Ptax 342 R Form

What is the Ptax 342 R

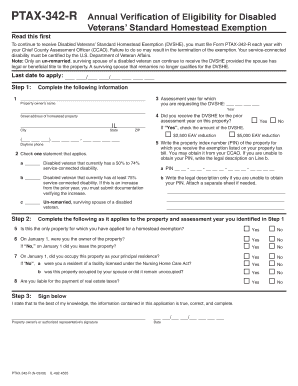

The Ptax 342 R is a form used in the United States for property tax assessment purposes. This document is essential for property owners who wish to appeal their property tax assessments or seek exemptions. The form collects information about the property, including its assessed value, location, and any relevant characteristics that may affect its valuation. Understanding the purpose and requirements of the Ptax 342 R is crucial for ensuring that property owners can effectively navigate the tax assessment process.

How to use the Ptax 342 R

Using the Ptax 342 R involves several key steps. First, property owners must obtain the form from their local tax authority or online resources. After acquiring the form, it should be filled out with accurate and detailed information about the property. This includes providing the property’s address, current assessed value, and any supporting documentation that may strengthen the appeal or request for exemption. Once completed, the form must be submitted to the appropriate tax office by the specified deadline to ensure consideration.

Steps to complete the Ptax 342 R

Completing the Ptax 342 R requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including previous tax assessments and property appraisals.

- Fill out the form with accurate property details, ensuring all sections are completed.

- Attach any supporting documents that substantiate your claim or appeal.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to your local tax authority by the deadline.

Legal use of the Ptax 342 R

The legal use of the Ptax 342 R is governed by state-specific property tax laws. This form serves as a formal request for review of property assessments, and its proper completion is essential for it to be considered valid. Submitting the Ptax 342 R within the designated time frame is critical, as late submissions may result in the forfeiture of the right to appeal. Understanding the legal implications and requirements associated with this form helps property owners protect their rights and interests in property taxation.

Filing Deadlines / Important Dates

Filing deadlines for the Ptax 342 R vary by state and locality. It is crucial for property owners to be aware of these deadlines to ensure their submissions are timely. Typically, deadlines are set at the beginning of the tax year or shortly after property assessments are mailed out. Missing these deadlines can result in losing the opportunity to appeal or request exemptions. Checking with local tax authorities for specific dates is recommended for accurate planning.

Who Issues the Form

The Ptax 342 R is typically issued by local tax assessors or county tax offices. These authorities are responsible for property assessments and related administrative processes. Property owners can obtain the form directly from their local tax office or through official state or county websites. Understanding the issuing authority is important for ensuring that the correct version of the form is used and for receiving guidance on the completion process.

Quick guide on how to complete ptax 342 r 5515075

Complete Ptax 342 R effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources you need to generate, modify, and eSign your documents quickly without difficulties. Manage Ptax 342 R on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Ptax 342 R with ease

- Obtain Ptax 342 R and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specially for that intent.

- Compose your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to confirm your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Ptax 342 R and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 342 r 5515075

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ptax 342 r and how does it relate to airSlate SignNow?

ptax 342 r refers to a specific form used in tax documentation. With airSlate SignNow, you can easily eSign and manage your ptax 342 r documents online, ensuring compliance and efficiency. Our platform simplifies document collaboration, making it ideal for handling important tax forms.

-

How much does it cost to use airSlate SignNow for ptax 342 r documentation?

airSlate SignNow offers competitive pricing plans tailored to your business needs. The subscription includes access to features that streamline the handling of ptax 342 r and other important documents. You can choose a plan that best fits your usage level and budget.

-

What features does airSlate SignNow offer for managing ptax 342 r documents?

airSlate SignNow includes features like document templates, customizable workflows, and secure eSigning specifically useful for ptax 342 r forms. These tools enhance productivity, allowing you to efficiently create, sign, and store critical tax documents. Compliance and ease of use are prioritized in our platform.

-

Can airSlate SignNow integrate with other platforms for ptax 342 r processing?

Yes, airSlate SignNow offers integrations with a variety of platforms, ensuring seamless processing of ptax 342 r forms. You can easily connect with software applications you already use, such as CRM systems and document management tools. This enhances workflow efficiency and reduces duplication of effort.

-

What are the benefits of using airSlate SignNow for ptax 342 r eSigning?

Using airSlate SignNow for ptax 342 r eSigning offers numerous benefits, including time savings, increased security, and improved tracking capabilities. Our solution allows you to sign documents from anywhere, on any device, which expedites the tax preparation process. Additionally, electronic signing is more secure than traditional methods.

-

Is airSlate SignNow secure for handling sensitive ptax 342 r information?

Absolutely, airSlate SignNow prioritizes security for all your documents, including sensitive ptax 342 r information. We implement robust encryption and adhere to industry security standards to protect your data. This ensures your tax forms are safely stored and transmitted.

-

How easy is it to get started with airSlate SignNow for ptax 342 r?

Getting started with airSlate SignNow for ptax 342 r is quick and user-friendly. Simply sign up for an account, and you'll have access to templates and tools tailored for efficient tax document management. Our intuitive interface guides you through the process, making it accessible for users of all technical levels.

Get more for Ptax 342 R

Find out other Ptax 342 R

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy