151 Vat Directive Form

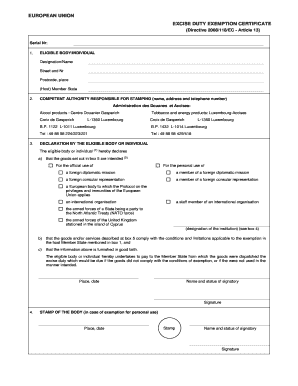

What is the Form 151?

The Form 151 is a specific document utilized in various administrative processes. It serves as a formal request or declaration, often required in legal, tax, or regulatory contexts. Understanding the purpose of this form is crucial for ensuring compliance and facilitating smooth transactions. The form typically collects essential information from the individual or entity submitting it, which may include identification details, financial data, or other relevant specifics necessary for processing.

How to Use the Form 151

Using the Form 151 involves several steps to ensure accurate completion and submission. First, gather all necessary information and documents that may be required to fill out the form. This can include identification numbers, financial statements, or supporting documentation. Next, carefully complete each section of the form, ensuring that all entries are accurate and legible. Once filled out, review the form to confirm that all information is correct before submission. Depending on the requirements, you may need to submit the form electronically or via mail.

Steps to Complete the Form 151

Completing the Form 151 can be straightforward if you follow these steps:

- Gather necessary documents and information.

- Read the instructions carefully to understand each section of the form.

- Fill out the form, ensuring clarity and accuracy in your entries.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal Use of the Form 151

The legal use of the Form 151 is governed by specific regulations and guidelines. It is essential to ensure that the form is completed in compliance with applicable laws to avoid any potential legal issues. This may include adhering to deadlines for submission and ensuring that all required information is provided. In some cases, the form may need to be notarized or accompanied by additional documentation to validate its legal standing.

Key Elements of the Form 151

Key elements of the Form 151 typically include:

- Identification Information: Details about the individual or entity submitting the form.

- Purpose of Submission: A clear statement regarding why the form is being submitted.

- Signature: The form often requires a signature to validate the information provided.

- Date of Submission: The date on which the form is completed and submitted.

Filing Deadlines / Important Dates

Filing deadlines for the Form 151 can vary based on the specific purpose of the form. It is crucial to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or complications in processing. Always check the relevant guidelines or consult with a professional to confirm the specific dates associated with your use of the Form 151.

Quick guide on how to complete 151 vat directive form

Handle 151 Vat Directive Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, adjust, and eSign your documents promptly without any hold-ups. Manage 151 Vat Directive Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign 151 Vat Directive Form effortlessly

- Find 151 Vat Directive Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign function, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your adjustments.

- Select your preferred method to share your form, whether by email, text message (SMS), or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign 151 Vat Directive Form and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 151 vat directive form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 151 and how can airSlate SignNow help?

Form 151 is a standardized document often used for various applications. With airSlate SignNow, you can easily fill, sign, and send form 151 digitally, ensuring that your submissions are quick and secure.

-

Is there a pricing plan for using airSlate SignNow for form 151?

Yes, airSlate SignNow offers a range of pricing plans designed to meet different needs, including options suitable for businesses that frequently handle form 151. You can choose a plan that best fits your usage requirements, and all plans come with a free trial to explore the features.

-

What features does airSlate SignNow provide for form 151?

airSlate SignNow offers features like eSigning, document templates, and secure cloud storage that simplify managing form 151. Additionally, the user-friendly interface allows for easy navigation, making document preparation efficient.

-

Can I integrate airSlate SignNow with other applications for handling form 151?

Absolutely! airSlate SignNow supports integration with popular applications such as Google Drive, Dropbox, and CRM software. This integration ensures seamless management of form 151 within your existing workflow.

-

How secure is the process of signing form 151 on airSlate SignNow?

Security is a priority with airSlate SignNow. When signing form 151, your data is encrypted, and the platform complies with industry standards, offering you peace of mind as you manage your documents securely.

-

What are the benefits of using airSlate SignNow for form 151?

Using airSlate SignNow for form 151 offers numerous benefits, including reduced turnaround time and enhanced document tracking. The platform’s simplicity allows users to focus on what matters most, streamlining the eSigning process.

-

Can airSlate SignNow assist with the customization of form 151?

Yes, airSlate SignNow allows you to customize form 151 by adding your branding, adjusting fields, and including specific instructions. This level of customization ensures that your form meets all necessary requirements while maintaining a professional appearance.

Get more for 151 Vat Directive Form

Find out other 151 Vat Directive Form

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF