Aicpa Erc Engagement Letter Form

What is the AICPA ERC Engagement Letter

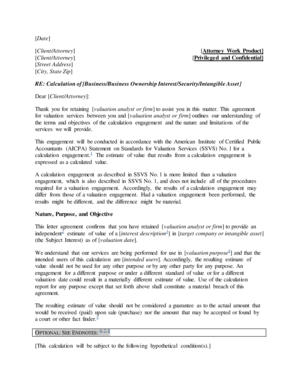

The AICPA Employee Retention Credit (ERC) engagement letter is a formal document that outlines the terms and conditions under which a certified public accountant (CPA) will provide services related to the Employee Retention Credit. This letter serves as a contract between the CPA and the client, detailing the scope of work, responsibilities, and expectations for both parties. It is essential for ensuring clarity and mutual understanding regarding the services rendered, particularly in the context of tax credits aimed at supporting businesses during economic challenges.

Key Elements of the AICPA ERC Engagement Letter

When drafting an AICPA ERC engagement letter, several key elements should be included to ensure comprehensiveness and clarity:

- Scope of Services: Clearly define the services to be provided, such as eligibility assessment, documentation preparation, and filing assistance.

- Responsibilities: Outline the responsibilities of both the CPA and the client, including the client's obligation to provide necessary documentation.

- Fees and Payment Terms: Specify the fee structure, payment schedule, and any additional costs that may arise during the engagement.

- Confidentiality: Include clauses that protect sensitive information shared during the engagement.

- Termination Clause: Detail the conditions under which either party may terminate the engagement.

Steps to Complete the AICPA ERC Engagement Letter

Completing the AICPA ERC engagement letter involves several systematic steps to ensure that all necessary information is accurately captured:

- Gather Information: Collect all relevant details about the client, including business structure, tax identification number, and prior tax filings.

- Define Scope: Clearly outline the services to be provided, ensuring that both parties agree on the tasks involved.

- Draft the Letter: Use a template or create a custom letter that incorporates all key elements and is tailored to the specific engagement.

- Review and Revise: Both parties should review the letter for accuracy and completeness, making any necessary adjustments.

- Sign the Document: Ensure that both the CPA and the client sign the engagement letter, either physically or electronically, to formalize the agreement.

Legal Use of the AICPA ERC Engagement Letter

The AICPA ERC engagement letter is legally binding when executed properly. To ensure its enforceability, it must meet certain criteria:

- Compliance with Regulations: The letter should comply with relevant laws and regulations governing engagement letters and tax credits.

- Clear Signatures: Both parties must provide clear signatures, which can be achieved through electronic signature solutions that comply with the ESIGN Act and UETA.

- Retention of Records: Both parties should retain copies of the signed engagement letter for their records, as it may be required for future reference or audits.

How to Obtain the AICPA ERC Engagement Letter

Obtaining an AICPA ERC engagement letter typically involves the following steps:

- Consult with a CPA: Reach out to a qualified CPA who specializes in tax credits and can provide the necessary services.

- Request a Sample: Ask the CPA for a sample engagement letter or template that can be customized for your specific needs.

- Customize the Template: Work with the CPA to tailor the sample letter to reflect the unique aspects of your business and the services provided.

- Finalize and Sign: Once the letter is customized, ensure both parties review, finalize, and sign the document.

Examples of Using the AICPA ERC Engagement Letter

The AICPA ERC engagement letter can be used in various scenarios, including:

- Small Businesses: A small business seeking to claim the Employee Retention Credit will engage a CPA to navigate the complexities of the application process.

- Startups: New businesses that may qualify for the credit can use the engagement letter to formalize their relationship with a CPA.

- Non-Profit Organizations: Non-profits looking to access the Employee Retention Credit can also benefit from a clear engagement letter outlining the services provided by their CPA.

Quick guide on how to complete aicpa erc engagement letter

Complete Aicpa Erc Engagement Letter effortlessly on any device

Managing documents online has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Aicpa Erc Engagement Letter on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Aicpa Erc Engagement Letter with ease

- Obtain Aicpa Erc Engagement Letter and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Aicpa Erc Engagement Letter while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aicpa erc engagement letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an audit engagement letter sample AICPA?

An audit engagement letter sample AICPA serves as a formal agreement between the auditor and the client, outlining the scope of the audit, responsibilities, and other key details. This sample ensures compliance with AICPA standards, which helps to maintain professionalism and transparency in the audit process.

-

How can airSlate SignNow help in creating an audit engagement letter sample AICPA?

airSlate SignNow provides an intuitive platform that enables users to easily generate and customize an audit engagement letter sample AICPA. With our templates and sign features, you can streamline the document creation process and ensure that all necessary elements, such as compliance with AICPA, are included efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including unlimited document signing and easy sharing features. For those looking to use an audit engagement letter sample AICPA, our competitive pricing ensures that you receive a cost-effective solution without compromising on quality.

-

What features does airSlate SignNow offer for eSigning documents?

Our platform provides several key features for eSigning documents, including real-time status tracking, customizable templates, and secure cloud storage. When creating an audit engagement letter sample AICPA, these features help ensure a smooth and efficient signing process for all parties involved.

-

Are there any integrations with other tools and software?

Yes, airSlate SignNow integrates seamlessly with a variety of popular tools and software, enhancing your workflow. If you're using project management or accounting tools to create an audit engagement letter sample AICPA, our integrations ensure you can easily manage and sign documents within your existing systems.

-

What are the benefits of using an audit engagement letter sample AICPA?

Using an audit engagement letter sample AICPA helps establish clear expectations and protects both the auditor and client during the audit process. It also simplifies documentation, ensuring compliance with AICPA standards while providing a solid foundation for further communication and collaboration.

-

Can I customize the audit engagement letter sample AICPA in airSlate SignNow?

Absolutely! airSlate SignNow allows you to fully customize the audit engagement letter sample AICPA to meet specific client or regulatory requirements. You can add, remove, or modify sections to ensure the letter addresses all necessary components relevant to your auditing standards.

Get more for Aicpa Erc Engagement Letter

- M micro osoft p power rpoint t computer resource center inc form

- Provenance collection in reservoir management workflow halcyon usc form

- Plain language program nih nih form

- Portrait photography contract template form

- Position contract template form

- Portrait session contract template form

- Post construction clean contract template form

- Post production contract template form

Find out other Aicpa Erc Engagement Letter

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy