Travel Expense Sheet Form

What is the Travel Expense Sheet

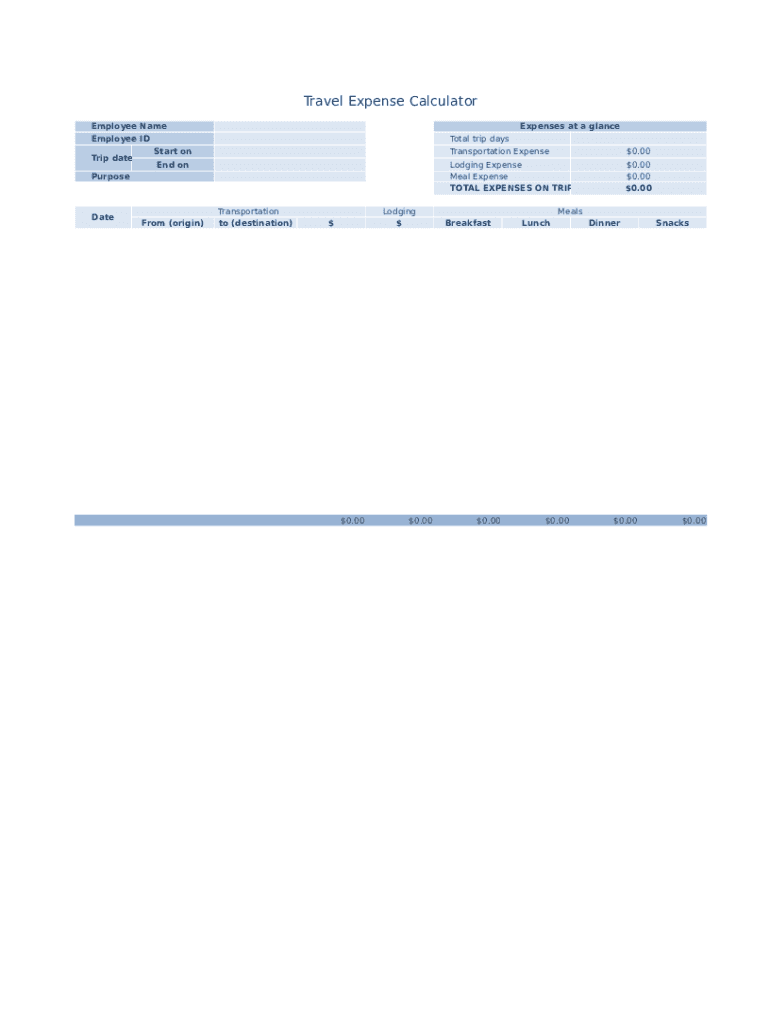

The travel expense sheet is a crucial document used by businesses to track and report expenses incurred during business travel. This sheet typically includes various categories such as transportation, lodging, meals, and other travel-related costs. By organizing these expenses systematically, companies can ensure accurate reporting and reimbursement for employees. It serves as a formal record that can be referenced for budgeting, accounting, and tax purposes.

How to use the Travel Expense Sheet

Using a travel expense sheet involves several straightforward steps. First, ensure you have a template that suits your needs, which can be a digital format like an expense calculator spreadsheet or a printable document. Next, fill in the relevant details for each expense category, including dates, amounts, and descriptions. It is important to keep receipts and attach them as proof of expenses. Finally, submit the completed sheet to your finance department for processing and reimbursement.

Steps to complete the Travel Expense Sheet

Completing the travel expense sheet requires attention to detail. Begin by gathering all receipts and documentation related to your travel expenses. Then, follow these steps:

- Open your travel expense worksheet or template.

- Enter the date of each expense.

- Specify the type of expense (e.g., transportation, lodging).

- Input the amount spent for each category.

- Add any necessary notes or descriptions to clarify the purpose of the expense.

- Attach digital copies of receipts if using an online form.

Once completed, review the sheet for accuracy before submitting it for reimbursement.

Legal use of the Travel Expense Sheet

The travel expense sheet must comply with specific legal standards to ensure that it is recognized as a legitimate document for reimbursement and tax purposes. This includes maintaining accurate records and adhering to IRS guidelines regarding deductible expenses. Proper documentation is essential; without it, businesses may face challenges during audits or when substantiating claims for tax deductions.

Key elements of the Travel Expense Sheet

Several key elements are essential for an effective travel expense sheet. These include:

- Date: The date of each expense incurred.

- Expense Type: Categories such as transportation, meals, and lodging.

- Amount: The total cost for each expense.

- Description: A brief explanation of the expense.

- Receipts: Attachments or notes indicating proof of purchase.

Incorporating these elements ensures clarity and completeness in expense reporting.

IRS Guidelines

The IRS provides specific guidelines regarding what constitutes a valid business travel expense. According to IRS regulations, expenses must be ordinary and necessary for the business. This includes costs related to transportation, lodging, and meals. It is crucial to keep accurate records and receipts to substantiate these expenses, as they may be subject to review during tax filing or audits. Familiarizing yourself with these guidelines can help ensure compliance and maximize potential deductions.

Quick guide on how to complete travel expense sheet

Complete Travel Expense Sheet effortlessly on any device

Managing online documents has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents promptly without delays. Handle Travel Expense Sheet on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related operation today.

How to amend and eSign Travel Expense Sheet with ease

- Locate Travel Expense Sheet and click on Get Form to initiate the process.

- Employ the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searches, or errors requiring new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Travel Expense Sheet to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the travel expense sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's approach to managing business travel expenses?

airSlate SignNow streamlines the management of business travel expenses by allowing users to eSign expense reports and travel documents seamlessly. This electronic document management ensures faster approvals and reduces paperwork, helping businesses to efficiently track and manage travel expenses.

-

How can airSlate SignNow help with expense reimbursement for business travel?

With airSlate SignNow, users can electronically sign and submit expense reimbursement forms for business travel quickly and conveniently. The platform simplifies the reimbursement process, ensuring timely payments and reducing administrative workload associated with handling physical documents.

-

Does airSlate SignNow offer integrations to manage business travel expenses?

Yes, airSlate SignNow provides integrations with popular accounting and travel management tools that help streamline the process of handling business travel expenses. By connecting with these applications, businesses can automate expense tracking and reporting, enhancing overall efficiency.

-

What features does airSlate SignNow include for tracking business travel expenses?

airSlate SignNow includes features such as customizable templates for expense reports, electronic signatures for faster approvals, and automated notifications. These capabilities enable businesses to effectively track and manage their business travel expenses while ensuring compliance with company policies.

-

Is airSlate SignNow a cost-effective solution for managing business travel expenses?

Absolutely! airSlate SignNow offers a cost-effective solution that reduces the need for paper-based processes and the associated costs of printing and mailing. With its subscription-based pricing model, businesses can save money while efficiently managing their business travel expenses.

-

Can airSlate SignNow help my team collaborate on business travel expense reports?

Yes, airSlate SignNow enables team collaboration on business travel expense reports by allowing multiple users to access, edit, and sign documents remotely. This ensures that all relevant personnel can contribute to and approve expense reports efficiently, regardless of their location.

-

What support options does airSlate SignNow offer for business travel expense queries?

airSlate SignNow provides comprehensive support options including live chat, email, and an extensive knowledge base addressing business travel expense queries. The dedicated customer support team is readily available to assist businesses in optimizing their use of the platform for managing travel expenses.

Get more for Travel Expense Sheet

- Council attestation form

- American airlines cargo reciept form

- Template sickness self certification return to work form windowonwoking org

- Lease application the residences on hollywood beach form

- Resale certificate form the condo guy

- Benefit limit exception upmc for you form

- I 821form 2014

- I 600 supplement 1 2013 form

Find out other Travel Expense Sheet

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF