Insperity W2 Form

What is the Insperity W2

The Insperity W2 is a tax form that reports an employee's annual wages and the amount of taxes withheld from their paycheck. This form is essential for both employees and employers, as it provides necessary information for filing income tax returns. The Insperity W2 includes details such as the employee's earnings, Social Security wages, Medicare wages, and federal income tax withheld. Understanding this form is crucial for ensuring accurate tax reporting and compliance with IRS regulations.

How to obtain the Insperity W2

To obtain the Insperity W2, employees can access it through the Insperity portal. After logging in with their credentials, they can navigate to the tax documents section to download or print their W2 form. If an employee has difficulty accessing the portal, they may contact Insperity's support line at for assistance. It's important to ensure that the personal information used for login is accurate to avoid any delays in retrieving the form.

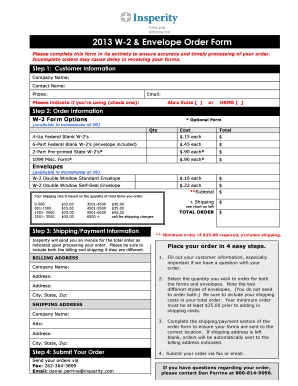

Steps to complete the Insperity W2

Completing the Insperity W2 involves several steps to ensure accuracy and compliance. First, gather all necessary information, including personal details and earnings for the tax year. Next, log into the Insperity portal to access the W2 form. Carefully enter the required information, ensuring that all figures match your pay stubs and other tax documents. After completing the form, review it for any errors before submitting it to the IRS or using it for your tax return.

Legal use of the Insperity W2

The legal use of the Insperity W2 is governed by IRS regulations. This form must be accurately completed and submitted to ensure compliance with federal tax laws. Employees should use the W2 to report their income when filing their tax returns. Additionally, employers are required to provide the W2 to their employees by January 31 each year. Failure to comply with these regulations can result in penalties for both employees and employers.

Key elements of the Insperity W2

Key elements of the Insperity W2 include the employee's name, address, Social Security number, and employer's identification number. The form also details the total wages earned, federal income tax withheld, Social Security wages, and Medicare wages. Understanding these components is vital for both employees and employers to ensure proper tax reporting and compliance with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Insperity W2 are critical for both employees and employers. Employers must provide the W2 forms to employees by January 31 of each year. Additionally, the forms must be submitted to the IRS by the end of February if filing by paper or by the end of March if filing electronically. Being aware of these deadlines helps avoid penalties and ensures timely tax reporting.

Form Submission Methods (Online / Mail / In-Person)

The Insperity W2 can be submitted through various methods. Employees typically file their tax returns online using tax software, which may integrate with the information provided on the W2. Alternatively, they can mail a paper copy of their tax return, including the W2, to the IRS. In-person submission is also an option at designated IRS offices, though this may require an appointment. Understanding these submission methods helps ensure that the W2 is filed correctly and on time.

Quick guide on how to complete insperity w2

Effortlessly Prepare Insperity W2 on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle Insperity W2 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

Simple Steps to Edit and Electronically Sign Insperity W2 Without Stress

- Locate Insperity W2 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to preserve your changes.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Insperity W2 and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the insperity w2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Insperity W2 process, and how does airSlate SignNow streamline it?

The Insperity W2 process involves preparing and distributing employee wage documents efficiently. airSlate SignNow simplifies this process by allowing users to electronically sign and send W2 forms securely, reducing the time and resources needed for manual handling.

-

How can I integrate airSlate SignNow with my Insperity W2 system?

Integrating airSlate SignNow with your Insperity W2 system is straightforward with our API. This allows you to automate document workflows, ensuring your W2 forms are sent and signed seamlessly within your existing processes.

-

Is there a specific pricing plan for using airSlate SignNow with Insperity W2?

AirSlate SignNow offers various pricing plans designed to fit different business needs, including options for users managing Insperity W2 forms. Each plan is cost-effective and tailored to ensure you get the most value out of your document signing needs.

-

What features of airSlate SignNow are beneficial for managing Insperity W2 documentation?

Key features like customizable templates, automated reminders, and secure storage are beneficial when managing Insperity W2 documentation. These tools enhance efficiency and ensure compliance by keeping your documents organized and easily accessible.

-

Can airSlate SignNow help with tax compliance related to Insperity W2?

Yes, airSlate SignNow supports tax compliance by ensuring that your Insperity W2 forms are completed and signed according to regulatory standards. This reduces the risk of errors and helps maintain accurate records during tax season.

-

What are the benefits of using airSlate SignNow for Insperity W2 forms over traditional methods?

Using airSlate SignNow for Insperity W2 forms offers numerous benefits over traditional methods, including faster turnarounds, reduced paper usage, and improved security. These advantages make document handling more efficient and environmentally friendly.

-

How secure is the airSlate SignNow platform when handling Insperity W2 forms?

The airSlate SignNow platform is highly secure, implementing top-level encryption and compliance with industry standards for handling sensitive information like Insperity W2 forms. Your data is protected throughout the entire signing process.

Get more for Insperity W2

Find out other Insperity W2

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter