CONTRIBUTION and LOAN REPAYMENT REMITTANCE BFORMb 2015

What is the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb

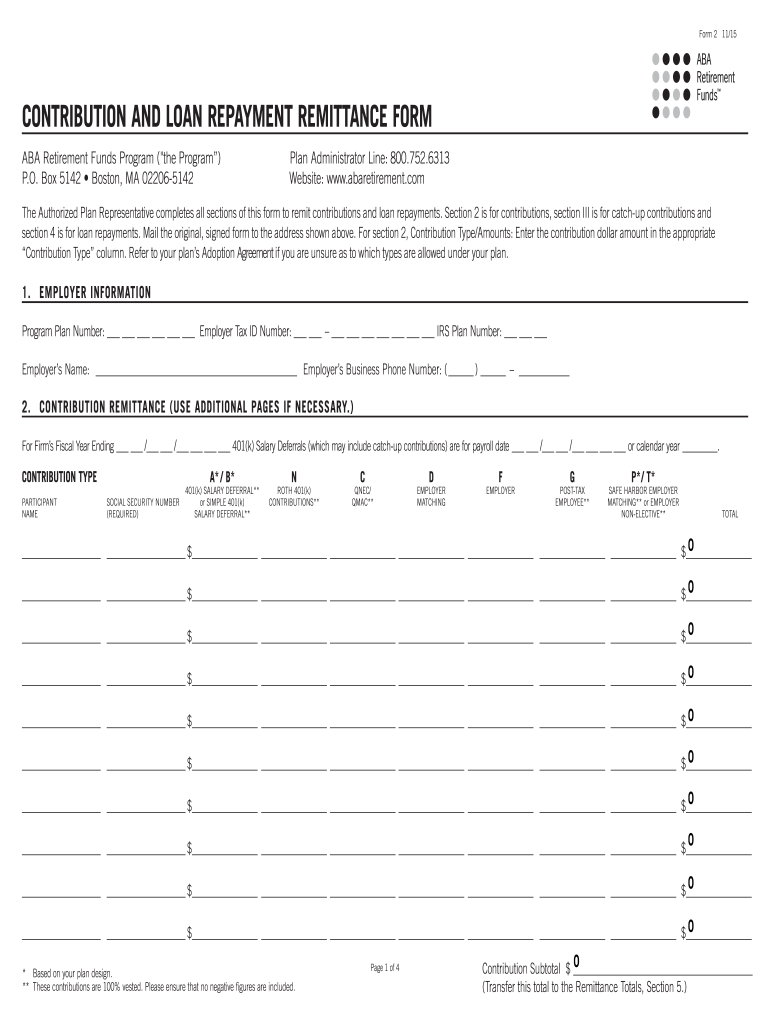

The CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb is a vital document used primarily for reporting contributions and repayments related to loans. This form is essential for maintaining accurate financial records and ensuring compliance with relevant regulations. It serves as an official record that details the amounts contributed and repaid, allowing for transparency in financial transactions. Understanding this form is crucial for individuals and businesses alike, as it plays a significant role in financial planning and accountability.

How to use the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb

Using the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb involves several straightforward steps. First, gather all necessary financial information, including details about the contributions made and loan repayments. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to double-check the information for accuracy to avoid potential issues. Once completed, the form can be submitted according to the specified submission methods, which may include online, by mail, or in person.

Steps to complete the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb

Completing the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents and information.

- Access the form from a reliable source.

- Fill in your personal and financial details accurately.

- Review the form for any errors or omissions.

- Submit the form through the appropriate channels.

By following these steps, you can ensure that your form is completed correctly and submitted on time.

Key elements of the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb

Key elements of the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb include:

- Personal Information: This section requires details such as your name, address, and contact information.

- Financial Details: You must provide specific amounts related to contributions and loan repayments.

- Signatures: The form typically requires signatures from all parties involved to validate the information.

- Date of Submission: Including the date is essential for record-keeping and compliance purposes.

These elements are crucial for ensuring the form is complete and legally binding.

Legal use of the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb

The legal use of the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb is governed by various regulations that ensure its validity. It is important to use this form in accordance with federal and state laws to avoid any legal repercussions. Properly executed, this form serves as a legal document that can be used in financial audits or disputes. Adhering to the guidelines for its use helps maintain compliance and protects the interests of all parties involved.

Form Submission Methods

Submitting the CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb can be done through several methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online Submission: Many jurisdictions allow for electronic filing, which can expedite the process.

- Mail: You can print the completed form and send it via postal service.

- In-Person Submission: Some may prefer to deliver the form directly to the appropriate office.

Choosing the right submission method is important for ensuring timely processing and compliance with deadlines.

Quick guide on how to complete contribution and loan repayment remittance bformb

The optimal method to obtain and endorse CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb

On the scale of an entire enterprise, ineffective workflows involving paper approvals can take up a signNow amount of productive time. Signing documents like CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb is an inherent component of operations in any enterprise, which is why the effectiveness of every agreement’s lifecycle profoundly impacts the company’s overall productivity. With airSlate SignNow, endorsing your CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb is as simple and swift as possible. With this platform, you will receive the most recent version of almost any form. Even better, you can sign it immediately without the requirement to install external software on your device or printing anything as hard copies.

How to obtain and endorse your CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb

- Browse our collection by category or use the search bar to locate the document you require.

- Examine the form preview by clicking Learn more to confirm it’s the correct one.

- Select Get form to begin editing instantly.

- Fill out your form and insert any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb.

- Choose the signing method that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options if necessary.

With airSlate SignNow, you have everything you need to handle your documentation effectively. You can find, complete, edit, and even send your CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb within a single tab without any fuss. Enhance your processes with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct contribution and loan repayment remittance bformb

FAQs

-

60 percentage of my salary goes to credit card and loan repayment. How can I come out of this?

Stop adding to the debt.Make a budget.Spend less.Earn more.Make a list of outstanding loans and find out the interest rate paid on each.Contact each of the loan/credit card companies and negotiate down the interest rate — there is room for negotiation.There might be a way of doing a large single final payment to an account today in lieu of continued payments. Ask if there’s an amount they would accept.Where possible, transfer high interest rate balances into lower rate balances.Make sure you always at least pay the required minimum payment to each account.“Freeze” the monthly payments at the current amount, instead of letting the minimum payments decrease.Focus on one account that you’re paying as much as you can in. The focus should be the highest interest rate (which makes you mathematically pay the minimum).Alternative focus — the smallest amount outstanding (which may be worth it to keep you motivated, as you can see accounts closing down faster).Last resort — consider bankruptcy as an option.

-

How are many Indian students able to afford to go to the USA for graduate studies, and how do they pay for it? Are they all naturally rich or do they take out loans? Are the loans from India or the US and how long do they take to repay?

As Balaji Viswanathan (பாலாஜி விஸ்வநாதன்) and Balaji Santhanam mentioned, most of the Indian students cannot afford to pay themselves for their grad studies in the US. They rely mostly on loans and assistantships. For me, it's completely the assistantship that I relied on.Other answers talked about what they did after coming to the US while pursing their grad studies. Whereas, my story is all about twists and turns that I have experienced to signNow my destination university. After my bachelor's I worked for TCS for 1.5 yrs. I could only manage to pay for university application fees and Toefl exam with my salary. I have decided to apply for 8 universities, which later turned out to be one of the best decisions of my life.After receiving my first admit, I approached the only public sector bank in my village. Later, I came to know that they won't be accepting agricultural lands for approving the educational loans. So my loan got rejected. In a similar way, with the help of my relatives I tried applying at multiple banks, but all my efforts were in vain. The only option I had was to request one of my relatives to be my surety, and I would receive a loan amount of 7 lakh rupees($12000 at that time). That would suffice for paying my tuition fees for 2 semesters. I had no idea how I could pay tuition fees for the remaining semesters, let alone my living expenses. After 3-4 months of agony that my family and I had for revolving around the banks to secure an educational loan, I discussed with my parents and gave a lot of thought if I should continue with my plan of action for my education. I had a lot of uncertainties floating on my mind back then and was trying to get an insight about all sorts of things such as how to gather funds for my coursework, living expenses; how to study exceptionally well to procure any kind of assistantships; how to re-pay the loan etc. After weighing all the risk factors, I had finally decided to make a move to pursue my Master's in the US. Therefore, I attended visa interview and got my F-1 stamping for Universtiy X. I was relieved for getting my visa stamping and then, began to plan and work out things necessary for my journey and stay at Univ X.Later, after two weeks, one fine morning I saw the eighth wonder in my life. There resides an email in my Inbox saying that I was offered Graduate Teaching Assistantship (GTA) from Univ Y. As a part of that assistantship, I would receive a full tuition fee waiver and on top of it, they would pay me with an amount of $1300 each month. I felt like I won a big jackpot in my life. Then the first thing I did was to cancel my educational loan. However, there is one last milestone that was to re-attempt the visa interview. Everyone suggested me to visit Univ X and request for a transfer to Univ Y. I believe in this quote "If there is no risk, there is no reward." So, I took the risk and got a visa stamping approved for the second time. However, this time its for Univ Y. Now, the rewards were: I didn't have to go to Univ X and stay there for few days until the transfer process gets completed and again fly to Univ Y. I directly started my journey to Univ Y. By the way, there's an anecdote behind receiving the GTA. The eighth university that I applied to was this Univ Y. When I was applying to this university, I had no idea that they would offer such kind of GTAs beforehand. The University Y offers only limited number of those GTAs. Initially, I got an email from that university saying that I was not considered in their final pool of GTAs. I felt bad but couldn't do anything about it. In the meantime, I have decided to choose University X and got my visa approval. After few weeks, I was chatting to a friend who got GTA from Univ Y and he told me that one of the GTA holders was going to drop her offer. The reason was that she planned to move to a different location where her fiance lives. Now, that raised hopes in me. I sent an email, to the concerned professors in the department describing the coursework that I am interested in, my skills, industry experience, and most importantly my interest towards working as a Teaching Assistant. It took another few weeks to receive the GTA offer. And, that's the happy ending I was waiting for.For 2 years of my Master's education, all I had to pay was about $750 each semester which included Health Insurance, Library fees, etc. I had 2 wonderful years of valuable education from September 2013 - July 2015 and also had experienced loads of fun-filled happy moments.Edit: Few people were eager to know about the universities X and Y. So, here they are:X - West Virginia UniversityY - University of Minnesota DuluthBoth are pretty decent universities. If anybody is willing is know more about univ Y message me or leave a comment so that I can reply to them.

-

After WW2, Britain had to pay its war loan back to the USA. Did any of those countries who benefited from Britain's sacrifice help out with a financial contribution towards the repayment?

I seriously doubt the premise of your question.Let's see how Greece benefited by Britain during WW2.Our gold was smuggled to Egypt after the fall of Greece and then moved again to South Africa for ‘safe keeping’. We never got all of it back.Britain supported the guerilas fighting the Germans and billed us for it. OSS officers were parachuted in Greece along with equipment and we paid for it. No one asked us and but the later part of the war Greece was essentially in Greek hand except Athens and a few other places. At that point the British made a deal with Germans which secured their unhindered retreat. The British then occupied Greece and WC ordered the occupying force to behave as if they were running a conquered country.Last but not least Britain actively enforced a Red Cross embargo during the harsh winter of 1943 which lead to a great scale famine. Their actions along with the brutality of the Germans, arguably the harshest occupation in Europe, led to Greece losing approximately 30% of her total population.That's all ok though because WC said that ‘from now on we will not say that Greeks fought like heroes, we will say that heroes fight like Greeks. I guess history was not his strong point and being a veteran of the Boer wars he was ok with massive civilian casualties.British sacrifices?

-

What companies offer a student loan repayment match to employees and how does the process work?

Several companies offer student loan repayment assistance programs (LRAP) to their employees. The largest include Fidelity, PwC and Aetna.Several surveys have shown that recent college graduates are more concerned with their student loans than with retirement plan contributions. Not only are student loan repayment assistance programs an effective recruiting and retention tool, but they tell employees that the employer cares about their employees’ concerns.Typically, the employer will provide $100 to $200 per month to the lender as an extra payment to the principle balance of the loan, capped at a lifetime maximum of $10,000.Under current law, this is a taxable benefit and is reported as part of taxable income to the IRS. There are several bills pending that would exclude employer-paid loan repayment assistance from taxable income.There are also independent LRAPs. Tufts University runs one to encourage its graduates to pursue careers in public service. (This one is structured in a way that makes the benefit tax-free.) The American Bar Association has one to encourage lawyers to pursue careers in public interest law. The federal government runs the largest LRAP, with each federal agency able to provide up to $60,000 to agency employees. There are also versions for members of the U.S. Armed Forces and Congressional staff.There are several companies that help employers manage the process. These include:EdAssist (part of Bright Horizons Family Solutions)GradifiTuition.ioStudent Loan GeniusLRAP Association

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

Is it feasible to take out a large loan, invest the entire loan in a hedge fund, and repay the loan with the interest earned?

Sure, its possible, but its a bit like making tiger soup (the trick is: first you need to catch the tiger).Assuming you wanted to do this (I'm not a lending officer, so take what I say with a pinch of salt), you would need to find a lender. Said lender would, assuming lender was half awake, ask for which HF sir would like to take out the loan. Sir would cite HF XYZ at which point, if you were extremely wealthy and a prized client of the lender, the lender might say, 'well, OK, but we would like a haircut of 50%' or whatever figure seemed appropriate (50% is being very liberal).So, you would presumably end up borrowing perhaps half the money you would use to invest in the HF but you would need to fund the other half with your own money. This assumes the lender is willing to extend credit against your HF. HFs are, to some extent, a fee structure rather than an asset class, so the rest would depend on what your HF actually did for a living. Given the wide perception that HFs have a habit of winking in and out of existence like Mayflies, I would be surprised if they were acceptable collateral (they arent liquid, its not like taking your stock portfolio as collateral - that is easily marked to market, and liquidated in the event you could not pay).You could, of course, mortgage an asset you already owned (its mildly preferable to actually selling your house). So, for example, say you have a house worth USD 1 mln; you could plausibly ask your bank for a loan against its value (A loan to value of 70% seems reasonable) and that would raise you USD 700K which you could use to invest in said HF.With me so far? The over arching point is that HFs are - or should be - playthings of the very wealthy or the very sophisticated. They are invariably illiquid, have been known to gate liquidations in times of crisis, and endure substantial volatility in some instances. They are, for these reasons, terrible collateral for the most part.

-

Has China started the new form of colonialism? Giving out loans to countries who they know can't repay them and then capturing strategic assets for repayment?

If you believe that institutions like the IMF that lend to countries and have the gall to ask for repayment and set conditions for their low-interest loans are also a form of neo-colonialism, then yes. Otherwise, no.

-

How easy or difficult is it for an Indian student to get a job in the US, after completing an MS (Structures) from a top ranking school? I am planning to take out a loan to pursue my MS. How can I repay the loan after completing my studies?

Thanks for A2A!Before answering your question, I’d like to point a few phrases/ words you have used,“Do Indians get full time jobs very easily”“Are domestic students given first preference”“I want to earn good money and live an American dream”“I've been told like once you get in such top universities you easily grab a package of 90,000$ to 1,10,000$”“Campus Placements”Sorry to be too blunt, but the above phrases show your confusion, lack of direction, immaturity! With respect to Masters in the US,Nothing comes easy. You won’t be spoon fed like you are in India!You are talking about a different country and hence their people would very obviously be given a preference! ( An Analogous Example - Would you keep quiet if a company comes to your college for placements and hires a random guy from a different college? )Figure out your dream first! Earning never comes under passion/interest.Salary differs from one university to another, one city to another, one company to another. ( $100k in Texas is not the same as $100k in California for obvious reasons like taxes, cost of living etc.)No Campus Placements in US! You rather have career fairs and you have to find a job on your own!If you have understood the above five points, go on and read further,Ask yourself the following questions,Why do you wanna do Masters?Is money the only reason why you even want to do Masters?Why CS?How skilled are you in your desired field of study?What is the subset of universities you are targeting?Why don’t you wanna work and pursue Masters directly?You will go through a self realization process if you take these questions honestly to your mind and think!After all this if you wanna do Masters in CS from Top 50 universities,Focus on your GRE, TOEFL.Improve your profile through publications, coding contests, GSOC etc.Maintain a good GPA so that you are among the top 5–10% of your class.Put in a lot of time and efforts into your SOP.Get LORs from professors, Department Head, Research people etc.Shortlist your subset you universities and apply early in their priority deadliness.Speak with seniors from these universities and understand how stuff works there.In case of multiple admits, figure out your real passion with one of your admits.Go and live your “Masters” dream.You might be wondering if I have answered your question or not! I’d say I have answered inherently which you’ll realize if you have realized yourself!The skills you learn from Masters,The network you gain from Masters,The interest in your desired field,The passion to pursue a challenging job role in your desired field,The Overall Masters experience from a global university,will take you to your desired well earned position! Remember, your primary purpose of Masters should be education and nothing else!All the very best!

Create this form in 5 minutes!

How to create an eSignature for the contribution and loan repayment remittance bformb

How to generate an electronic signature for the Contribution And Loan Repayment Remittance Bformb in the online mode

How to create an eSignature for your Contribution And Loan Repayment Remittance Bformb in Google Chrome

How to create an eSignature for putting it on the Contribution And Loan Repayment Remittance Bformb in Gmail

How to make an eSignature for the Contribution And Loan Repayment Remittance Bformb straight from your smartphone

How to generate an electronic signature for the Contribution And Loan Repayment Remittance Bformb on iOS

How to generate an eSignature for the Contribution And Loan Repayment Remittance Bformb on Android OS

People also ask

-

What is the Contribution and Loan Repayment Remittance BFormb?

The Contribution and Loan Repayment Remittance BFormb is a streamlined document designed to assist businesses in managing loan repayments and contributions. Utilizing airSlate SignNow, you can easily create, send, and eSign this form to ensure accuracy and compliance in your financial transactions.

-

How can airSlate SignNow help with the Contribution and Loan Repayment Remittance BFormb?

airSlate SignNow simplifies the process of handling the Contribution and Loan Repayment Remittance BFormb by providing an intuitive platform for document management. You can customize your forms, track signatures, and store all completed documents securely in one place, enhancing operational efficiency.

-

Is there a subscription fee for using airSlate SignNow for the Contribution and Loan Repayment Remittance BFormb?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the features and level of service you choose. However, investing in this solution for managing the Contribution and Loan Repayment Remittance BFormb can lead to signNow time and cost savings worth the cost.

-

What features does airSlate SignNow offer for managing the Contribution and Loan Repayment Remittance BFormb?

Key features include customizable templates, real-time tracking of document status, electronic signatures, and secure cloud storage. These tools specifically enhance the handling of the Contribution and Loan Repayment Remittance BFormb, making the entire process more efficient.

-

Can I integrate airSlate SignNow with other tools for the Contribution and Loan Repayment Remittance BFormb?

Absolutely! airSlate SignNow offers integrations with various platforms such as Google Drive, Dropbox, and CRM systems. This allows for a seamless workflow when managing the Contribution and Loan Repayment Remittance BFormb, ensuring all your data is connected in one ecosystem.

-

What are the benefits of using airSlate SignNow for the Contribution and Loan Repayment Remittance BFormb?

Using airSlate SignNow for the Contribution and Loan Repayment Remittance BFormb increases efficiency by reducing paperwork and manual errors. The electronic signature feature not only speeds up the process but also provides a legally binding way to finalize your documents securely.

-

Is airSlate SignNow suitable for small businesses managing the Contribution and Loan Repayment Remittance BFormb?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its affordable pricing plans and user-friendly interface make it an ideal choice for managing the Contribution and Loan Repayment Remittance BFormb effectively.

Get more for CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb

Find out other CONTRIBUTION AND LOAN REPAYMENT REMITTANCE BFORMb

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT