Csd540 Form

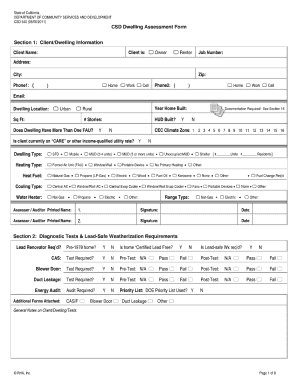

What is the Csd540 Form

The Csd540 Form is a specific document used in various legal and administrative contexts within the United States. It serves as a formal request or declaration related to certain transactions or processes. Understanding the purpose and requirements of the Csd540 Form is essential for compliance and effective communication with relevant authorities.

How to use the Csd540 Form

Using the Csd540 Form involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from official sources. Next, carefully fill out the required fields, ensuring that all necessary information is accurate and complete. Once completed, the form can be submitted according to the specified guidelines, whether online, by mail, or in person, depending on the requirements of the issuing authority.

Steps to complete the Csd540 Form

Completing the Csd540 Form requires attention to detail. Follow these steps to ensure accuracy:

- Obtain the latest version of the form from a reliable source.

- Read the instructions carefully to understand what information is required.

- Fill in personal details, including name, address, and relevant identification numbers.

- Provide any additional information as required by the specific context of the form.

- Review the completed form for accuracy and completeness.

- Sign and date the form as needed.

- Submit the form according to the specified method.

Legal use of the Csd540 Form

The legal validity of the Csd540 Form hinges on compliance with applicable regulations. It is crucial to ensure that the form is filled out correctly and submitted in accordance with legal standards. Electronic signatures may be accepted, provided that they meet the criteria outlined in laws such as ESIGN and UETA, ensuring that the form holds up in legal contexts.

Filing Deadlines / Important Dates

Filing deadlines for the Csd540 Form vary depending on the specific use case and the issuing authority. It is important to be aware of these deadlines to avoid penalties or complications. Always check the official guidelines for the most accurate and up-to-date information regarding submission timelines.

Form Submission Methods (Online / Mail / In-Person)

The Csd540 Form can typically be submitted through various methods, allowing for flexibility based on user preference and requirements:

- Online Submission: Many authorities allow electronic submission through secure portals.

- Mail Submission: The form can often be printed and sent via postal service to the designated address.

- In-Person Submission: Some situations may require or allow for direct submission at specified locations.

Quick guide on how to complete csd540 form

Prepare Csd540 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to acquire the correct template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly and without issues. Manage Csd540 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Csd540 Form without hassle

- Obtain Csd540 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, burdensome form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Csd540 Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the csd540 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Csd540 Form?

The Csd540 Form is a document utilized for various business purposes, often related to financial reporting and compliance. This form can be easily sent and signed electronically through airSlate SignNow, ensuring a seamless workflow.

-

How does airSlate SignNow simplify the Csd540 Form signing process?

airSlate SignNow streamlines the signing process of the Csd540 Form by allowing users to send, sign, and manage documents electronically. With its intuitive interface, users can sign the form from any device, which enhances efficiency and reduces processing time.

-

Is there a cost associated with using airSlate SignNow for the Csd540 Form?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, making it a cost-effective solution for managing the Csd540 Form. You'll find transparent pricing that allows you to choose a plan based on the volume of documents and users in your organization.

-

What features does airSlate SignNow offer for handling the Csd540 Form?

airSlate SignNow provides several features designed specifically for managing the Csd540 Form, including template creation, automated workflows, and real-time tracking of document status. These features help ensure that you can efficiently collect eSignatures and stay organized.

-

Can I integrate airSlate SignNow with other tools to manage the Csd540 Form?

Absolutely! airSlate SignNow supports integrations with numerous third-party applications, such as cloud storage services and CRM systems, to enhance your workflow when handling the Csd540 Form. This interoperability allows for smooth data transfer and improved collaboration.

-

What are the benefits of using airSlate SignNow for the Csd540 Form?

Utilizing airSlate SignNow for the Csd540 Form offers major benefits, including faster turnaround times for obtaining electronic signatures and reduced paperwork. This leads to enhanced productivity and a more environmentally friendly approach by minimizing printing and physical document management.

-

Is my data secure when using airSlate SignNow for the Csd540 Form?

Yes, airSlate SignNow prioritizes security and compliance, providing robust measures to protect your data when handling the Csd540 Form. Encryption, secure access controls, and compliance with industry standards ensure that your information remains safe throughout the signing process.

Get more for Csd540 Form

Find out other Csd540 Form

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy