VERMONT SMALL BUSINESS DEVELOPMENT CORP 2016-2026

What is the Vermont Small Business Development Corp?

The Vermont Small Business Development Corporation (VSBDC) is a vital resource for entrepreneurs and small business owners in Vermont. It provides guidance, support, and access to various financial resources tailored to the unique needs of small businesses in the state. The VSBDC aims to foster economic growth by helping businesses navigate the complexities of starting and managing a company. This includes offering advice on business planning, marketing strategies, and financial management, ensuring that businesses have the tools they need to succeed.

Eligibility Criteria for Vermont Small Business Loans

Eligibility for small business loans in Vermont typically requires that the applicant meets several key criteria. Businesses must be legally registered in Vermont and demonstrate a viable business plan. Additionally, the business should show the potential for profitability and job creation. Personal credit history may also be considered, along with the business's financial statements. Understanding these criteria can help applicants prepare better and increase their chances of securing funding.

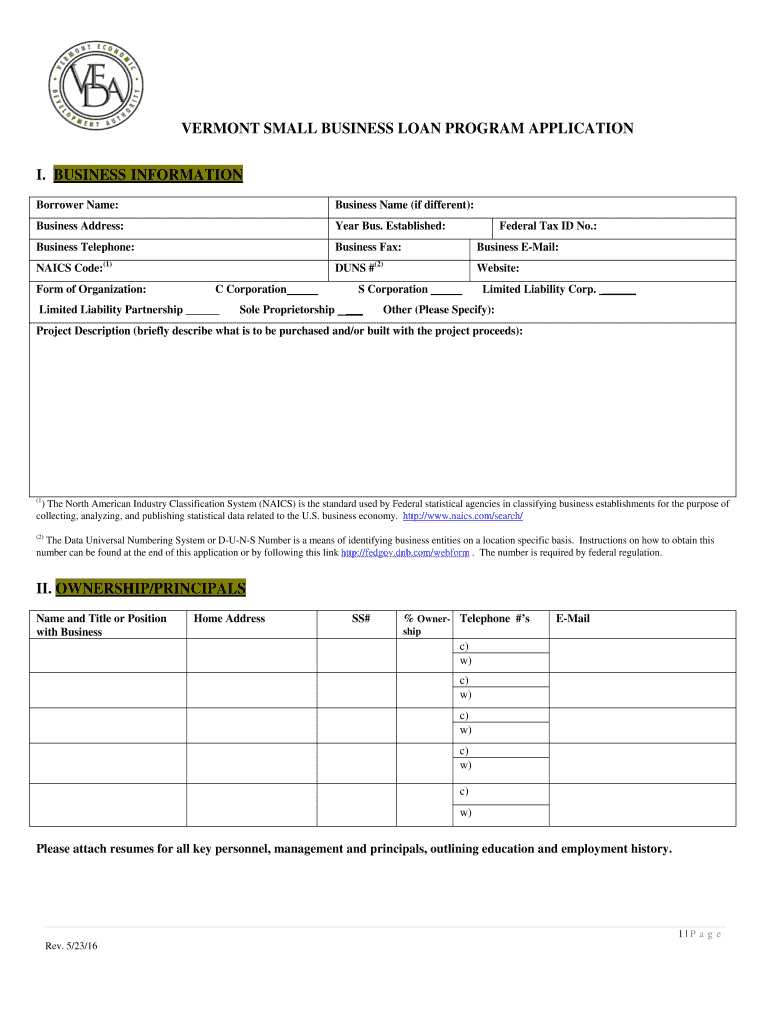

Application Process for Vermont Small Business Loans

The application process for small business loans in Vermont involves several steps. First, applicants should gather necessary documentation, including business plans, financial statements, and personal identification. Next, they will need to complete the loan application form, providing detailed information about their business operations and financial needs. After submission, the application will undergo a review process, during which lenders may request additional information or clarification. Understanding this process can help streamline the application and improve the likelihood of approval.

Required Documents for Small Business Loans

When applying for small business loans in Vermont, several documents are typically required. These may include:

- Business plan outlining the business model and goals

- Financial statements, such as profit and loss statements

- Tax returns for the past few years

- Personal financial information of the business owner

- Legal documents, including business registration and licenses

Having these documents prepared in advance can facilitate a smoother application process.

Steps to Complete the Vermont Small Business Loan Application

Completing the Vermont small business loan application involves a systematic approach. Follow these steps for an effective application:

- Gather all required documents, ensuring they are current and accurate.

- Fill out the loan application form carefully, providing all requested information.

- Review the application for completeness and accuracy before submission.

- Submit the application through the designated method, whether online or in person.

- Follow up with the lender to confirm receipt and inquire about the review timeline.

By adhering to these steps, applicants can enhance their chances of a successful loan application.

Legal Use of Vermont Small Business Loans

Understanding the legal aspects of small business loans in Vermont is crucial for compliance and successful operation. Loans must be used for legitimate business expenses, such as purchasing equipment, hiring employees, or expanding operations. Misuse of funds can lead to serious legal repercussions, including loan default. It is important for business owners to maintain clear records of how loan funds are utilized, ensuring that they align with the terms set forth by the lender.

Quick guide on how to complete vermont small business development corp

Manage VERMONT SMALL BUSINESS DEVELOPMENT CORP from anywhere, at any time

Your everyday business activities might necessitate additional focus when handling state-specific business documents. Reclaim your working hours and cut down on the paper-related costs associated with document-driven tasks using airSlate SignNow. airSlate SignNow provides you with a variety of pre-uploaded business documents, including VERMONT SMALL BUSINESS DEVELOPMENT CORP, which you can utilize and share with your business associates. Manage your VERMONT SMALL BUSINESS DEVELOPMENT CORP seamlessly with powerful editing and eSignature capabilities, and send it directly to your recipients.

Steps to obtain VERMONT SMALL BUSINESS DEVELOPMENT CORP in a few clicks:

- Select a form applicable to your state.

- Click Learn More to access the document and verify its accuracy.

- Select Get Form to start working on it.

- VERMONT SMALL BUSINESS DEVELOPMENT CORP will instantly appear in the editor. No further actions are needed.

- Utilize airSlate SignNow’s advanced editing features to complete or modify the form as necessary.

- Click on the Sign option to create your unique signature and eSign your document.

- When finished, click Done, save your changes, and access your document.

- Distribute the form via email or text message, or use a link-to-fill method with your partners, or allow them to download the document.

airSlate SignNow greatly expedites your dealings with VERMONT SMALL BUSINESS DEVELOPMENT CORP and enables you to access necessary documents from one location. A comprehensive collection of forms is organized and designed to cover vital organizational tasks essential for your enterprise. The advanced editor minimizes the likelihood of errors, allowing you to swiftly rectify mistakes and review your documents on any device before distribution. Start your free trial today to explore all the benefits of airSlate SignNow for your everyday business operations.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

What is the guidance to fill out a W2 form for an S Corp?

You can fill in the W2 form here W-2 Form: Fillable & Printable IRS Template Online | signNowThe W-2 form is one of the most frequently used forms by taxpayers.

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

Which US tax form do you fill out if you work full-time and have a 30+ hour a week small business?

If you are self employed from the small business, most likely you will fill schedule C:https://www.irs.gov/pub/irs-pdf/...You will claim profit from the small business as well as your W2 income from the 40 hr a week job.You may be able to use an online service such as turbotax:Online Tax Software for Self Employment and Personal TaxesHowever, you may benefit from sitting down with an accountant.

-

What forms should I fill out to start a business?

From a legal business entity standpoint, one does not normally have to file any forms with the state the business is located in to be considered a sole proprietor (SP). However, this highly unadvisable since a SP provides no liability protection.The most popular, and most advisable business entities are a Limited Liability Company (LLC) and a Corporation. These entities are state created entities meaning that you must file the necessary paperwork in the state where you will have the business headquarters. The state’s secretary of state’s office will have all the necessary documents, forms, and rules needed to create the entity of your choice. You will also have to pay a filing fee.It is important that you further discuss the issue with experienced counsel as they will be able to help you decide which entity is best for you, and help you with the filing.

-

If I open a small t-shirt store on Etsy or Storenvy, do I need to fill out a DBA form?

The short answer is no, however I would recommend that you do get yourself an LLC. A Limited Liability Corporation is very inexpensive and easy to get and will protect you in case of any sort of legal issue.In short if someone were to take legal action against you due to say defamation or creative license issues the LLC would help protect monies you make from your regular job or your personal belongings.Filling out the paperwork isn’t difficult and costs under $50 last I checked but if you don’t feel comfortable doing it yourself you can find several companies online (just google “get an llc”) that will do it for a fee of about $99 plus the fee for the LLC.

-

What are the required forms to fill out when starting a business?

It depends on where you're based: not only do different countries have different paperwork, but so do different states, counties and even cities. There are some places where you can start a new business without filling out any paperwork (although you'll likely have to deal with tax forms and the like after you've been in business for a while.There are some common forms that you should check on whether you need for your area:Business licenseProfessional license — In addition to a license for operating a business, certain professions are licensed.DBA / Doing business as — If you're doing business under a name other than your own, such as a company name, you may need to file a DBA.Incorporation or organizational documents — Depending on how you organize your business, you may need to file paperwork to incorporate.Tax registration — You will usually need to register with your local state if you're collecting sales tax. You will also probably need to complete paperwork to get a taxpayer identification number or an equivalent for your business.Employee forms — If you have employees, there can be quite a bit of paperwork, including their tax paperwork and any appropriate registration.These really are just a starting point. One of the best things you can do is find a local accountant or other professional to advise you on what you need.

-

How do I to take out a small business loan?

Hey! Here's what I recommend to small business owners:Decide if you want debt financing, equity financing, friends and family financing, or crowdfunding. James provides some good advice on crowdfunding below. Crowdfunding can take a lot of time and is a bit saturated. For the right businesses (in my opinion product-based businesses do best) it makes sense. Equity financing is also tough, but works great for startups--companies that intend to become quite large. Friends and family are a popular choice, but may not be an option, or if it they are, keep in mind the cons. Borrowing from those closest to you can be tough. That leaves debt financing--which is what you referenced specifically. It's a pretty solid choice, assuming your business is producing the funds to pay it off. Here's a good workflow:1. Start at your local bank. Bank loans have the lowest-rates, and if you can qualify for a bank loan, you should get a bank loan. The only time this wouldn't be the case is if you need the funds fast. Bank loans can take sometime to process. So, go with the bank. If you are denied, or need cash fast, your next best bet is to go online.2. Be careful when you shop for loans online. There's a lot of great lenders out there, and some not-so great. Read reviews. Do your research. But most importantly, SHOP! Unless you qualify for an SBA loan out of the gate, shop. I work for a company that operates as a marketplace for small business loans, so I obviously strongly believe in the value of shopping. But, the reason being is that some of the best and most popular online lenders offer loans that are pretty expensive (especially in the short-term loan category). These can be great options for the right business owners. But, if you can qualify for something cheaper, like an SBA loan or a longer-term loan, that's the product you should be taking. 3. The factors that are going to influence your offers the most will be your personal credit score, your business's revenue, your cash flow, and the age of your business (your options are best once your 2+ years in age). If you know you're less than stellar in one of these categories, this could affect your rates. I think it's good to have your expectations set going in.4. A few "good to knows" are that it is hard to qualify for a loan amount greater than 15% of your annual revenue and that usually, the length of a loan application represents the rates the lender offers. If all it takes to apply are 3 months bank statements, you're looking at a more expensive product. If you have to submit a decent amount of financials, from tax returns to P&Ls to Balance Sheets and more, then you're probably looking at a lower-cost product.5. Last bit of advice I'd give is to always ask what the APR is. This is the best way to compare different loan products. And, always ask the prepayment terms, in case you decide to pay the loan off early.I'm happy to answer follow up questions if you have a specific obstacle you're dealing with such as time in business, your personal credit score, etc. If you're wanting more info, I also put together this gigantic checklist for any business owner considering financing. It covers almost everything, and is a great tool no matter where you apply for a loan: Find Your Small Business Loan Best of luck!

Create this form in 5 minutes!

How to create an eSignature for the vermont small business development corp

How to create an eSignature for your Vermont Small Business Development Corp online

How to generate an electronic signature for your Vermont Small Business Development Corp in Google Chrome

How to create an eSignature for putting it on the Vermont Small Business Development Corp in Gmail

How to generate an eSignature for the Vermont Small Business Development Corp from your smart phone

How to create an eSignature for the Vermont Small Business Development Corp on iOS

How to make an electronic signature for the Vermont Small Business Development Corp on Android OS

People also ask

-

What are small business loans Vermont and how do they work?

Small business loans Vermont are financial products designed to provide funding for local businesses in Vermont. These loans can help cover operational costs, purchase inventory, or finance expansion. Typically, businesses can apply for these loans through traditional banks or alternative lenders, with varying terms and interest rates based on qualifications.

-

What types of small business loans are available in Vermont?

In Vermont, small business loans can include traditional term loans, lines of credit, SBA loans, and microloans. Each type serves different needs, from immediate cash flow to long-term investments. It's essential for business owners to assess their financial needs to choose the right loan type.

-

How can I apply for small business loans in Vermont?

To apply for small business loans Vermont, businesses typically need to gather necessary documentation, including financial statements, business plans, and tax returns. After identifying potential lenders, you can submit an application for review. Depending on the lender, the process can take anywhere from a few days to several weeks.

-

What are the eligibility requirements for small business loans Vermont?

Eligibility for small business loans Vermont varies by lender but generally includes a good credit score, established revenue streams, and a solid business plan. Lenders may also consider the business's financial history and collateral. Understanding these requirements can help improve your chances of approval.

-

What are the interest rates like for small business loans in Vermont?

Interest rates for small business loans Vermont can range signNowly depending on the lender and the specific loan product chosen. Rates may vary from as low as 3% for SBA loans to higher rates for unsecured loans. It's crucial to compare offers from multiple lenders to find the most favorable terms.

-

What are the benefits of small business loans Vermont?

The primary benefits of small business loans Vermont include access to necessary capital for growth, improved cash flow, and the ability to invest in new opportunities. These loans can also enhance your business’s credibility and allow you to build a bank relationship. Overall, they provide a crucial financial tool for local entrepreneurs.

-

Can I use small business loans in Vermont for startup costs?

Yes, small business loans Vermont can be used for startup costs, such as equipment purchases, marketing, and initial operating expenses. Many lenders offer specific loan products aimed at startups, designed to help new businesses get off the ground. However, it's vital to demonstrate a viable business plan and financial projections.

Get more for VERMONT SMALL BUSINESS DEVELOPMENT CORP

Find out other VERMONT SMALL BUSINESS DEVELOPMENT CORP

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself