Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc Form

What is the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc

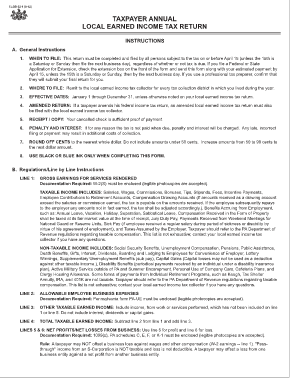

The Jordan Taxpayer Annual Local EIT Return is a specific form utilized by residents of Jordan to report their earned income for local tax purposes. This return is managed by Jordan Tax Service, Inc, which oversees the collection of local earned income taxes. The form captures essential information about the taxpayer's income, deductions, and other relevant financial details to ensure accurate tax assessment and compliance with local regulations.

Steps to complete the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc

Completing the Jordan Taxpayer Annual Local EIT Return involves several key steps:

- Gather necessary financial documents, including W-2 forms, 1099 forms, and any other income statements.

- Fill out the form accurately, ensuring all income sources are reported.

- Calculate any deductions or credits you may qualify for, which can reduce your taxable income.

- Review the completed form for accuracy to avoid potential errors that could lead to penalties.

- Submit the form to Jordan Tax Service, Inc by the specified deadline, ensuring you choose your preferred submission method.

How to obtain the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc

The Jordan Taxpayer Annual Local EIT Return can be obtained through several means. Taxpayers can visit the official website of Jordan Tax Service, Inc, where the form is typically available for download. Additionally, local tax offices may provide physical copies of the form. It is important to ensure you have the most current version of the form to comply with any updates in tax regulations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Jordan Taxpayer Annual Local EIT Return is crucial for compliance. Typically, the return must be filed by April fifteenth of the following tax year. However, specific deadlines may vary based on local regulations or extensions. It is advisable to check with Jordan Tax Service, Inc for any updates or changes to these important dates.

Required Documents

To complete the Jordan Taxpayer Annual Local EIT Return, several documents are necessary:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any additional income sources, such as interest or dividends.

- Documentation of deductions, such as receipts for business expenses or charitable contributions.

Penalties for Non-Compliance

Failing to file the Jordan Taxpayer Annual Local EIT Return on time or providing inaccurate information can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to adhere to filing requirements to avoid these consequences and ensure compliance with local tax laws.

Quick guide on how to complete jordan taxpayer annual local eit return jordan tax service inc

Complete Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc effortlessly on any gadget

Web-based document administration has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the accurate form and securely preserve it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Manage Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest way to modify and eSign Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc without difficulty

- Obtain Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc and then click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

No need to worry about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jordan taxpayer annual local eit return jordan tax service inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc.?

The Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc. is a tax return specific to employees who work in Jordan and are required to report their local earned income tax. This annual return ensures compliance with local tax laws and helps taxpayers avoid penalties by accurately reporting their earnings to the Jordan Tax Service, Inc.

-

How can I file my Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc. easily?

You can file your Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc. conveniently through our user-friendly platform. With airSlate SignNow, you can complete and eSign your documents electronically, streamlining the entire process for a hassle-free filing experience.

-

What are the costs associated with the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc.?

The costs for filing the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc. may vary depending on the complexity of your return and the services you choose. airSlate SignNow provides cost-effective solutions that can help you save on both time and money while ensuring accurate tax submission.

-

What features does airSlate SignNow offer for the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc.?

AirSlate SignNow offers a variety of features designed to facilitate the completion of the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc. These include electronic signatures, document tracking, and customizable templates, all of which enhance the efficiency and security of your tax filing process.

-

What benefits can I expect from using airSlate SignNow for the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc.?

Using airSlate SignNow for the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc. brings numerous benefits, such as increased accuracy, faster processing times, and the convenience of eSigning. Our platform minimizes the risk of errors and helps ensure compliance with local tax regulations.

-

Is airSlate SignNow compliant with local tax laws for the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc.?

Yes, airSlate SignNow is designed to comply with all applicable local tax laws, including those associated with the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc. We regularly update our platform to align with current regulations, ensuring that your tax filings are accurate and lawful.

-

Can I integrate airSlate SignNow with other accounting software for the Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc.?

Absolutely! AirSlate SignNow offers seamless integrations with various accounting software, making it easier to manage your Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc. with your existing financial systems. This integration helps streamline your workflow and enhances overall efficiency.

Get more for Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc

- 2014 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

- 2015 8804 form

- 32115 foreign partnership withholdinginternal revenue irsgov form

- 2016 form 8804 schedule a penalty for underpayment of estimated section 1446 tax by partnerships

- Irs 8804 2017 form

- 2000 form 709

- 2009 709 form

- 2004 709 form

Find out other Jordan Taxpayer Annual Local EIT Return Jordan Tax Service, Inc

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors