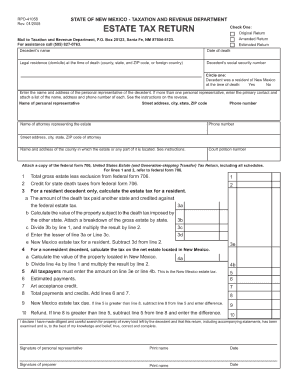

Rpd 41058 Form

What is the RPD 41058

The RPD 41058 form is a specific document used in various administrative processes, often related to tax or regulatory compliance. It is essential for individuals and businesses to understand its purpose and implications. Typically, this form serves as a means to report specific information to a governmental body, ensuring compliance with applicable laws and regulations. Understanding the RPD 41058 is crucial for anyone who needs to navigate the complexities of administrative requirements.

How to use the RPD 41058

Using the RPD 41058 form involves several straightforward steps. First, gather all necessary information that will be required to complete the form accurately. This may include personal identification details, financial data, or other relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed as required. Once the form is filled, review it for accuracy before submission. Depending on the specific requirements, you may need to submit the form electronically or via mail.

Steps to complete the RPD 41058

Completing the RPD 41058 form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all required documentation and information.

- Read the instructions provided with the form carefully.

- Fill in each section of the form, ensuring all required fields are completed.

- Double-check the information for accuracy and completeness.

- Sign and date the form as required.

- Submit the form according to the specified submission method.

Legal use of the RPD 41058

The legal use of the RPD 41058 form is governed by specific regulations that dictate how and when it should be utilized. Ensuring compliance with these regulations is essential for the form to be considered valid. This includes adhering to deadlines, providing accurate information, and maintaining proper records of submission. Failure to comply with the legal requirements associated with the RPD 41058 may result in penalties or other legal consequences.

Who Issues the Form

The RPD 41058 form is typically issued by a governmental agency or regulatory body relevant to its purpose. This could include state tax authorities or other entities responsible for overseeing compliance in specific areas. Understanding the issuing authority is important, as it provides context for the form's requirements and the implications of its use.

Form Submission Methods

Submitting the RPD 41058 form can be done through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via the agency's official website.

- Mailing the completed form to the designated address.

- In-person submission at a local office or designated location.

Each method may have different processing times and requirements, so it is advisable to review the guidelines provided by the issuing authority.

Quick guide on how to complete rpd 41058

Prepare Rpd 41058 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can acquire the needed form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Rpd 41058 on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Rpd 41058 smoothly

- Locate Rpd 41058 and click on Get Form to begin.

- Utilize our provided tools to complete your form.

- Emphasize relevant portions of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Rpd 41058 while ensuring exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd 41058

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rpd 41058 and how does it benefit my business?

RPD 41058 is a specific feature within the airSlate SignNow platform that streamlines document management and eSignature processes. By utilizing rpd 41058, businesses can improve workflow efficiency, reduce processing time, and enhance overall productivity while ensuring secure transactions.

-

How much does airSlate SignNow cost with rpd 41058 included?

The pricing for airSlate SignNow, including features like rpd 41058, varies based on the plan selected. You can choose from several pricing tiers, all designed to accommodate different business needs and budgets, ensuring that you get great value in utilizing rpd 41058.

-

What features does rpd 41058 offer to enhance document signing?

RPD 41058 offers features such as customizable templates, real-time tracking of document status, and automatic reminders for signers. These features not only simplify the signing process but also help in maintaining compliance and improving accountability in document management.

-

Is rpd 41058 easy to integrate with other systems?

Yes, rpd 41058 is designed for seamless integration with various software platforms. This allows businesses to easily incorporate airSlate SignNow into their existing workflows and document systems, ensuring that all tools work in harmony.

-

Can I use rpd 41058 for both small and large business needs?

Absolutely! RPD 41058 is scalable and suitable for businesses of all sizes. Whether you are a small startup or a large enterprise, airSlate SignNow with rpd 41058 can be tailored to meet your specific document signing and management needs.

-

What are the security features associated with rpd 41058?

RPD 41058 includes robust security measures such as encryption and secure access controls, ensuring that your documents and signatures are protected. This commitment to security helps businesses comply with legal regulations and safeguards sensitive information.

-

How does rpd 41058 improve the overall user experience?

RPD 41058 enhances user experience through its intuitive interface and user-friendly design. This makes it easy for both senders and signers to navigate the document signing process, reducing the learning curve and increasing overall satisfaction.

Get more for Rpd 41058

- Ohio f 6 permit form

- Liquor license special event form

- Handgun application 2012 form

- Louisville metro special event permit application louisvilleky form

- Olcc permit application 2012 2019 form

- Filming permits in annapolis form

- Nj division of gaming enforcement social affair permit 2011 form

- Cobb county commercial permit application form

Find out other Rpd 41058

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now