Self Employment Income Worksheet 2016

What is the Self Employment Income Worksheet

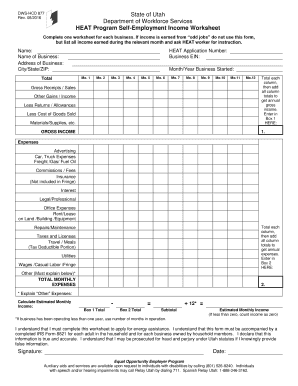

The Self Employment Income Worksheet is a crucial document for individuals who operate their own businesses or work as freelancers. This worksheet helps self-employed individuals calculate their net income by summarizing income and expenses related to their business activities. It serves as a foundational tool for preparing tax returns, ensuring that all relevant financial information is accurately reported to the IRS.

How to use the Self Employment Income Worksheet

Using the Self Employment Income Worksheet involves several steps. First, gather all relevant financial documents, including income statements and receipts for expenses. Next, input your total income from self-employment activities in the designated section. After that, list all allowable business expenses, such as supplies, travel, and home office deductions. Finally, subtract total expenses from total income to determine your net profit or loss, which will be reported on your tax return.

Steps to complete the Self Employment Income Worksheet

Completing the Self Employment Income Worksheet requires careful attention to detail. Follow these steps:

- Collect all income records, including invoices and sales receipts.

- Document all business-related expenses, ensuring you have receipts for verification.

- Fill in the total income section with your gross earnings.

- List all deductible expenses in the appropriate categories.

- Calculate your net income by subtracting total expenses from total income.

Legal use of the Self Employment Income Worksheet

The Self Employment Income Worksheet is legally recognized as a valid document for reporting income to the IRS. When filled out correctly, it can support your tax filings and provide a clear record of your business activities. It is essential to ensure that all information is accurate and truthful to avoid potential legal issues, including audits or penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Self Employment Income Worksheet. It is important to refer to the latest IRS publications to understand allowable deductions, reporting requirements, and any changes to tax laws that may affect self-employed individuals. Staying informed about IRS guidelines ensures compliance and helps maximize potential deductions.

Filing Deadlines / Important Dates

Self-employed individuals must adhere to specific filing deadlines for their tax returns. Typically, the deadline for filing individual tax returns is April 15. However, if you are unable to meet this deadline, you may apply for an extension, which generally extends the deadline to October 15. It is crucial to be aware of these dates to avoid penalties and interest on late payments.

Required Documents

To complete the Self Employment Income Worksheet, several documents are necessary. These include:

- Income statements from all self-employment activities.

- Receipts for business expenses.

- Bank statements that reflect business transactions.

- Previous tax returns for reference.

Quick guide on how to complete self employment income worksheet

Manage Self Employment Income Worksheet effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, as you can easily access the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Self Employment Income Worksheet on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The simplest way to alter and electronically sign Self Employment Income Worksheet without stress

- Find Self Employment Income Worksheet and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Self Employment Income Worksheet to ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self employment income worksheet

Create this form in 5 minutes!

How to create an eSignature for the self employment income worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self employment worksheet pdf?

A self employment worksheet pdf is a document designed to help self-employed individuals track their income, expenses, and tax obligations. This worksheet simplifies the organization of financial information, making tax preparation easier and more accurate.

-

How can I create a self employment worksheet pdf using airSlate SignNow?

You can easily create a self employment worksheet pdf using airSlate SignNow’s intuitive document editor. Simply import your existing worksheet or create a new one from scratch, add necessary fields, and customize it to fit your needs before saving or sharing it securely.

-

Is the self employment worksheet pdf included in airSlate SignNow's pricing plans?

Yes, the self employment worksheet pdf is accessible to all users with any of airSlate SignNow's subscription plans. This cost-effective solution ensures you have essential tools for managing your business documents without incurring additional charges.

-

What are the features of the self employment worksheet pdf offered by airSlate SignNow?

The self employment worksheet pdf from airSlate SignNow includes features such as customizable fields, electronic signatures, and document tracking. These features streamline the process of managing your self-employment finances while providing security and ease of use.

-

How does the self employment worksheet pdf benefit freelancers and contractors?

Freelancers and contractors benefit from the self employment worksheet pdf as it helps them efficiently track income and expenses throughout the year. By maintaining accurate records, users can maximize deductions and prepare for tax season with confidence, reducing stress and potential errors.

-

Can I integrate the self employment worksheet pdf into other software using airSlate SignNow?

Yes, airSlate SignNow allows integration with various software applications, enabling you to incorporate your self employment worksheet pdf seamlessly. This functionality enhances productivity by allowing data flow between different tools you may already use for managing your business information.

-

Are there any templates available for the self employment worksheet pdf?

airSlate SignNow provides several templates for the self employment worksheet pdf that you can customize according to your specific needs. These templates save time and ensure you include all essential information needed for tracking your self-employment activities effectively.

Get more for Self Employment Income Worksheet

- Sample tax transcript 1040ez sam lee finaid ucf form

- Umass amherst letterhead form

- That certain plot piece or parcel of land with the buildings and form

- 1443 claim form

- Local services tax employee listing sheet keystone collections group form

- Blank medication list form

- Biographic data 2005 form

- Cc1680 form

Find out other Self Employment Income Worksheet

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple