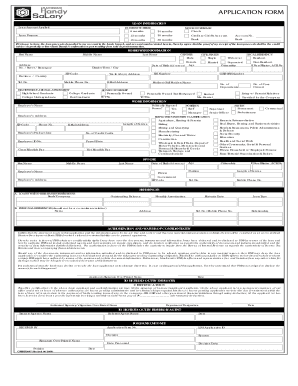

Planters Bank Personal Loan Form

What is the Planters Bank Personal Loan

The Planters Bank personal loan is a financial product designed to provide individuals with funds for various personal needs. This type of loan can be used for purposes such as debt consolidation, home improvements, medical expenses, or unexpected financial emergencies. The loan typically features fixed interest rates and flexible repayment terms, making it an accessible option for many borrowers. Understanding the specific terms and conditions associated with the Planters Bank personal loan is essential for making informed financial decisions.

How to obtain the Planters Bank Personal Loan

Obtaining a Planters Bank personal loan involves several straightforward steps. First, potential borrowers should assess their financial needs and determine the loan amount required. Next, it is advisable to check the eligibility criteria, which may include factors such as credit score, income level, and employment status. Once eligibility is confirmed, applicants can gather the necessary documentation, such as proof of income and identification. The final step is to complete the loan application, which can often be done online through the Planters Bank website, ensuring a convenient and efficient process.

Steps to complete the Planters Bank Personal Loan

Completing the Planters Bank personal loan application requires careful attention to detail. Here are the essential steps:

- Gather required documents, including identification and income verification.

- Visit the Planters Bank website or branch to access the loan application form.

- Fill out the application with accurate personal and financial information.

- Review the application for completeness and accuracy before submission.

- Submit the application either online or in person, as preferred.

Following these steps can help streamline the application process and improve the chances of loan approval.

Legal use of the Planters Bank Personal Loan

The legal use of a Planters Bank personal loan is governed by specific regulations and guidelines. Borrowers are encouraged to utilize the funds for legitimate purposes as outlined in the loan agreement. Misuse of loan funds can lead to legal repercussions, including potential penalties or loan default. It is essential to understand the terms and conditions of the loan to ensure compliance with applicable laws and regulations, thereby protecting both the borrower and the lender.

Eligibility Criteria

Eligibility for a Planters Bank personal loan typically includes several key criteria that applicants must meet. These may include:

- A minimum credit score, which varies by lender.

- Proof of stable income, demonstrating the ability to repay the loan.

- Age requirements, usually being at least eighteen years old.

- Residency status, often requiring applicants to be U.S. citizens or permanent residents.

Meeting these criteria is crucial for a successful loan application and approval process.

Required Documents

When applying for a Planters Bank personal loan, certain documents are typically required to verify the applicant's identity and financial status. Commonly needed documents include:

- Government-issued identification, such as a driver's license or passport.

- Proof of income, which may include pay stubs, tax returns, or bank statements.

- Social Security number for identity verification.

- Any additional documentation requested by the bank, such as proof of residency.

Having these documents prepared in advance can facilitate a smoother application process.

Quick guide on how to complete planters bank personal loan

Handle Planters Bank Personal Loan effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely archive it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Planters Bank Personal Loan on any platform with the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign Planters Bank Personal Loan without hassle

- Find Planters Bank Personal Loan and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Planters Bank Personal Loan while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the planters bank personal loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Planters Bank personal loan?

A Planters Bank personal loan is a financial product offered by Planters Bank that allows individuals to borrow money for various personal needs. This type of loan can be used for debt consolidation, home improvements, or unexpected expenses. With competitive interest rates and flexible terms, it is designed to provide customers with the funds they need.

-

What are the eligibility requirements for a Planters Bank personal loan?

To qualify for a Planters Bank personal loan, applicants typically need to be at least 18 years old, have a stable income, and a satisfactory credit score. Additionally, you may need to provide personal identification and financial documentation during the application process. Meeting these requirements will enhance your chances of loan approval.

-

How do I apply for a Planters Bank personal loan?

Applying for a Planters Bank personal loan can be done through the bank's website, in person at a branch, or by contacting customer service. The application process usually involves filling out a form with your personal and financial information. After submission, the bank will review your application and inform you of the decision.

-

What are the interest rates for a Planters Bank personal loan?

The interest rates for a Planters Bank personal loan vary based on factors such as your credit score and the loan amount. Typically, the rates are competitive compared to other financial institutions. It’s advisable to check with Planters Bank directly for the most current rates and to get a personalized quote based on your financial situation.

-

What are the repayment terms for a Planters Bank personal loan?

Repayment terms for a Planters Bank personal loan can range from a few months to several years, depending on the amount borrowed and your payment capability. Borrowers will have various options to choose from, allowing for flexibility in managing monthly payments. It's important to discuss these terms with a loan officer to find a plan that suits your financial goals.

-

What are the advantages of choosing a Planters Bank personal loan?

The advantages of choosing a Planters Bank personal loan include competitive interest rates, flexible repayment terms, and the potential for quick funding. Moreover, there are no collateral requirements with personal loans, making it an excellent option for individuals who need immediate cash flow without risking their assets. This makes the Planters Bank personal loan a beneficial choice for many borrowers.

-

Can I refinance my Planters Bank personal loan?

Yes, it is possible to refinance a Planters Bank personal loan to potentially secure better interest rates or more favorable loan terms. Refinancing can help you lower monthly payments or reduce the overall cost of the loan. It is recommended to assess your financial situation and consult with a loan specialist at Planters Bank to explore your options.

Get more for Planters Bank Personal Loan

Find out other Planters Bank Personal Loan

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document