Form 4683

What is the Form 4683

The Form 4683 is a tax form used by individuals and businesses in the United States to report and calculate certain tax liabilities. Specifically, it is often associated with reporting gains or losses from the sale of assets or investments. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 4683

Using the Form 4683 involves several steps to ensure accurate completion. First, gather relevant financial documents, including records of asset purchases and sales. Next, follow the form's structured sections to input necessary data, such as acquisition costs, sale prices, and any applicable deductions. It is essential to review IRS guidelines to ensure all information is reported correctly, as errors can lead to penalties or audits.

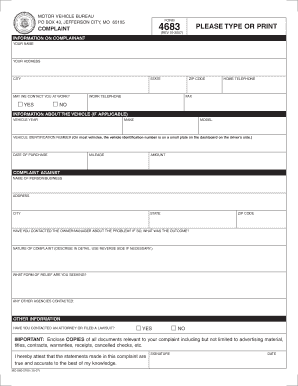

Steps to complete the Form 4683

Completing the Form 4683 requires careful attention to detail. Start by entering your personal information at the top of the form. Then, proceed to list each asset sold, including the date of sale, selling price, and cost basis. Ensure that you calculate any gains or losses accurately. After filling out all sections, review the form for completeness and accuracy before submission. It may be beneficial to consult a tax professional if you have questions about specific entries.

Legal use of the Form 4683

The legal use of the Form 4683 is governed by IRS regulations, which stipulate that the form must be used for its intended purpose. This includes accurately reporting gains or losses from asset sales. Failure to comply with these regulations can result in legal repercussions, including fines or audits. It is important to maintain records that support the information reported on the form to ensure compliance and facilitate any necessary reviews by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4683 are crucial for compliance. Typically, the form must be submitted along with your annual tax return by April fifteenth of the following year. If you are unable to meet this deadline, you may file for an extension, but it is important to understand that any taxes owed are still due by the original deadline to avoid penalties and interest. Keeping track of these dates is essential for timely and accurate tax reporting.

Required Documents

To complete the Form 4683 accurately, certain documents are required. These include records of asset purchases and sales, such as receipts, invoices, and statements from financial institutions. Additionally, any documentation related to improvements made to the assets, as well as records of related expenses, should be gathered. Having these documents readily available will help ensure that all information reported on the form is accurate and complete.

Quick guide on how to complete form 4683

Accomplish Form 4683 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without holdups. Handle Form 4683 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Form 4683 with ease

- Obtain Form 4683 and then click Access Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Complete button to save your changes.

- Select how you prefer to share your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 4683 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4683

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4683 and how can airSlate SignNow assist with it?

Form 4683 is a specific document used for tax-related purposes. With airSlate SignNow, you can easily create, fill out, and eSign form 4683, streamlining your document management process and ensuring compliance with tax regulations.

-

How much does it cost to use airSlate SignNow for managing form 4683?

airSlate SignNow offers competitive pricing plans that cater to various business needs. The costs are reasonable, and the ability to manage documents like form 4683 efficiently makes it a valuable investment for any organization.

-

Can I integrate airSlate SignNow with other tools to manage form 4683?

Yes, airSlate SignNow offers integrations with popular tools such as Google Drive, Salesforce, and more. These integrations allow you to seamlessly manage form 4683 alongside your other important business documents.

-

What features does airSlate SignNow offer for form 4683?

airSlate SignNow includes features like customizable templates, secure eSigning, and robust tracking options. These features ensure that your form 4683 is processed efficiently and securely.

-

Is airSlate SignNow secure for handling sensitive documents like form 4683?

Absolutely! airSlate SignNow employs advanced encryption and security measures to protect your documents. This ensures that your form 4683 and other sensitive information remain safe and confidential.

-

Can I access my form 4683 on mobile using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices. This allows you to create, edit, and eSign form 4683 on the go, providing flexibility and convenience in document management.

-

What benefits does airSlate SignNow offer for users handling form 4683?

Using airSlate SignNow for form 4683 can signNowly reduce paperwork, save time, and improve efficiency. The streamlined eSigning process enhances productivity and helps businesses focus on their core activities.

Get more for Form 4683

Find out other Form 4683

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF