Borang Permohonan Pembiayaan Maybank Form

What is the Borang Permohonan Pembiayaan Maybank

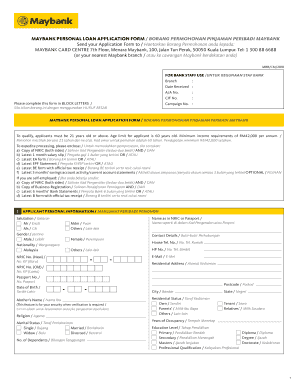

The Borang Permohonan Pembiayaan Maybank is a formal application form used to request financing from Maybank, a prominent financial institution. This document serves as a crucial step for individuals or businesses seeking loans or financial assistance. The form collects essential information about the applicant, including personal details, financial status, and the purpose of the loan. Properly completing this form is vital for the approval process, as it provides Maybank with the necessary data to assess the applicant's eligibility for financing.

Steps to Complete the Borang Permohonan Pembiayaan Maybank

Completing the Borang Permohonan Pembiayaan Maybank involves several key steps to ensure accuracy and completeness. First, gather all necessary documents, such as identification, proof of income, and any financial statements. Next, fill out the form meticulously, ensuring that all sections are completed accurately. It is important to double-check for any errors or omissions, as these can delay the application process. Once the form is completed, submit it along with the required documents to Maybank through the designated submission method.

Required Documents

When applying using the Borang Permohonan Pembiayaan Maybank, several documents are typically required to support your application. These may include:

- Government-issued identification (e.g., passport or driver's license)

- Proof of income (e.g., pay stubs or tax returns)

- Bank statements for the past few months

- Details of existing debts or financial obligations

- Any additional documentation specific to the loan type

Having these documents ready can streamline the application process and increase the chances of approval.

Legal Use of the Borang Permohonan Pembiayaan Maybank

The Borang Permohonan Pembiayaan Maybank must be used in accordance with legal guidelines to ensure that the application is valid. This includes providing truthful and accurate information, as any discrepancies may lead to legal repercussions or denial of the application. Additionally, applicants should be aware of their rights and responsibilities under applicable laws governing financial transactions. Understanding these legal aspects can help applicants navigate the process more effectively and avoid potential pitfalls.

Application Process & Approval Time

The application process for the Borang Permohonan Pembiayaan Maybank typically involves several stages. After submitting the completed form and required documents, Maybank will review the application. This review process may take anywhere from a few days to several weeks, depending on various factors such as the complexity of the application and the volume of requests being processed. Applicants will be notified of the decision via their preferred communication method, and if approved, will receive further instructions on how to proceed with the loan agreement.

Eligibility Criteria

To qualify for financing through the Borang Permohonan Pembiayaan Maybank, applicants must meet specific eligibility criteria. These criteria often include:

- Age requirement (usually at least eighteen years old)

- Stable income source

- Good credit history

- Residency status (must be a resident of the country where Maybank operates)

Meeting these criteria is essential for a successful application and can significantly influence the approval process.

Quick guide on how to complete borang permohonan pembiayaan maybank 473390010

Effortlessly Prepare Borang Permohonan Pembiayaan Maybank on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Borang Permohonan Pembiayaan Maybank on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The Easiest Way to Modify and Electronically Sign Borang Permohonan Pembiayaan Maybank without Hassle

- Obtain Borang Permohonan Pembiayaan Maybank and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Borang Permohonan Pembiayaan Maybank and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borang permohonan pembiayaan maybank 473390010

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting an application pinjaman di Maybank?

The process for submitting an application pinjaman di Maybank involves filling out the required forms with your financial information and income details. You can submit your application online through Maybank's official site or in-person at any branch. Make sure all your documents are complete to ensure a smooth application process.

-

What are the eligibility criteria for an application pinjaman di Maybank?

To qualify for an application pinjaman di Maybank, you must be a Malaysian citizen or a permanent resident, at least 18 years old, and have a steady income source. Additionally, your credit history should be in good standing. Meeting these criteria increases your chances of approval.

-

How long does it take to process an application pinjaman di Maybank?

The processing time for an application pinjaman di Maybank can vary, but typically it takes around 3 to 5 business days. If additional documentation is required, this may extend the timeframe. It’s advisable to check directly with Maybank for the most current processing times.

-

What types of loans are available through the application pinjaman di Maybank?

Maybank offers various types of loans through their application pinjaman di Maybank, including personal loans, home loans, and vehicle loans. Each type comes with its own set of terms and conditions tailored to meet different financial needs. Customers should review options to find the best fit for their requirements.

-

Are there any fees associated with the application pinjaman di Maybank?

Yes, there may be fees associated with the application pinjaman di Maybank, such as processing fees, legal fees, and any other applicable charges. It's important to review the terms before applying to understand all potential costs involved. This transparency will help you better prepare financially.

-

What are the benefits of using Maybank for my application pinjaman?

Using Maybank for your application pinjaman di Maybank provides competitive interest rates, flexible repayment terms, and a user-friendly application process. Moreover, Maybank has a strong reputation for customer service, ensuring that you have support throughout the entire process. This can lead to a stress-free borrowing experience.

-

Can I track the status of my application pinjaman di Maybank online?

Yes, you can track the status of your application pinjaman di Maybank online through their official portal. After submitting your application, you’ll receive a confirmation with a tracking number. This feature allows you to stay updated on its progress at your convenience.

Get more for Borang Permohonan Pembiayaan Maybank

Find out other Borang Permohonan Pembiayaan Maybank

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe