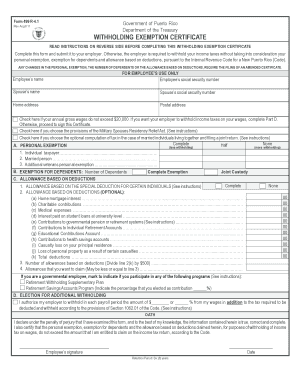

499 R 4 Form

What is the 499 R 4

The 499 R 4 form is a document used primarily in the context of tax reporting and compliance in the United States. It serves as a means for businesses to report specific financial information to the Internal Revenue Service (IRS). This form is essential for ensuring that all income and expenses are accurately documented, which helps in maintaining transparency and compliance with federal tax laws.

How to use the 499 R 4

Using the 499 R 4 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including income statements and expense receipts. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your financial activities. Once completed, review the form for any errors before submission to avoid potential penalties. The form can be submitted electronically or via mail, depending on your preference and the specific requirements set by the IRS.

Steps to complete the 499 R 4

Completing the 499 R 4 form involves a systematic approach to ensure accuracy:

- Collect all relevant financial documents, including income and expense records.

- Fill in the form with accurate figures, ensuring that all entries are clear and legible.

- Double-check all calculations and ensure that the totals match your financial records.

- Sign and date the form to validate your submission.

- Submit the form either online or by mailing it to the appropriate IRS address.

Legal use of the 499 R 4

The legal use of the 499 R 4 form is crucial for compliance with federal tax regulations. It must be completed accurately to ensure that all reported information is truthful and reflects actual financial activities. Failure to use the form correctly can result in legal repercussions, including fines or audits by the IRS. It is important to adhere to all guidelines provided by the IRS when completing and submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the 499 R 4 form are set by the IRS and must be adhered to in order to avoid penalties. Generally, the form should be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. However, it is advisable to check for any specific extensions or changes in deadlines that may apply to your situation. Keeping track of these dates is essential for maintaining compliance and avoiding unnecessary fees.

Required Documents

To complete the 499 R 4 form, several documents are typically required. These include:

- Income statements that detail all sources of revenue.

- Expense receipts that support all claimed deductions.

- Previous tax returns for reference and accuracy.

- Any additional documentation that may be required by the IRS for specific situations.

Who Issues the Form

The 499 R 4 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to comply with federal tax regulations.

Quick guide on how to complete 499 r 4

Effortlessly Prepare 499 R 4 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage 499 R 4 on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

Efficiently Modify and Electronically Sign 499 R 4 with Ease

- Locate 499 R 4 and click on Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Mark important parts of the documents or obscure sensitive data with tools airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to confirm your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about missing or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and electronically sign 499 R 4 to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 499 r 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 499 r 4 feature in airSlate SignNow?

The 499 r 4 feature in airSlate SignNow is designed to streamline the signing process for documents. It allows users to send, sign, and manage important documents with ease, enhancing productivity and efficiency. This feature is particularly beneficial for businesses looking to simplify their document workflows.

-

How does the pricing for airSlate SignNow compare with its competitors?

airSlate SignNow offers competitive pricing that gives you great value for the features it provides, including the capabilities associated with 499 r 4. Customers can choose from various plans based on their specific needs, ensuring that they only pay for the tools that will benefit their business. This cost-effective solution makes it accessible for both small and large enterprises.

-

What are the key benefits of using airSlate SignNow's 499 r 4?

One of the primary benefits of the 499 r 4 in airSlate SignNow is its user-friendly interface, which simplifies document signing. Additionally, it increases turnaround times for contracts and agreements, allowing you to close deals faster. The feature also enhances security and compliance, making it a reliable choice for businesses.

-

Can I integrate airSlate SignNow's 499 r 4 with other platforms?

Yes, airSlate SignNow’s 499 r 4 seamlessly integrates with various third-party applications. This enables users to connect their document signing workflows with existing systems, enhancing overall productivity. Popular integrations include CRM tools, payment processors, and storage services, making it an adaptable solution for different businesses.

-

Is training or support available for using the 499 r 4 feature?

Absolutely! airSlate SignNow provides extensive training resources and customer support for users of the 499 r 4 feature. We offer tutorials, webinars, and a dedicated support team to assist you with any questions or challenges. This commitment ensures you can leverage the full potential of the feature without any hassle.

-

What types of documents can I sign using the 499 r 4 feature?

With the 499 r 4 feature in airSlate SignNow, you can sign a variety of document types, including contracts, agreements, and forms. The flexibility of this feature allows users to manage all their signing needs in one place, whether for legal, financial, or personal documents. This simplifies the process of handling multiple document types efficiently.

-

How secure is the document signing process with 499 r 4?

The document signing process with the 499 r 4 feature is highly secure. airSlate SignNow employs advanced encryption protocols to protect your data during transmission and storage. Additionally, features like audit trails and user authentication ensure compliance and enhance security, giving you peace of mind when signing important documents.

Get more for 499 R 4

- Adult player registration form ross rugby club rossrugby co

- Heritage college transcript form

- Independent review form

- Substitute teacher application maggie l walker governoramp39s school form

- Educational activity evaluation form v1 palliative

- Field trip opt out formindd missoula county public schools

- The snap iv teacher and parent rating scale form

- Keyword form 63766371

Find out other 499 R 4

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document