Form Ct 1065ct 1120si Ext 2013

What is the Form Ct 1065ct 1120si Ext

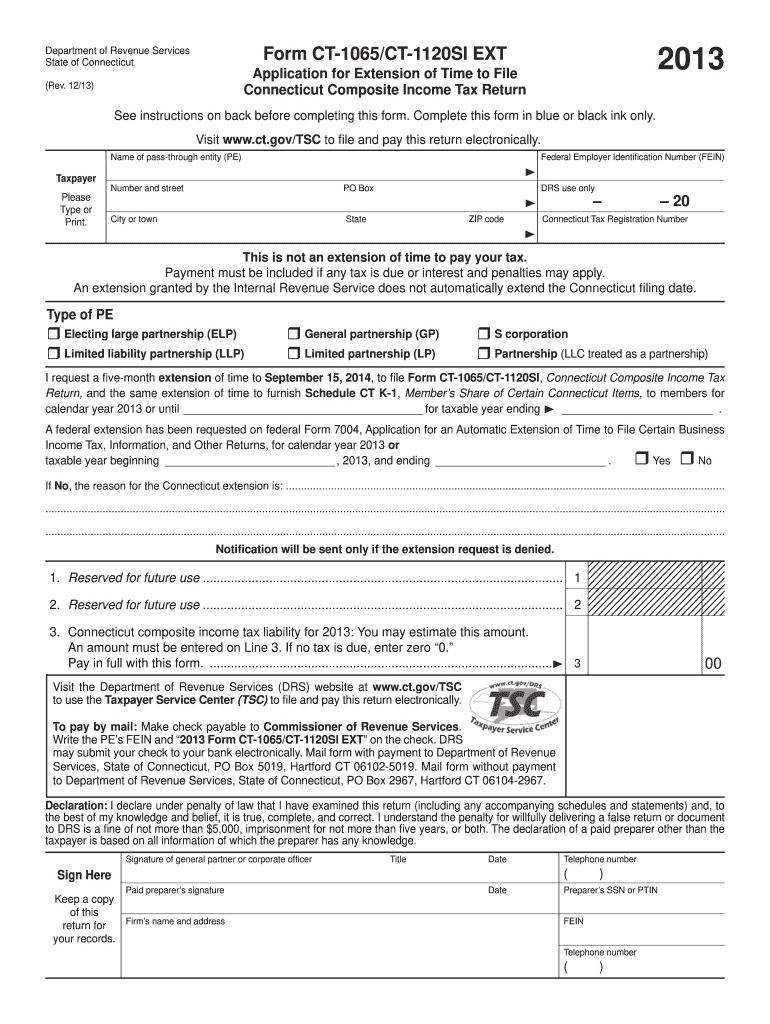

The Form Ct 1065ct 1120si Ext is a tax form used by partnerships and corporations in the state of Connecticut to apply for an extension of time to file their income tax returns. This form allows businesses to request additional time to prepare their tax documents without incurring penalties for late filing. It is essential for taxpayers to understand that this extension does not extend the time to pay any taxes owed; it only postpones the filing deadline.

How to use the Form Ct 1065ct 1120si Ext

To use the Form Ct 1065ct 1120si Ext, taxpayers must accurately complete all required fields, ensuring that their information matches what is on file with the Connecticut Department of Revenue Services. The form typically requires details such as the business name, address, and tax identification number. After filling out the form, it can be submitted electronically or by mail, depending on the taxpayer's preference. It is crucial to submit the form before the original filing deadline to avoid penalties.

Steps to complete the Form Ct 1065ct 1120si Ext

Completing the Form Ct 1065ct 1120si Ext involves several steps:

- Gather necessary information, including your business's tax identification number and financial details.

- Fill in the business name and address accurately.

- Indicate the type of extension being requested, specifying the original due date of the return.

- Review the form for accuracy and completeness.

- Submit the completed form via your chosen method, either electronically or by mail.

Legal use of the Form Ct 1065ct 1120si Ext

The legal use of the Form Ct 1065ct 1120si Ext is governed by Connecticut state tax laws. Taxpayers must ensure that they are eligible to use this form and that they comply with all relevant regulations. Filing the form correctly and on time is essential to maintain compliance and avoid penalties. The form serves as an official request for an extension, and improper use may result in legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 1065ct 1120si Ext typically coincide with the original due dates for the respective income tax returns. For partnerships and corporations, the deadline is generally the fifteenth day of the third month following the end of the tax year. Taxpayers should mark their calendars to ensure timely submission of the extension request to avoid penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form Ct 1065ct 1120si Ext:

- Online Submission: Many taxpayers prefer to file electronically through the Connecticut Department of Revenue Services website, which offers a streamlined process.

- Mail: The form can be printed and mailed to the appropriate address provided by the state, ensuring it is postmarked by the filing deadline.

- In-Person: Taxpayers may also choose to deliver the form in person at designated state offices, although this method is less common.

Quick guide on how to complete form ct 1065ct 1120si ext 2013

Your assistance manual on how to prepare your Form Ct 1065ct 1120si Ext

If you wish to learn how to fill out and submit your Form Ct 1065ct 1120si Ext, here are several brief guidelines on how to simplify tax processing.

To begin, you simply need to establish your airSlate SignNow account to transform the way you handle documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to alter, draft, and finalize your income tax documents effortlessly. With its editor, you can switch between text, check boxes, and eSignatures, and return to modify information as necessary. Optimize your tax management with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Form Ct 1065ct 1120si Ext in just a few minutes:

- Create your account and start handling PDFs in a matter of minutes.

- Utilize our directory to obtain any IRS tax form; navigate through versions and schedules.

- Select Get form to access your Form Ct 1065ct 1120si Ext in our editor.

- Populate the required fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to more mistakes and delays in refunds. Moreover, before e-filing your taxes, make sure to consult the IRS website for submission rules specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1065ct 1120si ext 2013

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do I relist my previous company that is unlisted from MCA for not filling out the e-return form 2013-14?

First of all you have to prepare all financials and get it audited from an Auditor (CA), and then approach National company law tribunal (NCLT) with petition for restoration of your company.It is pertinent to note that NCLT observe may things before making the company active, one of them is that whether company was making some operation during these periods or not, i.e you have to proof with supporting documents like VAT return/Service tax return/Income tax return that company was in operation.Company Registration

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

Create this form in 5 minutes!

How to create an eSignature for the form ct 1065ct 1120si ext 2013

How to create an electronic signature for the Form Ct 1065ct 1120si Ext 2013 in the online mode

How to generate an eSignature for your Form Ct 1065ct 1120si Ext 2013 in Chrome

How to create an electronic signature for putting it on the Form Ct 1065ct 1120si Ext 2013 in Gmail

How to generate an electronic signature for the Form Ct 1065ct 1120si Ext 2013 from your smart phone

How to generate an eSignature for the Form Ct 1065ct 1120si Ext 2013 on iOS devices

How to create an eSignature for the Form Ct 1065ct 1120si Ext 2013 on Android

People also ask

-

What is Form Ct 1065ct 1120si Ext?

Form Ct 1065ct 1120si Ext is a tax extension form used by LLCs and corporations in Connecticut to request additional time for filing their returns. This form is essential for businesses looking to manage their tax deadlines effectively and avoid penalties. Understanding how to properly use Form Ct 1065ct 1120si Ext can save time and resources during the tax season.

-

How can airSlate SignNow help with Form Ct 1065ct 1120si Ext?

airSlate SignNow provides a streamlined way to eSign and manage documents, including Form Ct 1065ct 1120si Ext. With our user-friendly platform, businesses can easily prepare and send their tax extension forms for electronic signatures. This functionality helps ensure that all necessary documents are completed accurately and submitted on time.

-

What features does airSlate SignNow offer for Form Ct 1065ct 1120si Ext?

Our platform includes features such as customizable templates, secure document storage, and real-time tracking for Form Ct 1065ct 1120si Ext. Additionally, you can automate reminders for signers, helping to expedite the signing process. These features enhance efficiency and accuracy when handling your tax extension forms.

-

Is there a cost associated with using airSlate SignNow for Form Ct 1065ct 1120si Ext?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. We provide a cost-effective solution that includes everything you need to manage Form Ct 1065ct 1120si Ext and other documents. Moreover, our plans come with a free trial period, allowing you to evaluate the service before making a commitment.

-

Can I integrate airSlate SignNow with other software when using Form Ct 1065ct 1120si Ext?

Absolutely! airSlate SignNow integrates seamlessly with popular software applications like Google Drive, Salesforce, and Dropbox. This integration allows you to manage Form Ct 1065ct 1120si Ext alongside your other business tools, making the document workflow smoother and more efficient.

-

What are the benefits of using airSlate SignNow for tax forms like Form Ct 1065ct 1120si Ext?

Using airSlate SignNow for Form Ct 1065ct 1120si Ext simplifies the process of preparing and signing tax forms. Our platform enhances collaboration, reduces paperwork, and ensures compliance with legal standards through secure electronic signatures. Additionally, it minimizes the chances of errors that can occur with manual signatures.

-

How secure is airSlate SignNow when handling Form Ct 1065ct 1120si Ext?

airSlate SignNow prioritizes security for all documents, including Form Ct 1065ct 1120si Ext. We utilize industry-standard encryption protocols and secure storage measures to protect your sensitive data. Our commitment to compliance with regulations ensures that your documents remain safe throughout the signing process.

Get more for Form Ct 1065ct 1120si Ext

Find out other Form Ct 1065ct 1120si Ext

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe