Form PT 351 1 May Fuel Consumed in New York State by Tax Ny

What is the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny

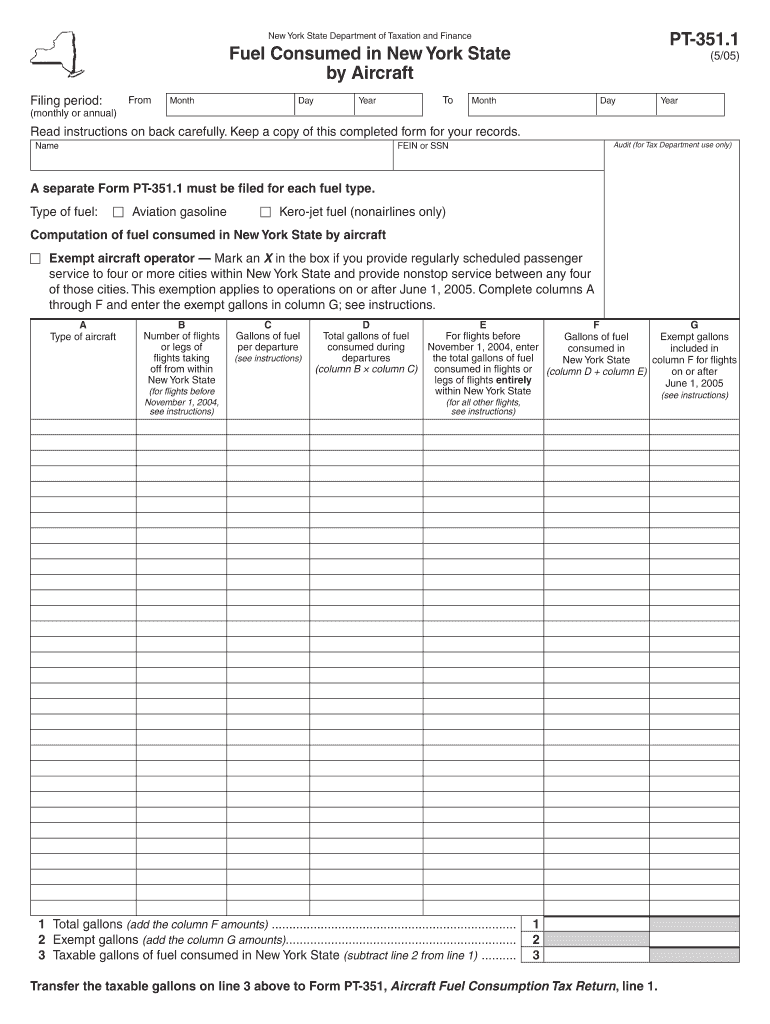

The Form PT 351 1 May Fuel Consumed In New York State By Tax Ny is a crucial document used by businesses and individuals to report fuel consumption for tax purposes in New York State. This form helps ensure compliance with state tax regulations and provides necessary data for tax assessments. It is particularly relevant for entities that operate vehicles or machinery powered by fuel, as they must accurately report their fuel usage to the state tax authority.

How to use the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny

Using the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny involves several steps. First, gather all relevant information regarding your fuel consumption, including the types of fuel used and the total gallons consumed during the reporting period. Next, fill out the form accurately, ensuring all required fields are completed. Finally, submit the form by the designated deadline to avoid any penalties. Utilizing electronic signature solutions can streamline the submission process and enhance security.

Steps to complete the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny

Completing the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny requires careful attention to detail. Follow these steps:

- Collect all necessary data on fuel consumption for the reporting period.

- Access the form through the official state website or authorized platforms.

- Fill in your business or personal information as required.

- Input the total gallons of fuel consumed, categorized by fuel type.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, depending on your preference.

Legal use of the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny

The legal use of the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny is essential for compliance with state tax laws. This form must be filled out accurately and submitted on time to avoid legal repercussions. It is recognized by the New York State Department of Taxation and Finance as a valid document for reporting fuel consumption, and it must adhere to all relevant regulations to ensure its legal standing.

State-specific rules for the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny

New York State has specific rules governing the use of the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny. These include deadlines for submission, requirements for reporting fuel types, and guidelines for record-keeping. It is important to stay informed about any changes in state regulations that may affect how this form is completed and submitted. Compliance with these rules helps avoid penalties and ensures accurate tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form PT 351 1 May Fuel Consumed In New York State By Tax Ny are critical to ensure compliance. Typically, the form must be submitted by a specified date each year, often aligned with the end of the fiscal year or specific reporting periods. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines to avoid late fees or penalties.

Quick guide on how to complete form pt 3511 may 2005 fuel consumed in new york state by tax ny

Effortlessly Prepare Form PT 351 1 May Fuel Consumed In New York State By Tax Ny on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without complications. Handle Form PT 351 1 May Fuel Consumed In New York State By Tax Ny on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Form PT 351 1 May Fuel Consumed In New York State By Tax Ny with Ease

- Obtain Form PT 351 1 May Fuel Consumed In New York State By Tax Ny and click on Get Form to initiate the process.

- Utilize the resources we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive details with the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just moments and carries the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about absent or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form PT 351 1 May Fuel Consumed In New York State By Tax Ny to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Can you add 5 odd numbers to get 30?

It is 7,9 + 9,1 + 1 + 3 + 9 = 30Wish you can find the 7,9 and 9,1 in the list of1,3,5, 7,9 ,11,13,151,3,5,7, 9,1 1,13,15

-

Mathematical Puzzles: What is () + () + () = 30 using 1,3,5,7,9,11,13,15?

My question had been merged with another one and as a result, I have added the previous answer to the present one. Hopefully this provides a clearer explanation. Just using the numbers given there, it's not possible, because odd + odd = even, even + odd = odd. 30 is an even number, the answer of 3 odd numbers must be odd, it's a contradiction. If what people say is true, then the question is wrongly phrased its any number of operations within those three brackets must lead to 30. Then it becomes a lot easier. Such as 15 + 7 + (7 + 1). That would give 30. But it assumes something that the question does not state explicitly and cannot be done that way. I still stick to my first point, it can't be done within the realm of math and just using three numbers, if not, then the latter is a way to solve it.EDIT: This question has come up many times, Any odd number can be expressed as the following, Let [math]n, m, p[/math] be an odd number, [math] n = 1 (mod[/math] [math]2), m = 1 (mod[/math] [math]2), p = 1 (mod[/math] [math]2)[/math][math]n+m+p = 1 + 1 + 1 (mod[/math] [math]2)[/math]Let's call [math]n+m+p[/math] as [math]x[/math][math]=> x = 3 (mod[/math] [math]2)[/math]Numbers in modulo n can be added, I'll write a small proof for it below, [math]a = b (mod[/math] [math]n), c = d (mod[/math] [math]n)[/math][math]a+c = b+d (mod[/math] [math]n)[/math]We can rewrite [math]b[/math] and [math]d[/math] in the following way, [math]n | (b - a) => b-a = n*p[/math] (for some integer p) [math]b = a + np[/math][math]b = a + np, d = c + nq[/math][math]b + d = a + np + c + nq[/math][math]b+d = a + c + n(p + q)[/math]Now we have shown that our result is true, moving forward, [math]3 = 1 (mod[/math] [math]2)[/math][math]x = 1 (mod[/math] [math]2)[/math]Therefore the sum of three odd numbers can never be even. It will always be congruent to 1 in mod 2.(This was what I wrote for a merged answer).Modular arithmetic - Link on modular arithmetic, the basic operations. Modular multiplicative inverse - The multiplicative inverse in modular operations.Congruence relationFermat's little theorem Modular exponentiation - As title suggests.Good luck!

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

Need to fill out Form 10C and Form 19. Where can I get a 1 rupee revenue stamp in Bangalore?

I believe you are trying to withdraw PF. If that is correct, then I think its not a mandatory thing as I was able to submit these forms to my ex-employer without the stamp. I did receive the PF!

-

How do I fill out the regional centre code in IGNOU OpenMat Form 1?

IGNOU OPENMAT Entrance Application Forms & Procedureplease view this link

Create this form in 5 minutes!

How to create an eSignature for the form pt 3511 may 2005 fuel consumed in new york state by tax ny

How to generate an eSignature for your Form Pt 3511 May 2005 Fuel Consumed In New York State By Tax Ny online

How to generate an eSignature for the Form Pt 3511 May 2005 Fuel Consumed In New York State By Tax Ny in Google Chrome

How to create an electronic signature for putting it on the Form Pt 3511 May 2005 Fuel Consumed In New York State By Tax Ny in Gmail

How to generate an electronic signature for the Form Pt 3511 May 2005 Fuel Consumed In New York State By Tax Ny from your smart phone

How to generate an eSignature for the Form Pt 3511 May 2005 Fuel Consumed In New York State By Tax Ny on iOS

How to create an eSignature for the Form Pt 3511 May 2005 Fuel Consumed In New York State By Tax Ny on Android OS

People also ask

-

What is Form PT 351 1 May Fuel Consumed In New York State By Tax Ny?

Form PT 351 1 May Fuel Consumed In New York State By Tax Ny is a document required for businesses to report fuel consumption in New York State. This form helps you track your fuel usage for tax purposes and ensures compliance with state regulations. Submitting this form accurately can save you money on taxes and avoid potential penalties.

-

How can airSlate SignNow help with Form PT 351 1 May Fuel Consumed In New York State By Tax Ny?

With airSlate SignNow, you can electronically sign and manage your submissions of Form PT 351 1 May Fuel Consumed In New York State By Tax Ny. Our platform streamlines the process, making it quick and easy to fill out and send your form securely. This efficiency saves you time and ensures timely submissions.

-

What are the pricing options for using airSlate SignNow to manage Form PT 351 1 May Fuel Consumed In New York State By Tax Ny?

airSlate SignNow offers various pricing plans tailored to different business needs, allowing you to choose the best fit for managing Form PT 351 1 May Fuel Consumed In New York State By Tax Ny. Plans typically include flexible monthly or annual subscriptions, making it cost-effective. Additionally, you gain access to a suite of features that enhance document management.

-

What features does airSlate SignNow offer for managing forms like Form PT 351 1 May Fuel Consumed In New York State By Tax Ny?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time tracking for forms like Form PT 351 1 May Fuel Consumed In New York State By Tax Ny. You can automate reminders and notifications, ensuring that your team never misses a deadline. These features signNowly enhance productivity and reduce error rates.

-

Can I integrate airSlate SignNow with other software for Form PT 351 1 May Fuel Consumed In New York State By Tax Ny?

Yes, airSlate SignNow offers robust integration capabilities, allowing you to connect with various software applications to streamline the management of Form PT 351 1 May Fuel Consumed In New York State By Tax Ny. This includes integrations with popular CRM systems, cloud storage solutions, and other business tools, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for Form PT 351 1 May Fuel Consumed In New York State By Tax Ny?

Using airSlate SignNow for Form PT 351 1 May Fuel Consumed In New York State By Tax Ny provides signNow benefits, including increased efficiency, reduced paperwork, and enhanced security. It allows for fast and reliable document handling, ensuring compliance with state regulations. The ease of use and affordability make it a valuable tool for businesses of all sizes.

-

Is airSlate SignNow secure for submitting Form PT 351 1 May Fuel Consumed In New York State By Tax Ny?

Absolutely! airSlate SignNow employs state-of-the-art security measures to protect your information when submitting Form PT 351 1 May Fuel Consumed In New York State By Tax Ny. We utilize encryption protocols and adhere to industry standards to keep your data safe and confidential. This ensures peace of mind when handling sensitive tax information.

Get more for Form PT 351 1 May Fuel Consumed In New York State By Tax Ny

Find out other Form PT 351 1 May Fuel Consumed In New York State By Tax Ny

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free