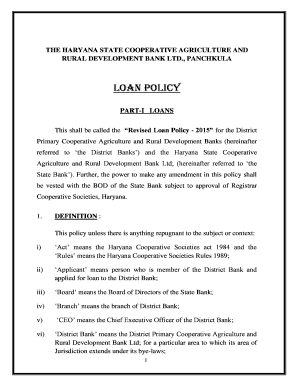

Loan Policy Sample Form

What is the cooperative loan policy sample?

A cooperative loan policy sample outlines the guidelines and procedures for lending within a cooperative organization. This document serves as a framework to ensure that all lending practices are consistent, fair, and compliant with applicable regulations. It typically includes information on eligibility criteria, loan terms, interest rates, and repayment schedules. By having a clearly defined policy, cooperatives can manage their lending processes more effectively, ensuring transparency and accountability while also protecting the interests of both the organization and its members.

Key elements of the cooperative loan policy sample

The cooperative loan policy sample includes several critical components that guide the lending process. Key elements often found in this document are:

- Eligibility criteria: Defines who can apply for loans, including membership requirements and financial qualifications.

- Loan types: Details the various types of loans available, such as personal loans, business loans, or emergency loans.

- Application process: Outlines the steps borrowers must take to apply for a loan, including necessary documentation and submission methods.

- Interest rates and fees: Specifies the rates applicable to different loan types and any associated fees.

- Repayment terms: Describes the repayment schedule, including duration, frequency, and methods of payment.

- Default procedures: Explains the actions that will be taken in the event of non-payment or default.

Steps to complete the cooperative loan policy sample

Completing a cooperative loan policy sample involves several steps to ensure that the document is comprehensive and tailored to the cooperative's needs. These steps include:

- Gathering input: Consult with stakeholders, including board members and financial officers, to gather insights on lending practices.

- Drafting the policy: Create a draft that incorporates all key elements, ensuring clarity and compliance with legal requirements.

- Reviewing the draft: Circulate the draft among stakeholders for feedback and make necessary revisions based on their input.

- Finalizing the policy: Once all revisions are made, prepare the final version for approval by the cooperative's governing body.

- Implementing the policy: Distribute the finalized policy to all members and staff, ensuring everyone understands the lending procedures.

Legal use of the cooperative loan policy sample

The legal validity of a cooperative loan policy sample is essential for its enforcement. To ensure that the policy is legally sound, it must comply with relevant federal and state regulations governing lending practices. This includes adherence to consumer protection laws and regulations related to interest rates and lending disclosures. Additionally, the policy should be reviewed periodically to reflect any changes in legislation or cooperative practices. By maintaining legal compliance, cooperatives can protect themselves from potential disputes and ensure that their lending practices are fair and transparent.

How to use the cooperative loan policy sample

The cooperative loan policy sample can be utilized as a foundational document for establishing or revising lending practices within a cooperative. To use the sample effectively:

- Customization: Tailor the sample to reflect the specific needs and circumstances of the cooperative.

- Training: Provide training for staff and members on the policy to ensure understanding and compliance.

- Monitoring: Regularly review and assess the implementation of the policy to identify areas for improvement.

- Feedback: Encourage feedback from members regarding the lending process to enhance the policy over time.

Examples of using the cooperative loan policy sample

Practical examples of how a cooperative loan policy sample can be applied include:

- Loan applications: Utilizing the policy to guide the processing of loan applications, ensuring that all criteria are met.

- Member education: Hosting workshops to educate members about the lending policy and how it affects their borrowing options.

- Policy updates: Using the sample as a basis for updating existing policies in response to changing financial conditions or member needs.

Quick guide on how to complete loan policy sample

Effortlessly Prepare Loan Policy Sample on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly and without hassle. Handle Loan Policy Sample on any device using airSlate SignNow mobile apps for Android or iOS, and enhance your document-related processes today.

The easiest method to edit and electronically sign Loan Policy Sample effortlessly

- Obtain Loan Policy Sample and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, either via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or inaccuracies that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any chosen device. Edit and electronically sign Loan Policy Sample and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan policy sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan policy sample?

A loan policy sample is a template that outlines the terms and conditions related to a loan, including repayment schedules, interest rates, and default clauses. It serves as a reference for businesses and individuals to draft their own loan policies. By using a loan policy sample, you can ensure that all critical elements are covered in your agreements.

-

How can airSlate SignNow help in creating a loan policy sample?

airSlate SignNow provides an intuitive platform that allows users to create, customize, and eSign loan policy samples easily. With its user-friendly interface, you can draft your loan policy with all necessary elements tailored to your needs. Additionally, you can collaborate with team members in real-time to enhance the document's precision.

-

Are there any sample templates available for a loan policy?

Yes, airSlate SignNow offers a variety of sample templates for loan policies. These templates can save you time and ensure that your loan policy meets the legal requirements. You can customize these samples to fit your specific business needs and compliance standards.

-

What pricing options does airSlate SignNow offer for its services?

airSlate SignNow offers various pricing plans tailored to suit different business sizes and needs, starting from a free trial to premium unlimited plans. Each plan provides access to essential features, including creating and managing loan policy samples. You can choose a plan based on how frequently you need to send and eSign documents.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports multiple integrations with popular applications, which enables seamless transfer of data across platforms. This functionality allows you to incorporate your loan policy samples into existing workflows easily, enhancing efficiency and collaboration among team members.

-

What are the benefits of using airSlate SignNow for eSigning loan policies?

Using airSlate SignNow for eSigning loan policies offers numerous benefits, including faster turnaround times and secure document storage. The platform is designed to streamline the signing process, making it easy for all parties involved to sign loan policy samples. This leads to quicker approvals and reduced paperwork.

-

Is airSlate SignNow secure for handling loan policy documents?

Yes, airSlate SignNow prioritizes the security of your documents, implementing industry-standard encryption and compliance measures. This ensures that your loan policy samples and personal information are protected from unauthorized access. You can eSign documents with peace of mind, knowing that your data is secure.

Get more for Loan Policy Sample

Find out other Loan Policy Sample

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney