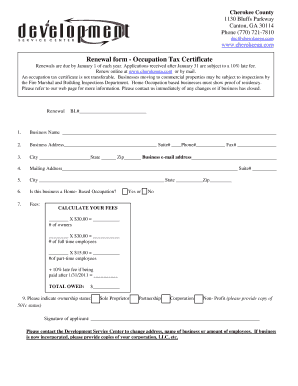

Renewal Form Occupation Tax Certificate Cherokee County

What is the Renewal Form Occupation Tax Certificate Cherokee County

The Renewal Form Occupation Tax Certificate Cherokee County is a document required for businesses operating within Cherokee County, Georgia. This certificate verifies that a business has complied with local regulations and has paid the necessary occupation tax. It is essential for maintaining legal operation and ensuring compliance with county laws. The renewal process typically occurs annually, requiring businesses to submit updated information and fees to the county's tax office.

How to Obtain the Renewal Form Occupation Tax Certificate Cherokee County

To obtain the Renewal Form Occupation Tax Certificate Cherokee County, businesses can visit the Cherokee County Tax Office website or contact their office directly. The form is usually available for download online, allowing businesses to print and fill it out at their convenience. Additionally, businesses may be able to request a physical copy by visiting the tax office in person. It is important to ensure that all required information is accurately completed to avoid delays in processing.

Steps to Complete the Renewal Form Occupation Tax Certificate Cherokee County

Completing the Renewal Form Occupation Tax Certificate Cherokee County involves several key steps:

- Download or request the renewal form from the Cherokee County Tax Office.

- Fill out the form with accurate business information, including the business name, address, and contact details.

- Provide any required documentation, such as proof of previous payments or business licenses.

- Review the form for accuracy and completeness.

- Submit the completed form along with the necessary fees to the Cherokee County Tax Office, either online, by mail, or in person.

Legal Use of the Renewal Form Occupation Tax Certificate Cherokee County

The Renewal Form Occupation Tax Certificate Cherokee County serves as a legal document that confirms a business's compliance with local tax regulations. It is important for businesses to retain a copy of this certificate, as it may be required for various legal and financial transactions, including applying for loans, permits, or licenses. Failure to renew this certificate can result in penalties or legal action against the business.

Required Documents for the Renewal Form Occupation Tax Certificate Cherokee County

When submitting the Renewal Form Occupation Tax Certificate Cherokee County, businesses typically need to provide several key documents:

- Completed renewal form.

- Proof of previous occupation tax payments.

- Business license or registration documents.

- Any additional documentation requested by the Cherokee County Tax Office.

Penalties for Non-Compliance with the Renewal Form Occupation Tax Certificate Cherokee County

Non-compliance with the renewal of the Occupation Tax Certificate can lead to significant penalties for businesses operating in Cherokee County. These penalties may include fines, interest on unpaid taxes, and potential legal action. Additionally, businesses may face difficulties in obtaining necessary permits or licenses if they fail to maintain their occupation tax certificate. It is crucial for business owners to stay informed about renewal deadlines and requirements to avoid these consequences.

Quick guide on how to complete renewal form occupation tax certificate cherokee county

Easily Prepare Renewal Form Occupation Tax Certificate Cherokee County on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly solution to conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Renewal Form Occupation Tax Certificate Cherokee County on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related function today.

The simplest way to alter and eSign Renewal Form Occupation Tax Certificate Cherokee County effortlessly

- Find Renewal Form Occupation Tax Certificate Cherokee County and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Renewal Form Occupation Tax Certificate Cherokee County and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the renewal form occupation tax certificate cherokee county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Cherokee County occupation tax certificate?

A Cherokee County occupation tax certificate is a legal document that allows businesses to operate within Cherokee County in accordance with local regulations. This certificate is essential for ensuring compliance with tax laws and can be obtained through the appropriate county offices.

-

How do I apply for a Cherokee County occupation tax certificate?

To apply for a Cherokee County occupation tax certificate, you need to visit the Cherokee County tax office or their official website. The application process typically requires submitting relevant business information and payment of the associated fees.

-

What are the costs associated with obtaining a Cherokee County occupation tax certificate?

The costs for a Cherokee County occupation tax certificate can vary based on the type of business and its annual revenue. It's important to check with the Cherokee County tax office for the most up-to-date fee schedule related to obtaining this certificate.

-

Are there any benefits to getting a Cherokee County occupation tax certificate?

Yes, obtaining a Cherokee County occupation tax certificate provides legitimacy to your business and ensures you comply with local regulations. This certificate can enhance your business reputation and might be necessary for securing additional permits or licenses.

-

Can I eSign documents related to the Cherokee County occupation tax certificate application?

Yes, with airSlate SignNow, you can easily eSign documents related to your Cherokee County occupation tax certificate application. Our platform streamlines the process, making it convenient and secure to handle all necessary paperwork online.

-

How long does it take to receive my Cherokee County occupation tax certificate?

The processing time for a Cherokee County occupation tax certificate can vary, but generally, it takes a few business days once your application is submitted. It's advisable to check with your local tax office for specific timelines.

-

Can I renew my Cherokee County occupation tax certificate online?

Many businesses can renew their Cherokee County occupation tax certificate online, depending on the services provided by the local tax office. Utilizing platforms like airSlate SignNow can facilitate easier management of the renewal process.

Get more for Renewal Form Occupation Tax Certificate Cherokee County

Find out other Renewal Form Occupation Tax Certificate Cherokee County

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online