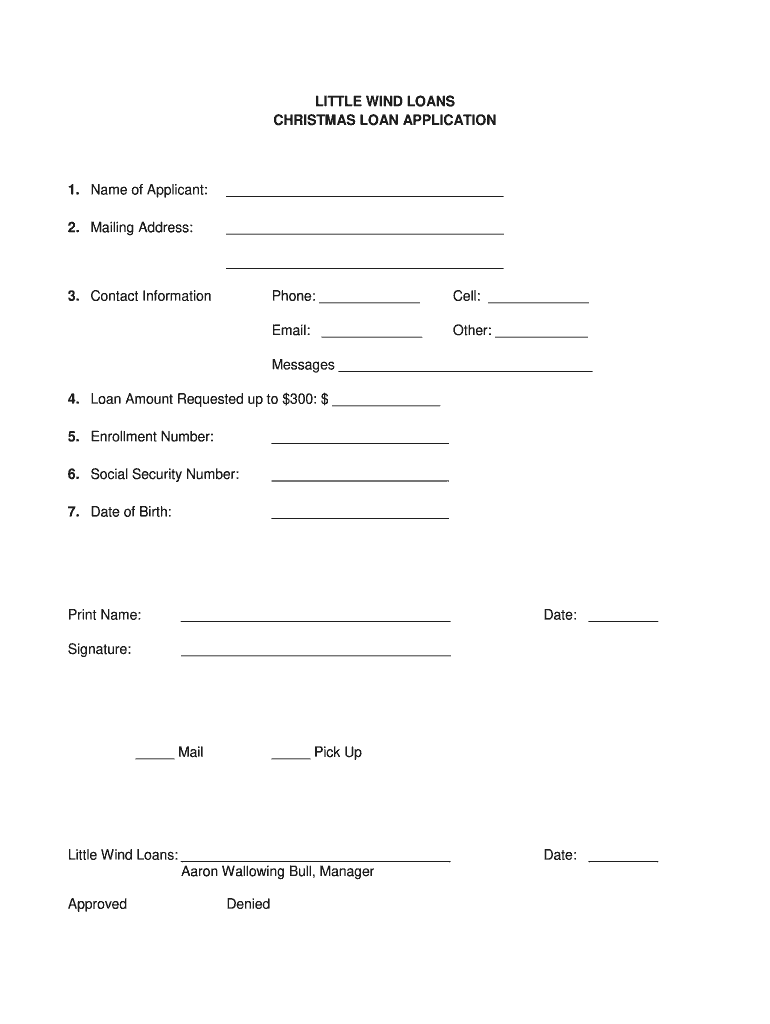

Little Wind Loans Christmas Loans Form

What is the Little Wind Loans Christmas Loans

The Little Wind Loans Christmas Loans are designed to provide financial assistance during the holiday season. These loans typically cater to individuals seeking small amounts of money to cover festive expenses such as gifts, decorations, or travel. They are often characterized by their quick approval process and flexible repayment options, making them accessible for those who may need a little extra help during this time of year.

How to obtain the Little Wind Loans Christmas Loans

Obtaining a Little Wind Loans Christmas Loan involves a straightforward application process. First, individuals should gather necessary documentation, which may include proof of income, identification, and other financial information. Next, applicants can complete the loan application form, either online or in person. After submission, the lender will review the application, and if approved, funds can be disbursed quickly, often within one business day.

Steps to complete the Little Wind Loans Christmas Loans

Completing the Little Wind Loans Christmas Loans application involves several key steps:

- Gather required documents, such as proof of income and identification.

- Fill out the loan application form accurately, ensuring all information is complete.

- Submit the application through the preferred method, whether online or in person.

- Await approval, which may take a short time depending on the lender's process.

- If approved, review the loan terms and sign the agreement to receive funds.

Legal use of the Little Wind Loans Christmas Loans

It is essential to understand the legal aspects of using Little Wind Loans Christmas Loans. These loans must comply with federal and state regulations to ensure they are offered fairly and transparently. Borrowers should be aware of their rights, including the right to receive clear information about interest rates, fees, and repayment terms. Additionally, ensuring that the lender is licensed and adheres to legal standards can help protect borrowers from predatory lending practices.

Eligibility Criteria

Eligibility for Little Wind Loans Christmas Loans typically includes several criteria that applicants must meet. Generally, individuals must be at least eighteen years old, have a steady source of income, and possess a valid identification document. Some lenders may also consider credit history, although many offer loans to those with varying credit profiles. Meeting these criteria can help streamline the application process and increase the chances of approval.

Required Documents

When applying for Little Wind Loans Christmas Loans, applicants should prepare specific documents to facilitate the process. Commonly required documents include:

- Proof of income, such as pay stubs or bank statements.

- Identification, like a driver's license or passport.

- Social Security number for identity verification.

- Additional financial information, if requested by the lender.

Application Process & Approval Time

The application process for Little Wind Loans Christmas Loans is designed to be efficient. After gathering necessary documents, applicants can fill out the loan application form. Most lenders aim to provide a decision within a few hours to one business day. If approved, borrowers will receive details regarding the loan amount, interest rate, and repayment schedule. Timely submission of all required documents can help expedite the approval process.

Quick guide on how to complete little wind loans christmas loans form

The simplest method to locate and sign Little Wind Loans Christmas Loans

Across the entirety of a company, ineffective workflows surrounding paper approvals can consume a signNow amount of working hours. Executing documents like Little Wind Loans Christmas Loans is an inherent aspect of operations in any enterprise, which is why the effectiveness of each agreement's lifecycle holds considerable importance for the overall performance of the company. With airSlate SignNow, finalizing your Little Wind Loans Christmas Loans can be as straightforward and swift as possible. This platform provides you with the most recent version of nearly any form. Even better, you can sign it right away without the need to install third-party software on your device or produce any physical copies.

Steps to obtain and sign your Little Wind Loans Christmas Loans

- Browse our library by category or utilize the search feature to find the document you require.

- Check the form preview by clicking Learn more to confirm it is the correct one.

- Click Get form to start editing immediately.

- Fill out your form and include any necessary details using the toolbar.

- When finished, click the Sign tool to endorse your Little Wind Loans Christmas Loans.

- Choose the signature method that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize your editing and proceed to sharing options as required.

With airSlate SignNow, you possess everything needed to handle your documentation effectively. You can search, complete, edit, and even send your Little Wind Loans Christmas Loans in a single interface without any difficulty. Enhance your operations by utilizing one streamlined, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

What percentage of its assets is a bank allowed to lend out in the form of loans?

Commercial banks create money when they make loans. In the UK a bank is required to hold the equivalent of at least 10% of the money they loan out. If they have reserves of $100 then they can create money, as loans, to the value of $900.This process is called fractional reserve banking.If you would like to know more about this process have a look at Positive Money’s website How Banks Create Money

-

How can you get financial aid if your parents won't fill out their part and you don't qualify for third party loans?

In that case, likely the only aid you can get is federal loans limited to 5,500 freshman year and increasing about 1k each year. If you speak to your financial aid office they may be able to arrange that, but they may require that your parents sign a form that they refuse to fill out your aid forms. You will not be able to get any federal Pell Grant or Grants from the college. However, in many cases you would be eligible for Merit Aid or Scholarships that do not depend on family income. If you have good enough test scores there are some colleges around the country that will give a lot of aid for that. They may not always be in the most desirable areas but the important thing is that you will get a college degree.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How are many Indian students able to afford to go to the USA for graduate studies, and how do they pay for it? Are they all naturally rich or do they take out loans? Are the loans from India or the US and how long do they take to repay?

As Balaji Viswanathan (பாலாஜி விஸ்வநாதன்) and Balaji Santhanam mentioned, most of the Indian students cannot afford to pay themselves for their grad studies in the US. They rely mostly on loans and assistantships. For me, it's completely the assistantship that I relied on.Other answers talked about what they did after coming to the US while pursing their grad studies. Whereas, my story is all about twists and turns that I have experienced to signNow my destination university. After my bachelor's I worked for TCS for 1.5 yrs. I could only manage to pay for university application fees and Toefl exam with my salary. I have decided to apply for 8 universities, which later turned out to be one of the best decisions of my life.After receiving my first admit, I approached the only public sector bank in my village. Later, I came to know that they won't be accepting agricultural lands for approving the educational loans. So my loan got rejected. In a similar way, with the help of my relatives I tried applying at multiple banks, but all my efforts were in vain. The only option I had was to request one of my relatives to be my surety, and I would receive a loan amount of 7 lakh rupees($12000 at that time). That would suffice for paying my tuition fees for 2 semesters. I had no idea how I could pay tuition fees for the remaining semesters, let alone my living expenses. After 3-4 months of agony that my family and I had for revolving around the banks to secure an educational loan, I discussed with my parents and gave a lot of thought if I should continue with my plan of action for my education. I had a lot of uncertainties floating on my mind back then and was trying to get an insight about all sorts of things such as how to gather funds for my coursework, living expenses; how to study exceptionally well to procure any kind of assistantships; how to re-pay the loan etc. After weighing all the risk factors, I had finally decided to make a move to pursue my Master's in the US. Therefore, I attended visa interview and got my F-1 stamping for Universtiy X. I was relieved for getting my visa stamping and then, began to plan and work out things necessary for my journey and stay at Univ X.Later, after two weeks, one fine morning I saw the eighth wonder in my life. There resides an email in my Inbox saying that I was offered Graduate Teaching Assistantship (GTA) from Univ Y. As a part of that assistantship, I would receive a full tuition fee waiver and on top of it, they would pay me with an amount of $1300 each month. I felt like I won a big jackpot in my life. Then the first thing I did was to cancel my educational loan. However, there is one last milestone that was to re-attempt the visa interview. Everyone suggested me to visit Univ X and request for a transfer to Univ Y. I believe in this quote "If there is no risk, there is no reward." So, I took the risk and got a visa stamping approved for the second time. However, this time its for Univ Y. Now, the rewards were: I didn't have to go to Univ X and stay there for few days until the transfer process gets completed and again fly to Univ Y. I directly started my journey to Univ Y. By the way, there's an anecdote behind receiving the GTA. The eighth university that I applied to was this Univ Y. When I was applying to this university, I had no idea that they would offer such kind of GTAs beforehand. The University Y offers only limited number of those GTAs. Initially, I got an email from that university saying that I was not considered in their final pool of GTAs. I felt bad but couldn't do anything about it. In the meantime, I have decided to choose University X and got my visa approval. After few weeks, I was chatting to a friend who got GTA from Univ Y and he told me that one of the GTA holders was going to drop her offer. The reason was that she planned to move to a different location where her fiance lives. Now, that raised hopes in me. I sent an email, to the concerned professors in the department describing the coursework that I am interested in, my skills, industry experience, and most importantly my interest towards working as a Teaching Assistant. It took another few weeks to receive the GTA offer. And, that's the happy ending I was waiting for.For 2 years of my Master's education, all I had to pay was about $750 each semester which included Health Insurance, Library fees, etc. I had 2 wonderful years of valuable education from September 2013 - July 2015 and also had experienced loads of fun-filled happy moments.Edit: Few people were eager to know about the universities X and Y. So, here they are:X - West Virginia UniversityY - University of Minnesota DuluthBoth are pretty decent universities. If anybody is willing is know more about univ Y message me or leave a comment so that I can reply to them.

Create this form in 5 minutes!

How to create an eSignature for the little wind loans christmas loans form

How to generate an eSignature for the Little Wind Loans Christmas Loans Form in the online mode

How to create an electronic signature for your Little Wind Loans Christmas Loans Form in Google Chrome

How to make an electronic signature for signing the Little Wind Loans Christmas Loans Form in Gmail

How to create an eSignature for the Little Wind Loans Christmas Loans Form right from your mobile device

How to make an electronic signature for the Little Wind Loans Christmas Loans Form on iOS devices

How to make an eSignature for the Little Wind Loans Christmas Loans Form on Android devices

People also ask

-

What are little wind loans and who can benefit from them?

Little wind loans are designed for small businesses and individuals seeking quick access to funds without extensive requirements. These loans can support projects, cover unexpected expenses, or fund business growth, making them ideal for entrepreneurs and freelancers.

-

How do I apply for little wind loans?

Applying for little wind loans is made simple through our user-friendly online platform. You can fill out a short application form, submit the necessary documents, and receive a quick decision, ensuring fast access to the funds you need.

-

What are the typical interest rates for little wind loans?

Interest rates for little wind loans vary depending on the applicant's credit profile and loan amount. However, we strive to offer competitive rates to make borrowing affordable while helping you achieve your financial goals.

-

What features distinguish little wind loans from other financing options?

Little wind loans stand out due to their quick approval process, minimal documentation requirements, and flexibility. Unlike traditional loans, they are designed to meet the needs of small businesses, making them a convenient choice for urgent financial needs.

-

Can little wind loans be used for business expansion?

Absolutely! Little wind loans can be utilized for various purposes, including business expansion. Whether you're looking to invest in new equipment or hire additional staff, these loans can provide the necessary capital to support your growth.

-

What are the benefits of using little wind loans?

The primary benefits of little wind loans include fast access to funds, minimal paperwork, and the ability to use the loans for diverse needs. They empower you to tackle immediate financial challenges without the hassle of lengthy application processes.

-

Are there any integration options for managing little wind loans?

Yes, our platform offers integration options that simplify the management of little wind loans within your existing financial systems. This feature enhances your financial tracking and reporting capabilities, making it easier to manage your loans effectively.

Get more for Little Wind Loans Christmas Loans

- Hr 7029 dbpr form

- Cdc and flu prevention posters form

- Non collusion affidavit of prime bidder form

- Abridged familyfriend lease agreement form

- Strs form sr 0307

- 09 emp5571 v1 0 1 26blank xps this form is to be used when a group of employees are to be working overtime hours and the

- Oebb fitness rewards registration form oregon

- Non contracted provider payment dispute bformb triple s advantage

Find out other Little Wind Loans Christmas Loans

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast