CERTIFICATE of DOMICILE of NON RESIDENT for INDONESIA TAX 2021

What is the Certificate of Domicile of Non Resident for Indonesia Tax

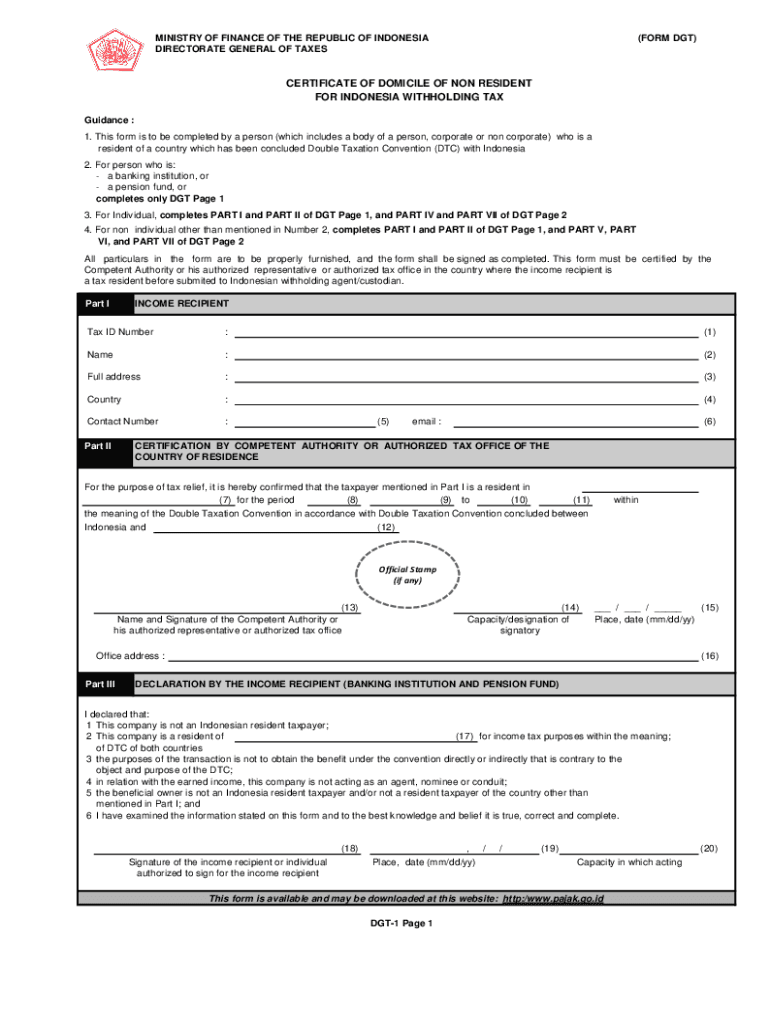

The Certificate of Domicile of Non Resident for Indonesia Tax is an official document that certifies an individual's or entity's tax residency status outside of Indonesia. This certificate is crucial for non-residents who earn income from Indonesian sources, as it helps determine the applicable tax rates and potential exemptions under double taxation agreements. The document confirms that the holder is a tax resident in their home country, which can significantly affect their tax liabilities in Indonesia.

How to Obtain the Certificate of Domicile of Non Resident for Indonesia Tax

To obtain the Certificate of Domicile of Non Resident for Indonesia Tax, individuals or entities typically need to follow these steps:

- Contact the tax authority in your home country to request the certificate.

- Provide necessary documentation, such as proof of residency, identification, and any previous tax filings.

- Complete any required forms as specified by the tax authority.

- Submit the application and wait for processing, which may vary based on jurisdiction.

Key Elements of the Certificate of Domicile of Non Resident for Indonesia Tax

The Certificate of Domicile of Non Resident for Indonesia Tax includes several key elements that validate the document's authenticity and purpose:

- The name and address of the individual or entity applying for the certificate.

- The tax identification number (TIN) or equivalent from the home country.

- A statement confirming the individual's or entity's non-resident status for Indonesian tax purposes.

- The signature and seal of the issuing authority, which adds legitimacy to the document.

Steps to Complete the Certificate of Domicile of Non Resident for Indonesia Tax

Completing the Certificate of Domicile involves several important steps:

- Gather all necessary personal and financial information, including identification and proof of residency.

- Fill out the certificate form accurately, ensuring all details match your official documents.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the appropriate tax authority, either online or in person, based on their requirements.

Legal Use of the Certificate of Domicile of Non Resident for Indonesia Tax

The legal use of the Certificate of Domicile of Non Resident for Indonesia Tax is primarily to establish the tax residency status of non-residents in relation to their income from Indonesian sources. This certificate is essential for:

- Claiming reduced tax rates or exemptions under applicable tax treaties.

- Avoiding double taxation on income earned in Indonesia.

- Providing proof of tax residency to Indonesian tax authorities when required.

Required Documents for the Certificate of Domicile of Non Resident for Indonesia Tax

When applying for the Certificate of Domicile of Non Resident for Indonesia Tax, several documents are typically required:

- A valid identification document, such as a passport or national ID.

- Proof of residency, which can include utility bills, lease agreements, or tax returns from the home country.

- Any forms or applications specified by the tax authority in your jurisdiction.

Quick guide on how to complete certificate of domicile of non resident for indonesia tax

Effortlessly Complete CERTIFICATE OF DOMICILE OF NON RESIDENT FOR INDONESIA TAX on Any Device

Managing documents online has become increasingly popular among companies and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle CERTIFICATE OF DOMICILE OF NON RESIDENT FOR INDONESIA TAX on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign CERTIFICATE OF DOMICILE OF NON RESIDENT FOR INDONESIA TAX with Ease

- Locate CERTIFICATE OF DOMICILE OF NON RESIDENT FOR INDONESIA TAX and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and electronically sign CERTIFICATE OF DOMICILE OF NON RESIDENT FOR INDONESIA TAX and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct certificate of domicile of non resident for indonesia tax

Create this form in 5 minutes!

How to create an eSignature for the certificate of domicile of non resident for indonesia tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Certificate of Domicile of Non Resident for Indonesia Tax?

The Certificate of Domicile of Non Resident for Indonesia Tax is an official document that certifies an individual's or entity's tax residency status outside of Indonesia. This certificate is essential for non-residents to benefit from reduced withholding tax rates on income sourced from Indonesia, as stipulated in tax treaties.

-

How can airSlate SignNow help me obtain a Certificate of Domicile of Non Resident for Indonesia Tax?

airSlate SignNow simplifies the process of obtaining a Certificate of Domicile of Non Resident for Indonesia Tax by allowing you to easily fill out, sign, and send the necessary documents electronically. Our platform ensures that your documents are securely stored and easily accessible, streamlining the entire process.

-

What are the costs associated with obtaining a Certificate of Domicile of Non Resident for Indonesia Tax through airSlate SignNow?

The costs for obtaining a Certificate of Domicile of Non Resident for Indonesia Tax through airSlate SignNow are competitive and vary based on the specific services you choose. We offer flexible pricing plans that cater to different business needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the Certificate of Domicile of Non Resident for Indonesia Tax?

airSlate SignNow offers a range of features for managing your Certificate of Domicile of Non Resident for Indonesia Tax, including customizable templates, electronic signatures, and real-time tracking of document status. These features enhance efficiency and ensure compliance with tax regulations.

-

Are there any benefits to using airSlate SignNow for my Certificate of Domicile of Non Resident for Indonesia Tax?

Using airSlate SignNow for your Certificate of Domicile of Non Resident for Indonesia Tax provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform also allows for easy collaboration with tax professionals, ensuring that your documents are accurate and compliant.

-

Can I integrate airSlate SignNow with other tools for managing my Certificate of Domicile of Non Resident for Indonesia Tax?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms, allowing you to manage your Certificate of Domicile of Non Resident for Indonesia Tax alongside your existing workflows. This integration capability enhances productivity and ensures a smooth document management process.

-

How secure is the process of obtaining a Certificate of Domicile of Non Resident for Indonesia Tax with airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your Certificate of Domicile of Non Resident for Indonesia Tax and other sensitive information, ensuring that your data remains confidential and secure.

Get more for CERTIFICATE OF DOMICILE OF NON RESIDENT FOR INDONESIA TAX

Find out other CERTIFICATE OF DOMICILE OF NON RESIDENT FOR INDONESIA TAX

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free