industry standards to ensure the security of the Form W 8 Rev November Certificate Of Foreign Status. Our platform is designed to protect sensitive information, providing peace of mind for users.

Get more for Form W 8 Rev November Certificate Of Foreign Status

Find out other Form W 8 Rev November Certificate Of Foreign Status

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free