Ct 1065ct 1120 Si V Form 2014

What is the Ct 1065ct 1120 Si V Form

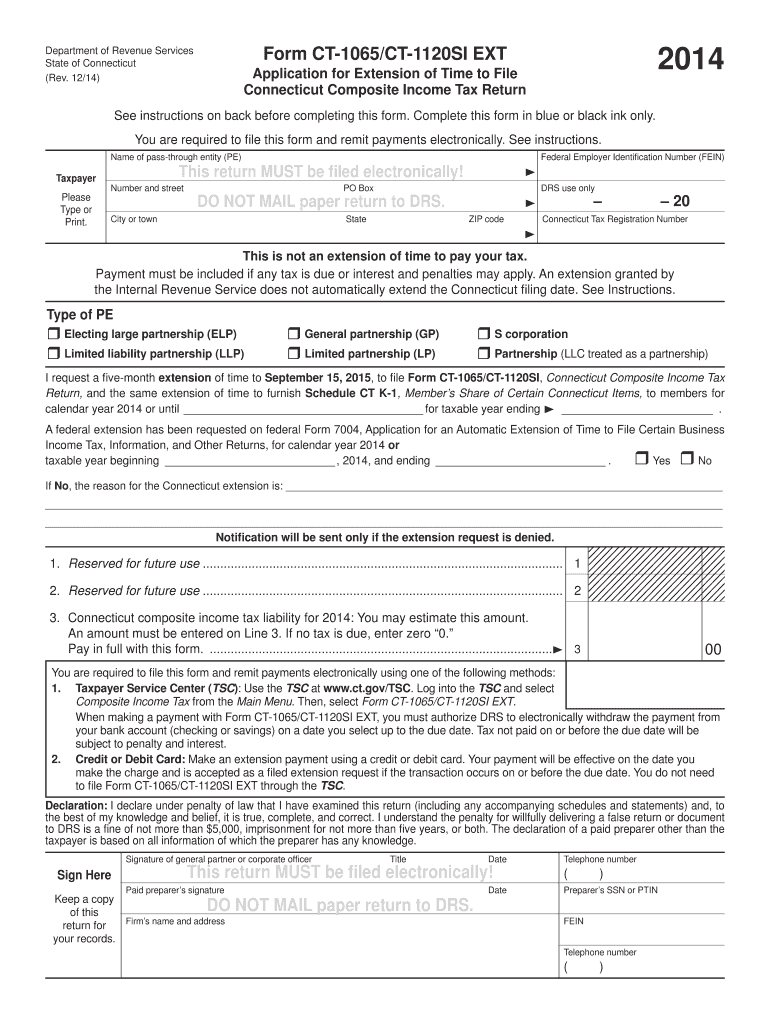

The Ct 1065ct 1120 Si V Form is a tax document utilized primarily for reporting income, deductions, and credits for partnerships and S corporations in Connecticut. This form is essential for businesses operating within the state, as it ensures compliance with state tax regulations. By accurately completing this form, entities can report their financial activities and determine their tax obligations effectively.

How to use the Ct 1065ct 1120 Si V Form

Using the Ct 1065ct 1120 Si V Form involves several steps. First, gather all necessary financial documents, including income statements, expense reports, and any relevant tax records. Next, fill out the form with accurate information regarding your business's income, deductions, and credits. Once completed, review the form for accuracy before submitting it to the appropriate state tax authority. Utilizing digital tools can simplify this process, allowing for easier completion and submission.

Steps to complete the Ct 1065ct 1120 Si V Form

Completing the Ct 1065ct 1120 Si V Form requires careful attention to detail. Follow these steps:

- Gather all financial documents, including income and expense records.

- Fill in the entity's identification information at the top of the form.

- Report total income earned during the tax year.

- List all allowable deductions and credits applicable to your business.

- Calculate the total tax liability based on the provided information.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, as per the guidelines.

Legal use of the Ct 1065ct 1120 Si V Form

The Ct 1065ct 1120 Si V Form is legally binding when completed and submitted according to state regulations. It must be filed by partnerships and S corporations to fulfill their tax obligations in Connecticut. Accurate reporting on this form helps avoid penalties and ensures compliance with state tax laws. Businesses should maintain copies of submitted forms for record-keeping and future reference.

Filing Deadlines / Important Dates

It is crucial to adhere to filing deadlines for the Ct 1065ct 1120 Si V Form to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the close of the tax year. For entities operating on a calendar year, this means the deadline is usually March 15. Extensions may be available, but they must be filed appropriately to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The Ct 1065ct 1120 Si V Form can be submitted through various methods. Businesses may choose to file online via the Connecticut Department of Revenue Services website, which offers a secure and efficient way to submit forms. Alternatively, the form can be mailed to the designated tax office or, in some cases, submitted in person. Each method has specific guidelines that should be followed to ensure proper processing.

Quick guide on how to complete ct 1065ct 1120 si v 2014 form

Your instructional manual on how to prepare your Ct 1065ct 1120 Si V Form

If you're interested in understanding how to finish and submit your Ct 1065ct 1120 Si V Form, here are a few straightforward recommendations on how to simplify tax processing.

To start, all you need to do is create your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, design, and finalize your tax documents seamlessly. With its editor, you can toggle between text, check boxes, and electronic signatures and revisit to adjust responses as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Ct 1065ct 1120 Si V Form in a few minutes:

- Set up your account and start working on PDFs in just a few minutes.

- Utilize our directory to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Ct 1065ct 1120 Si V Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting in written form can lead to increased errors and delayed refunds. It goes without saying, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 1065ct 1120 si v 2014 form

FAQs

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

Create this form in 5 minutes!

How to create an eSignature for the ct 1065ct 1120 si v 2014 form

How to create an eSignature for the Ct 1065ct 1120 Si V 2014 Form online

How to make an eSignature for the Ct 1065ct 1120 Si V 2014 Form in Chrome

How to generate an electronic signature for signing the Ct 1065ct 1120 Si V 2014 Form in Gmail

How to create an electronic signature for the Ct 1065ct 1120 Si V 2014 Form right from your smartphone

How to make an electronic signature for the Ct 1065ct 1120 Si V 2014 Form on iOS

How to make an eSignature for the Ct 1065ct 1120 Si V 2014 Form on Android devices

People also ask

-

What is the Ct 1065ct 1120 Si V Form and why do I need it?

The Ct 1065ct 1120 Si V Form is a signNow tax document required for businesses operating in Connecticut. This form helps to report income, expenses, and tax liability effectively. Utilizing airSlate SignNow can streamline the process of filling out and eSigning this form, making compliance easier for your business.

-

How does airSlate SignNow support the completion of the Ct 1065ct 1120 Si V Form?

airSlate SignNow offers a user-friendly interface that simplifies the completion of your Ct 1065ct 1120 Si V Form. You can easily upload documents, fill in necessary information, and sign securely, ensuring that all your tax paperwork is organized and compliant. This solution saves time and reduces errors associated with traditional methods.

-

Is there a cost associated with using airSlate SignNow for the Ct 1065ct 1120 Si V Form?

Yes, there is a cost for using airSlate SignNow, but it is designed to be cost-effective for businesses. The platform offers various pricing plans accommodating different needs, allowing you to choose one that fits your budget while still enabling efficient handling of the Ct 1065ct 1120 Si V Form and other documents.

-

Can I integrate airSlate SignNow with my accounting software for the Ct 1065ct 1120 Si V Form?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting software applications, enabling users to manage their Ct 1065ct 1120 Si V Form alongside their financial records. This integration helps streamline your workflow and ensures that your documents remain organized and accessible.

-

What are the benefits of using airSlate SignNow for tax documents like the Ct 1065ct 1120 Si V Form?

Using airSlate SignNow for tax documents, including the Ct 1065ct 1120 Si V Form, provides numerous benefits. You gain access to a secure platform for eSigning and sharing, reduce paperwork errors, and save valuable time during tax season. Additionally, the platform's compliance measures help ensure your documents are filed correctly.

-

Is airSlate SignNow secure for submitting the Ct 1065ct 1120 Si V Form?

Yes, airSlate SignNow employs advanced security features to protect your documents, including the Ct 1065ct 1120 Si V Form. With encryption and secure cloud storage, you can confidently eSign and share sensitive tax documents, knowing that your data is in safe hands and compliant with security standards.

-

How can I get started with airSlate SignNow for the Ct 1065ct 1120 Si V Form?

Getting started with airSlate SignNow is simple! Just visit our website, sign up for an account, and follow the prompts to upload your Ct 1065ct 1120 Si V Form. Our intuitive platform will guide you through filling out the necessary information and eSigning, making the process quick and easy.

Get more for Ct 1065ct 1120 Si V Form

- Dd827 form

- Pradhan mantri fasal bima yojna form

- Statement of live birth ontario 443361924 form

- 4790 2 chapter 7 form

- Incomplete contract southern utah university suu form

- Victorville municipal utility services vmus will serve letter form

- Exit agreement template form

- Exp buyer broker agreement template form

Find out other Ct 1065ct 1120 Si V Form

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe