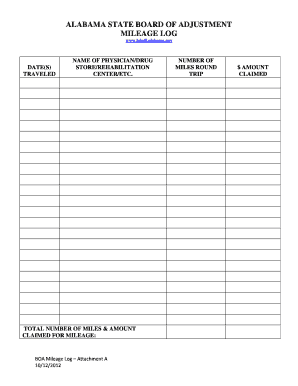

Mileage Log Form

What is the Mileage Log

A mileage log is a detailed record that tracks the miles driven for business purposes. This document is essential for individuals and businesses seeking to claim vehicle expenses on their tax returns. By maintaining an accurate mileage log, taxpayers can substantiate their claims and ensure compliance with IRS regulations. The log typically includes information such as the date of travel, destination, purpose of the trip, and the total miles driven.

Steps to complete the Mileage Log

Creating a mileage log involves several straightforward steps. Begin by documenting the date of each trip, followed by the starting and ending odometer readings. Next, note the purpose of the trip, whether it is for client meetings, business errands, or other work-related activities. It’s important to calculate the total miles driven for each trip accurately. Regularly updating your log will help maintain its accuracy and reliability.

Legal use of the Mileage Log

To ensure the mileage log is legally valid, it must meet specific requirements set forth by the IRS. The log should be maintained contemporaneously, meaning it should be filled out in real-time rather than reconstructed later. This practice helps provide credible evidence of business-related travel. Furthermore, using a digital tool to create and store the mileage log can enhance its legitimacy, as it offers features like timestamps and secure storage.

IRS Guidelines

The IRS has established guidelines for maintaining a mileage log to claim deductions. According to these guidelines, taxpayers must keep detailed records of their business mileage, including the date, destination, purpose, and total miles driven. The IRS allows for two methods of calculating vehicle expenses: the standard mileage rate and actual expenses. Taxpayers should choose the method that best suits their situation while ensuring compliance with IRS documentation requirements.

Key elements of the Mileage Log

A comprehensive mileage log should include several key elements to be effective. These elements are:

- Date: The date when the trip occurred.

- Destination: The location where the trip took place.

- Purpose: A brief description of the reason for the trip.

- Starting and Ending Odometer Readings: The mileage recorded at the beginning and end of the trip.

- Total Miles Driven: The total distance traveled during the trip.

How to use the Mileage Log

Using a mileage log effectively involves consistent and accurate record-keeping. Begin by selecting a method for tracking your mileage, whether through a digital application or a physical notebook. Each time you complete a business trip, immediately enter the relevant details into your log. At the end of the tax year, compile your records to calculate total deductible mileage. This organized approach will help simplify the tax filing process and ensure you maximize your deductions.

Quick guide on how to complete mileage log

Easily Prepare Mileage Log on Any Device

Digital document management has become popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct format and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Mileage Log on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Simplest Way to Modify and Electronically Sign Mileage Log

- Obtain Mileage Log and click Get Form to begin.

- Use the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools specifically offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and select the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mileage Log to ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mileage log

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer to help users create mileage logs?

airSlate SignNow offers an intuitive platform that enables users to create mileage logs easily. With customizable templates and built-in calculations, users can efficiently document their mileage for business trips. The user-friendly interface ensures that creating a mileage log is quick and straightforward.

-

Is there a cost associated with creating a mileage log using airSlate SignNow?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Users can access the mileage log feature as part of a subscription, which is cost-effective compared to traditional methods. Each plan is designed to offer great value while simplifying the process to create mileage logs.

-

How can airSlate SignNow help streamline my mileage tracking process?

With airSlate SignNow, users can create mileage logs seamlessly, reducing manual entry and potential errors. The application allows for automatic tracking using integrations with GPS technologies, making it easier to log every mile driven. This ensures accurate documentation and saves time in tracking mileage.

-

Can I integrate airSlate SignNow with other applications to assist in creating mileage logs?

Absolutely! airSlate SignNow offers integrations with various applications such as accounting software and CRM tools. This allows users to create mileage logs within their existing workflows, making the process smoother and enhancing productivity.

-

What benefits does airSlate SignNow provide for businesses needing to create mileage logs?

Using airSlate SignNow to create mileage logs offers businesses increased accuracy and accountability in their expense reporting. The platform helps eliminate paperwork, enabling digital management of mileage data. This leads to faster reimbursements and improved compliance with tax regulations.

-

Is it easy to share created mileage logs with team members or clients?

Yes, sharing created mileage logs is effortless with airSlate SignNow. Users can quickly send their completed logs via email or through secure links, allowing for easy collaboration. This ensures that all stakeholders have access to accurate information at all times.

-

What types of mileage logs can I create with airSlate SignNow?

airSlate SignNow allows users to create various types of mileage logs, including personal, business, and charitable trip logs. You can customize your log to meet specific requirements, ensuring it aligns with your business needs. This versatility is beneficial for both individuals and businesses.

Get more for Mileage Log

Find out other Mileage Log

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien