Personal Financial Statement United Bank 2011-2026

What is the Personal Financial Statement United Bank

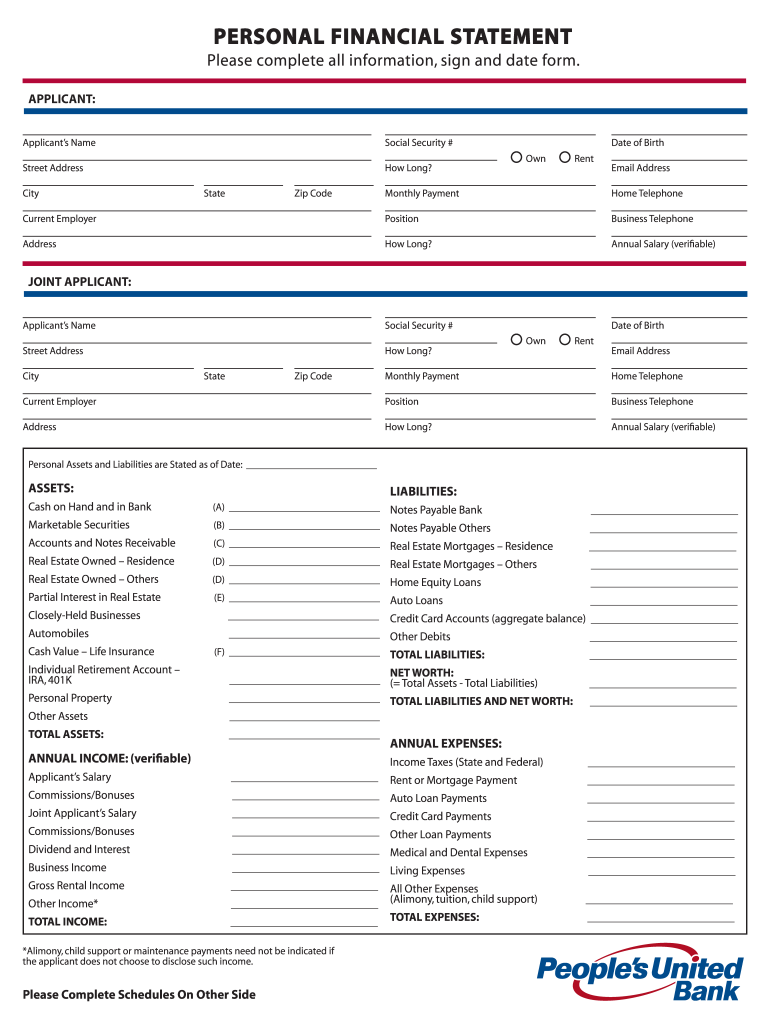

The Personal Financial Statement from United Bank is a comprehensive document that outlines an individual's financial position. This statement typically includes details about assets, liabilities, income, and expenses, providing a clear snapshot of a person's financial health. It is often required for loan applications, financial assessments, or personal record-keeping. By compiling this information, individuals can better understand their financial standing and make informed decisions regarding their finances.

How to use the Personal Financial Statement United Bank

Using the Personal Financial Statement from United Bank involves several steps. First, gather all relevant financial information, including bank statements, investment accounts, and debt obligations. Next, fill out the form accurately, ensuring that all sections are completed. This includes detailing your assets, such as real estate and savings, as well as liabilities like loans and credit card debts. Once completed, this document can be submitted to lenders or used for personal financial planning.

Steps to complete the Personal Financial Statement United Bank

Completing the Personal Financial Statement requires careful attention to detail. Follow these steps:

- Collect all financial documents, including income statements and asset valuations.

- Begin filling out the form by entering personal information, such as name and address.

- List all assets, including cash, investments, and property, with their current values.

- Detail all liabilities, including mortgages, loans, and credit card balances.

- Review the completed statement for accuracy before submitting.

Legal use of the Personal Financial Statement United Bank

The Personal Financial Statement is a legally recognized document that can be used in various financial transactions. It serves as a formal declaration of an individual's financial status, which lenders may require when assessing creditworthiness. Ensuring the accuracy of the information provided is crucial, as any discrepancies can lead to legal implications or denial of financial services.

Key elements of the Personal Financial Statement United Bank

Key elements of the Personal Financial Statement include:

- Assets: Items of value owned, such as cash, real estate, and investments.

- Liabilities: Outstanding debts and obligations, including loans and credit card balances.

- Income: Monthly or annual income sources, such as salary, rental income, or dividends.

- Expenses: Regular expenditures that impact financial health, including housing costs and living expenses.

Examples of using the Personal Financial Statement United Bank

The Personal Financial Statement can be utilized in various scenarios, such as:

- Applying for a mortgage or personal loan, where lenders require proof of financial stability.

- Assessing eligibility for financial aid or government assistance programs.

- Planning for retirement by evaluating current financial resources against future needs.

Quick guide on how to complete united bank personal financial statement form

The optimal method to obtain and sign Personal Financial Statement United Bank

Across the entirety of your organization, ineffective workflows related to paper approvals can take up a signNow amount of work hours. Signing documents such as Personal Financial Statement United Bank is a standard aspect of operations in any enterprise, which is why the productivity of each agreement’s progression signNowly impacts the company’s overall effectiveness. With airSlate SignNow, signing your Personal Financial Statement United Bank can be as effortless and swift as possible. You’ll discover with this platform the most recent version of virtually any document. Even better, you can sign it right away without needing to install external software on your computer or printing anything as physical copies.

Steps to obtain and sign your Personal Financial Statement United Bank

- Browse our collection by category or utilize the search bar to find the document you require.

- View the document preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your document and provide any required details using the toolbar.

- Once finished, click the Sign tool to sign your Personal Financial Statement United Bank.

- Choose the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you have everything you need to manage your documents effectively. You can find, complete, modify, and even send your Personal Financial Statement United Bank all in one tab with no complications. Optimize your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How should I start investing my money as a 26 year old with no related knowledge?

The best investment you can make is to invest in yourself. The second best investment you can make is to reduce costs.Invest in yourselfEducation: You should be investing in your education. That doesn't necessarily mean college or grad school -- but it does mean massive knowledge accumulation to advance your career. Luckily, the cost of attaining knowledge has gone down dramatically. Buy time to focus more on your career. You can invest small amounts of money to buy yourself time. You can invest money to pay for things like grocery deliveries, laundry services, etc. to increase your time. Sometimes you can get a whole hour for less than you make in 10 minutes -- always make that trade-off if you can afford it. If you can put more hours in your career, you should see faster and larger raises, promotions, etc.More details at: What is the best way to maximize profit using my 20K?Cut your expensesThe second best investment for a young person to make is to cut your expenses -- especially the reoccurring expenses. Cutting expenses is much better than corresponding income because you get taxed on income. And if you live in a place like California or Manhattan, then you get taxed A LOT on income (top tax bracket for Fed+State+local is about 54%). For instance: Cut expenses like your monthly cable bill -- if you call your cable or mobile phone provider, you could probably knock off $15/mo in a 30 min phone call. That means you just made $180/year tax free. Cancel other services you don't use. Get a place with lower rent and just live cheaper. Long-term: two years of savingsIf you grow your revenues enough and cut your expenses enough, you will save. If things go well, you might achieve freedom. My definition of financial freedom for a young person is having two years of savings in the bank. That means you could sustain your current lifestyle for two years with no additional income. If you can achieve two years of savings, you can take real risks. You can quit your job to pursue a "crazy" idea. You have freedom to build real wealth.

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the dd form for SBI bank?

Write the name of the beneficiary in the space after “in favour of “ and the branch name where the beneficiary would encash it in the space “payable at”.Fill in the amount in words and figures and the appropriate exchange .Fill up your name and address in “Applicant's name” and sign at “ applicant's signature”

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How can I learn mutual funds investment?

Its not that complex… Here, i have written everything you need to know about Mutual funds. Read this, you can start investing without anyone’s help.Mutual fund is like fixed deposit where we deposit our money and it will give us return.There are three types of mutual funds, they are debt fund, equity fund & balanced fund.Debt fund is similar to Bank. When we invest our money in debt fund, fund house will use our money to give loans to private companies or Indian government or State government.Debt fund - Risk is low. Return is around 8%. If you withdraw money within 3 years, you need to pay tax based on your income tax slab (like 10% or 20% or 30%). If you withdraw after 3 years, you need to pay 20% tax with indexation.Indexation: 20% tax with indexation means you will be discounting inflation while paying tax. So you will be paying less tax after discounting inflation (less than 15%)Inflation: Inflation is most important factor when comes to finance. It means decrease in purchasing power of money. To give you an example, before 10 years Rs.10 is a big amount. But now??? In 10 years from now Rs.10 will be nothing. Thats the inflation, every year value of money will get reduced. Government regularly release inflation details.There are many types of debt funds like gilt, income, short term, liquid, ultra short term.Gilt fund - your money will be loaned to government. Risk is very low since borrower is Government.Income fund - you will receive monthly income. Suitable for retired people.Liquid fund - you can withdraw your money anytime without any charges. It is like savings account.Short term or Ultra short term - if you like to invest only for some months.Let me warn you, debt funds are not risk free. They too carry some risk. Sometimes company default loans (Vijay Mallya, Nirav Modi). Then there is a risk of interest rate.If like to invest with minimal risk, then open the debt fund in valueresearchonline website. There you will find the below diagram (or chart?). Good low risk debt fund should have black box in red area. The meaning is, the fund is less sensitive to interest rate change and has good credit quality.Equity fund. As the name says, your money will get invested in Share market.Equity fund is riskier than debt fund. But it gives good return like 12% to 25%. If you withdraw withing an year you need to pay short term capital gain tax of 15%. If you withdraw after 1 year and if your return is more than 1 lakh, you need to pay capital gain tax of 10%.It is recommended to hold equity mutual funds at least 5 years to see decent return.Equity mutual funds comes in many types like large cap, mid cap, small cap, sector.Large cap or Bluechip fund - your money will get invested in big companies. Risk is low and return is around 10% - 13%.Mid cap fund - your money will get invested in medium size companies. Return is more than 13%. Medium risk.Small cap fund - your money will get invested in small companies. Very risky but good return, more than 20%.Sector fund - your money will get invested in companies in specific sector. For example, Equity Infra fund means, your money will get invested in Infrastructure companies. Return varies based on sector, but it will be more than 15%.Index fund - Return is around 10%. Medium risk.What is index fund? There are many indices in India like Nifty, Sensex, Bank nifty, etc., Each index comprise of many companies with different weightage. For example, Nifty comprise of top 50 companies in NSE. If you invest your money in Nifty index fund, it is like investing in top 50 companies in NSE.ELSS - It is tax saving mutual fund. You can save tax under Section 80C. It is getting popular now. Lock in period is 3 years. Return is around 12%.Arbitrage fund - It is very very low risk equity fund. Arbitrage fund won’t get affected by markets up and down. Return is 8%. Taxing is same as equity mutual funds.Balanced or Hybrid fund. It is mix of Equity and Debt fund. (65% equity and 35% debt). Low risk. Return around 12%. Taxation is similar to equity fund.First, choose fund type based on your risk potential (like debt or equity or balanced).If you are retired person or if you don’t want to take any risks then choose Debt funds.If you like to take only small amount of risk, choose balanced fund.If you earn average income, then choose balanced fund or large cap or both.If you fall under huge income category, then mix large cap, mid cap and small cap.To choose fund, visit Funds - Value Research Online. Here are the list of things to note while choosing fund…See the fund’s performance from inception. See yearly, 3 year, 5 year and overall return.See the expense ratio. Expense ratio is the amount you are going to pay as commission. Less than 1% is better.See exit load. This is amount you need to pay when you withdraw.Value research online gives star rating for all funds. Choose funds with atleast 4 Stars.IMPORTANT NOTE: All funds comes in two plans Regular & Direct plan. Regular means you invest via Broker or Agent. Direct means you invest directly. Broker or Agents charge commission. Their commission will be around 1% per year. IT IS LOT OF MONEY. So never go with Broker or Agents.If you are new to mutual fund, you need to register KYC first. It is one time process and it is centralized. Once you get registered, you can invest in any mutual funds just by giving your PAN number. To register KYC, first select fund house (example, SBI Mutual fund or HDFC mutual fund). Find their office in your city and go and register KYC. You can also register e-KYC online, but it has some limitations. So i suggest you to visit office and do it in person.Once KYC is done, you can invest in any mutual funds. If you do KYC in SBI mutual fund, you can also invest in HDFC or ICICI mutual funds. KYC is centralized.Once KYC is done, visit mutual fund company website (like SBI mutual fund site or LT mutual fund site). Register there. Start investing. You can either invest as Lump sum. Or as SIP. SIP means you can invest small amount monthly. Money will be automatically deducted from your account.FAQ:When should i invest?If you are planning to invest via SIP you can start anytime. But if you are planning to invest as Lumpsum, there is a completely different approach. If you like to invest lumpsum in debt fund. You can invest anytime, no issues.But if you like to invest lumpsum in equity mutual fund, you need to follow different approach, since investing lumpsum in equity mutual fund is very risky. First invest your lump amount in liquid fund or ultra short term debt fund [Lets call Fund A]. These funds don’t have exit load (or withdrawing fee), so there is no charges when money gets transferred. Now, set up STP (Systematic Transfer Plan) to transfer a fixed amount monthly to an equity fund [Fund B]. For example, if you have 1 lakh lump amount, set a monthly amount to Rs.5,000. Every month, Rs.5,000 from Fund A will get transferred to Fund B. Fully automatic.Note: Never invest lump amount directly in equity mutual funds.Is there any service which helps me to invest in Mutual funds easily?There are so many apps these days which help you to invest money in mutual funds via direct plan. Like, Zerodha Coins [Not a promotion, you can try any app you want]. These apps are not free, they charge small amount monthly. You can easily set up investments from the app and also you can track the fund performance. I personally find such apps useful.I heard mutual fund is risky.Every investment is risky, whether it is real estate, gold or FD.Gold. What if someone stole or you lose is somewhere? Think how many times you heard from your friends or relatives (or happened to you) that they lost Jewels?FD. FD return is very low. If you are a tax payer and if you invest in FD, then you are LOSING MONEY because of tax and inflation. You will be losing 1% or more per year if you invest in FD. And also, what happens if bank goes bankrupt? FD is insured for Rs.1 lakh. If you have 10 lakhs in FD and bank goes bankrupt, you receive Rs.1 lakh.Real estate. Many factors affect real estate like current government, policies, economy, water issue, etc., And there is liquidity problem . You can’t buy or sell real estate fast.Like these mutual funds also carry risk. If you plan properly you can reduce the risk by investing GILT fund or Arbitrage fund. Remember, mutual fund house invest your money in companies like ICICI bank, TCS, ITC, Tata motors, etc., It is very unlikely that these companies shut down their business.Is it true that debt fund carry Zero Risk?No. As i said earlier Risk is everywhere. When compared with equity, debt fund carry low risk. Still there is some risk. Companies default their loan (remember Kingfisher?). Companies goes bankrupt.What funds are you investing?I am investing in…Aditya Birla SL Balanced '95 Direct-G (Balanced fund)IDFC Focused Equity Direct-G (Large and mid cap)L&T Emerging Businesses Direct-G (Small cap)What should i choose? Growth or Dividend or Dividend reinvestment?Growth - To unleash the power of compound interest choose Growth. It will give you massive return in long term. (Recommended)Dividend - If you want regular income from your investment, then choose Dividend. This option is recommended for retired people.Dividend reinvestment - Companies release dividend regularly. If you choose this option then fund house will buy new units of the fund with dividend money.If I choose dividend fund, do I need to pay income tax for dividend income?No, there is no income tax for dividend income.What is the minimum age required to invest in mutual fund?There is no minimum age. You can start at any age. If you are below 18, you need to provide birth certificate.What is the minimum amount needed to invest in mutual fund?You can start with as low as Rs.500.I am already investing via Regular plan. How to switch to direct plan?Visit fund company website. Register yourself and login. There will be option to Switch. While switching select Direct plan. Simple.How do I know whether I am investing in Regular plan or Direct plan?Login to your account or check your statement. See the fund name. If the name ends with Direct, it is direct plan. Or if it ends with regular it is regular plan.What should i do after investing?It takes atleast 5 years to see decent return from equity mutual funds. Bookmark the website value research online. It is popular site about mutual funds. They give star rating for all mutual funds. Good fund should have atleast 4 stars. Every once in a while check number of stars for your fund. If it goes below 3 stars, i suggest you to switch fund.I am investing in equity mutual fund. I got negative returns. Now i have less money than what i invest. What should i do?Market fluctuates. It is normal. As i said earlier, you need to wait atleast 5 years to see decent return from equity mutual funds.How to withdraw money?Login to your account. Choose redeem option. Money will be withdrawn to your bank account.How to terminate mutual fund?First redeem your money. Then you need to send post (physical, no email) to mutual fund company asking them to terminate. But it is not necessary. Just withdraw money and done with that.What happens if I fail to pay monthly instalment for SIP because of no funds in my savings account?Nothing will happen. Don't worry.How to switch funds?Case 1: Switch funds from same fund house. For example, LT Fund A to LT Fund B. Login to fund house website. Choose switch option. It is simple.Case 2: Switch funds of different fund house. For example, LT Fund A to SBI Fund A. There is no direct option for this. First you need to withdraw money from fund A and invest freshly in Fund B.How to track my mutual funds investments?If you are investing via apps like Zerodha coin, you can easily track form those apps.What are open ended and close ended mutual funds?When comes to mutual funds always go with open ended funds. Open ended fund gives better return than close ended. And also you can enter and exit open ended funds anytime.———————————————————————————————————Hope, i explained everything here. Please don’t contact me with questions which i already explained here. I won’t respond. Spend some time to read. If i missed anything, do comment here.Invest with your own risk. Market fluctuates, sometimes market crashes, companies default their loans. Anything can happen. I am just sharing knowledge.Happy investing.Ashok Ramesh.

Create this form in 5 minutes!

How to create an eSignature for the united bank personal financial statement form

How to create an electronic signature for your United Bank Personal Financial Statement Form in the online mode

How to generate an electronic signature for your United Bank Personal Financial Statement Form in Google Chrome

How to create an eSignature for putting it on the United Bank Personal Financial Statement Form in Gmail

How to generate an eSignature for the United Bank Personal Financial Statement Form right from your mobile device

How to generate an eSignature for the United Bank Personal Financial Statement Form on iOS

How to create an electronic signature for the United Bank Personal Financial Statement Form on Android devices

People also ask

-

What is a Personal Financial Statement United Bank and why do I need it?

A Personal Financial Statement United Bank is a document that summarizes your financial situation, including assets, liabilities, and net worth. It's essential for loan applications, mortgage approvals, or any financial dealings that require a clear picture of your finances. Using airSlate SignNow makes it easy to create and eSign your Personal Financial Statement, ensuring a smooth submission process.

-

How can airSlate SignNow help me create a Personal Financial Statement United Bank?

airSlate SignNow offers templates that simplify the process of drafting a Personal Financial Statement United Bank. With user-friendly features, you can easily fill in your financial details and eSign the document securely. This ensures that your statement is both professional and compliant with banking requirements.

-

What are the costs associated with using airSlate SignNow for my Personal Financial Statement United Bank?

airSlate SignNow provides a cost-effective solution for managing documents, including your Personal Financial Statement United Bank. Pricing plans vary based on features, but they typically offer a free trial, so you can assess the platform's value before committing. This makes it accessible for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other financial software for my Personal Financial Statement United Bank?

Yes, airSlate SignNow seamlessly integrates with various financial software, allowing you to manage your Personal Financial Statement United Bank more efficiently. These integrations enable you to pull data from your financial applications directly, saving time and reducing errors in your statement preparation.

-

What security measures does airSlate SignNow implement for my Personal Financial Statement United Bank?

Security is a top priority at airSlate SignNow. Your Personal Financial Statement United Bank is protected by advanced encryption and secure cloud storage, ensuring that your sensitive financial information is safe from unauthorized access. Additionally, the platform complies with industry standards to guarantee data protection.

-

Is it possible to send my Personal Financial Statement United Bank to different recipients using airSlate SignNow?

Absolutely! airSlate SignNow allows you to easily send your Personal Financial Statement United Bank to multiple recipients for review or signature. You can track the status of your document in real-time, ensuring that you know when it has been viewed or signed, facilitating efficient communication.

-

Can I edit my Personal Financial Statement United Bank after sending it with airSlate SignNow?

Yes, you can edit your Personal Financial Statement United Bank even after it has been sent for eSignature, as long as it hasn’t been fully executed. airSlate SignNow provides an intuitive interface that allows you to make necessary adjustments and resend the document quickly, maintaining the accuracy of your financial information.

Get more for Personal Financial Statement United Bank

Find out other Personal Financial Statement United Bank

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple