Eic Form

What is the EIC Form

The EIC form, or Earned Income Credit form, is a tax document used by eligible taxpayers to claim the Earned Income Tax Credit (EITC). This credit is designed to benefit low to moderate-income working individuals and families, providing a financial boost by reducing the amount of tax owed and potentially resulting in a refund. The EIC form is essential for those who qualify, as it helps maximize tax refunds and supports financial stability.

How to Use the EIC Form

Using the EIC form involves several key steps. First, ensure you meet the eligibility criteria, which include income limits and filing status. Next, gather necessary documentation, such as proof of income and identification for qualifying children, if applicable. When completing the form, accurately report your income and any other required information. Finally, submit the form along with your tax return, either electronically or by mail, to ensure you receive the credit.

Steps to Complete the EIC Form

Completing the EIC form can be straightforward if you follow these steps:

- Check your eligibility based on income and filing status.

- Gather necessary documents, including W-2 forms and Social Security numbers for qualifying children.

- Fill out the EIC form, ensuring all information is accurate and complete.

- Review your completed form for any errors or omissions.

- Submit the form with your tax return by the filing deadline.

Legal Use of the EIC Form

The legal use of the EIC form is governed by IRS regulations. To ensure compliance, taxpayers must accurately report their income and provide truthful information regarding their eligibility for the credit. Misrepresentation or failure to meet eligibility criteria can lead to penalties, including the denial of the credit and potential fines. Using reliable eSignature solutions can help maintain the integrity of the submission process.

Eligibility Criteria

To qualify for the Earned Income Credit, taxpayers must meet specific eligibility criteria, including:

- Having earned income from employment or self-employment.

- Meeting income limits based on filing status and number of qualifying children.

- Being a U.S. citizen or resident alien for the entire tax year.

- Filing a tax return, even if no tax is owed.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for claiming the EIC. Typically, the deadline for submitting your tax return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to deadlines, especially for those who may need to file for an extension.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the EIC form, including:

- Online submission through tax preparation software, which often includes eSignature options for convenience.

- Mailing a paper form to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-person submission at designated IRS offices or authorized tax preparation locations.

Quick guide on how to complete eic form

Prepare Eic Form with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with everything you need to create, modify, and electronically sign your documents swiftly without delays. Handle Eic Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign Eic Form effortlessly

- Obtain Eic Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and electronically sign Eic Form to ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eic form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

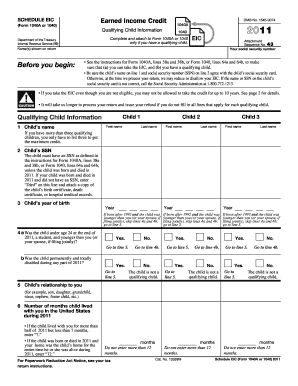

What is the 'schedule eic 2011' and why is it important?

The 'schedule eic 2011' is a tax form used to claim the Earned Income Credit (EIC) for the tax year 2011. It's important because it helps eligible taxpayers reduce their tax liability and potentially receive a refund. Understanding how to complete this form correctly can ensure you maximize your benefits.

-

How can airSlate SignNow help with the 'schedule eic 2011'?

airSlate SignNow simplifies the process of preparing and signing documents like the 'schedule eic 2011.' Our platform allows you to securely eSign the form, ensuring compliance and accuracy while saving time in the document handling process.

-

Is there a cost associated with using airSlate SignNow for the 'schedule eic 2011'?

Yes, airSlate SignNow offers several pricing plans tailored to fit the needs of different users. We provide a cost-effective solution, allowing you to manage your eSigning processes, including the 'schedule eic 2011,' without breaking the bank.

-

What features are available for the 'schedule eic 2011' on airSlate SignNow?

With airSlate SignNow, you can easily upload, eSign, and send the 'schedule eic 2011' for quick approval. Key features include customizable templates, real-time tracking, and secure storage, all designed to enhance your document workflow.

-

Are there any benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the 'schedule eic 2011' offers numerous benefits, including reduced turnaround times and increased efficiency. You can streamline your eSigning process, reducing the time spent on paperwork, so you can focus more on your business.

-

Can I integrate airSlate SignNow with other software to manage the 'schedule eic 2011'?

Yes, airSlate SignNow supports integration with a variety of applications and tools. This means you can seamlessly connect our eSigning solution to your existing workflows, making it easier to manage and submit the 'schedule eic 2011' alongside your other financial documents.

-

What security measures does airSlate SignNow have for the 'schedule eic 2011'?

AirSlate SignNow prioritizes security with encryption, secure access controls, and compliance with major regulations. When handling sensitive documents like the 'schedule eic 2011,' you can rest assured that your information is protected throughout the eSigning process.

Get more for Eic Form

- 2001 contract of sale cooperative apartment form

- Pennsylvania apartment lease blumberg legal forms online

- Home health change care form

- Online yahtzee score sheet form

- Year statement daycare form

- How to fill out the behind the wheel instruction log form

- Baseball scorecard blank printable form

- 4 point inspection template form

Find out other Eic Form

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy