Pass through Entity Tax Forms CT Gov 2016

What is the Pass Through Entity Tax Forms CT gov

The Pass Through Entity Tax Forms CT gov are specific tax documents designed for entities that pass their income directly to owners or investors. This includes structures such as partnerships, S corporations, and limited liability companies (LLCs). These forms allow the income to be taxed at the individual level rather than at the entity level, which can lead to potential tax savings for owners. Understanding these forms is crucial for compliance with state tax regulations and for optimizing tax obligations.

Steps to complete the Pass Through Entity Tax Forms CT gov

To accurately complete the Pass Through Entity Tax Forms CT gov, follow these steps:

- Gather necessary financial documents, including income statements, expense reports, and prior year tax returns.

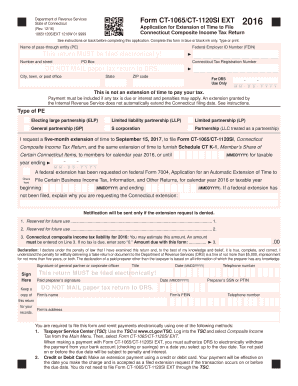

- Identify the specific form required for your entity type, such as Form CT-1065 for partnerships or Form CT-1120SI for S corporations.

- Fill out the form with accurate information, ensuring all income and deductions are reported correctly.

- Review the completed form for any errors or omissions.

- Sign the form electronically using a compliant eSignature solution, ensuring it meets legal requirements.

- Submit the form either online through the state’s tax portal or via mail, depending on your preference.

Legal use of the Pass Through Entity Tax Forms CT gov

The legal use of the Pass Through Entity Tax Forms CT gov is governed by state tax laws. These forms must be filled out accurately to reflect the entity's financial situation and comply with tax regulations. Using these forms correctly allows entities to benefit from pass-through taxation, where income is taxed at the individual owner level rather than at the entity level. Adhering to the legal requirements ensures that the forms are valid and can help avoid penalties associated with non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Pass Through Entity Tax Forms CT gov are critical for compliance. Typically, these forms are due on the fifteenth day of the fourth month following the end of the entity's tax year. For calendar year filers, this means the deadline is April 15. It is essential to stay informed about any changes to deadlines, especially during tax season, to ensure timely submission and avoid late fees.

Required Documents

When preparing to complete the Pass Through Entity Tax Forms CT gov, certain documents are required to ensure accuracy and compliance. These documents may include:

- Financial statements, including profit and loss statements.

- Prior year tax returns for the entity.

- Records of income distributions to owners or partners.

- Documentation of any deductions or credits being claimed.

Having these documents ready will facilitate a smoother filing process and help ensure that all information is reported correctly.

Form Submission Methods

The Pass Through Entity Tax Forms CT gov can be submitted through several methods to accommodate different preferences. These methods include:

- Online submission via the state’s tax portal, which often provides immediate confirmation of receipt.

- Mailing a paper version of the form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can enhance the efficiency of the filing process and ensure compliance with state regulations.

Quick guide on how to complete pass through entity tax forms ctgov

Your assistance manual on how to prepare your Pass Through Entity Tax Forms CT gov

If you’re pondering how to compose and submit your Pass Through Entity Tax Forms CT gov, here are some brief recommendations on how to streamline tax declaration.

To begin, all you need to do is set up your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is a highly intuitive and powerful document solution that enables you to modify, design, and finalize your income tax paperwork effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to edit details whenever necessary. Simplify your tax organization with sophisticated PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Pass Through Entity Tax Forms CT gov in a matter of minutes:

- Create your account and start working on PDFs promptly.

- Utilize our directory to access any IRS tax document; explore various versions and schedules.

- Click Get form to open your Pass Through Entity Tax Forms CT gov in our editor.

- Complete the mandatory fields with your data (text, numbers, checkmarks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to return errors and delay refunds. Moreover, prior to e-filing your taxes, consult the IRS website for filing guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct pass through entity tax forms ctgov

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the pass through entity tax forms ctgov

How to generate an eSignature for the Pass Through Entity Tax Forms Ctgov online

How to make an eSignature for the Pass Through Entity Tax Forms Ctgov in Google Chrome

How to create an eSignature for putting it on the Pass Through Entity Tax Forms Ctgov in Gmail

How to generate an electronic signature for the Pass Through Entity Tax Forms Ctgov straight from your smartphone

How to generate an electronic signature for the Pass Through Entity Tax Forms Ctgov on iOS

How to create an electronic signature for the Pass Through Entity Tax Forms Ctgov on Android OS

People also ask

-

What are Pass Through Entity Tax Forms CT gov and who needs them?

Pass Through Entity Tax Forms CT gov are specific forms required for entities like partnerships and S corporations to report income and distribute tax obligations to their owners. Businesses operating in Connecticut that fall under these categories must file these forms to comply with state tax regulations.

-

How does airSlate SignNow assist with Pass Through Entity Tax Forms CT gov?

airSlate SignNow provides a streamlined solution for electronically signing and sending Pass Through Entity Tax Forms CT gov. With our user-friendly interface, you can easily manage your tax documents, ensuring they are signed and submitted on time to avoid penalties.

-

What features does airSlate SignNow offer for handling Pass Through Entity Tax Forms CT gov?

Our platform features customizable templates, secure eSignatures, and automated workflows that specifically cater to Pass Through Entity Tax Forms CT gov. This ensures that your documents are not only compliant but also efficiently processed, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for Pass Through Entity Tax Forms CT gov?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs, making it an affordable choice for managing Pass Through Entity Tax Forms CT gov. We provide options that cater to both small businesses and larger enterprises, ensuring you only pay for what you need.

-

Can I integrate airSlate SignNow with other accounting software for Pass Through Entity Tax Forms CT gov?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your Pass Through Entity Tax Forms CT gov alongside your financial records. This integration simplifies the workflow, making it easier to keep track of your tax obligations.

-

How secure is airSlate SignNow when handling Pass Through Entity Tax Forms CT gov?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to ensure that your Pass Through Entity Tax Forms CT gov are protected throughout the signing process, safeguarding sensitive information from unauthorized access.

-

What benefits do I gain by using airSlate SignNow for my Pass Through Entity Tax Forms CT gov?

By using airSlate SignNow for your Pass Through Entity Tax Forms CT gov, you benefit from faster processing times, reduced paperwork, and improved compliance. Our easy-to-use solution enhances your productivity, allowing you to focus more on your business and less on administrative tasks.

Get more for Pass Through Entity Tax Forms CT gov

Find out other Pass Through Entity Tax Forms CT gov

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament