What is a Credit Union Fiduciary Account Form 2012

What is the What Is A Credit Union Fiduciary Account Form

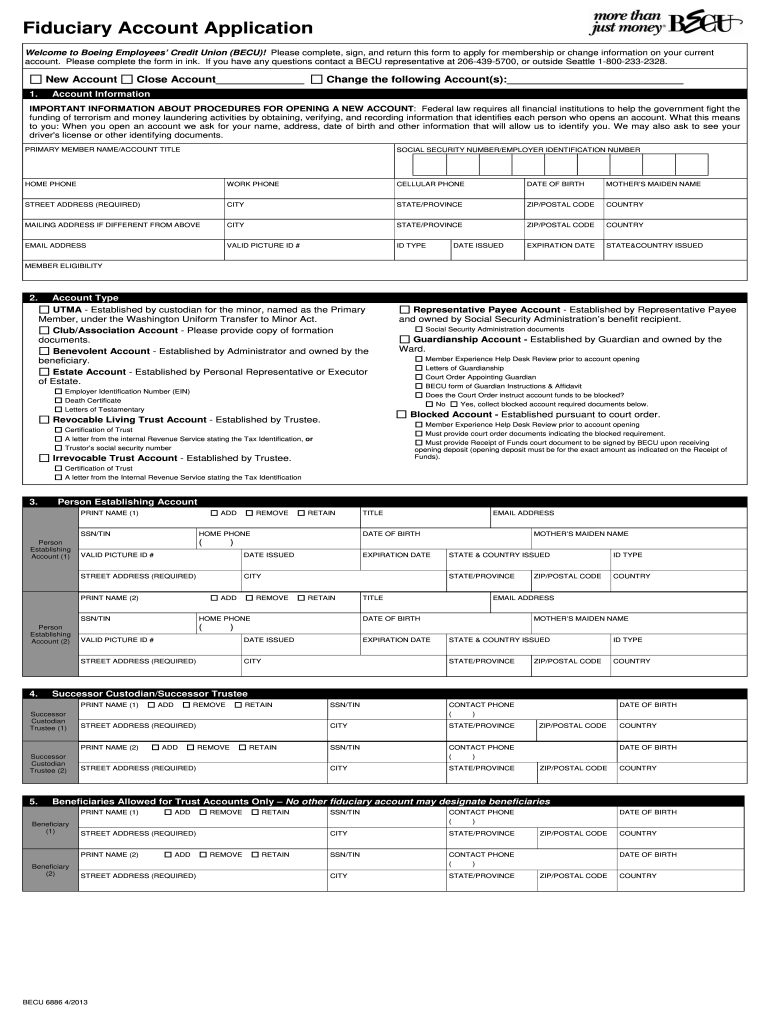

The What Is A Credit Union Fiduciary Account Form is a specific document used by credit unions to establish fiduciary accounts. These accounts are set up to manage funds on behalf of another individual or entity, typically in situations involving minors, estates, or trusts. The form outlines the responsibilities and authority of the fiduciary, ensuring that funds are handled according to legal and ethical standards. It is essential for maintaining transparency and accountability in financial transactions.

How to use the What Is A Credit Union Fiduciary Account Form

Using the What Is A Credit Union Fiduciary Account Form involves several steps. First, the fiduciary must complete the form with accurate information, including details about the account holder and the nature of the fiduciary relationship. Once filled out, the form must be submitted to the credit union for processing. It is crucial to ensure that all required signatures are obtained and that the form is submitted in compliance with the credit union's guidelines. This helps to facilitate a smooth account setup and ensures that all legal requirements are met.

Steps to complete the What Is A Credit Union Fiduciary Account Form

Completing the What Is A Credit Union Fiduciary Account Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including personal details of the fiduciary and the beneficiary.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Obtain signatures from all required parties.

- Submit the form to the credit union, either online or in person, as per their submission guidelines.

Legal use of the What Is A Credit Union Fiduciary Account Form

The What Is A Credit Union Fiduciary Account Form is legally binding once completed and signed. It establishes the fiduciary's authority to manage the account on behalf of another party. This form must comply with state and federal regulations governing fiduciary relationships, ensuring that the fiduciary acts in the best interest of the beneficiary. Misuse of the form or failure to adhere to legal standards can result in penalties or legal action.

Key elements of the What Is A Credit Union Fiduciary Account Form

Key elements of the What Is A Credit Union Fiduciary Account Form include:

- Identification of the fiduciary and the beneficiary.

- Description of the fiduciary relationship and the purpose of the account.

- Details regarding the management of funds, including any limitations on withdrawals.

- Signatures of all parties involved, confirming their agreement to the terms outlined in the form.

Examples of using the What Is A Credit Union Fiduciary Account Form

Examples of situations where the What Is A Credit Union Fiduciary Account Form may be used include:

- Establishing a custodial account for a minor child.

- Managing an estate's funds by an appointed executor.

- Handling trust assets by a designated trustee.

Quick guide on how to complete what is a credit union fiduciary account 2012 form

The optimal method to discover and endorse What Is A Credit Union Fiduciary Account Form

On the level of your entire organization, unproductive practices involving paper approvals can take up a signNow amount of work hours. Endorsing documents such as What Is A Credit Union Fiduciary Account Form is an inherent aspect of operations across all sectors, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the company’s overall performance. With airSlate SignNow, endorsing your What Is A Credit Union Fiduciary Account Form is as straightforward and quick as it can be. This platform offers the most recent version of almost any form. Even better, you can endorse it immediately without the necessity of installing external software on your computer or printing anything as physical copies.

Steps to obtain and endorse your What Is A Credit Union Fiduciary Account Form

- Search our collection by category or utilize the search bar to find the document you require.

- Preview the form by clicking on Learn more to confirm it’s the correct one.

- Select Get form to start editing right away.

- Fill out your form and include any essential information using the toolbar.

- Once finished, click the Sign tool to endorse your What Is A Credit Union Fiduciary Account Form.

- Pick the signing option that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as needed.

With airSlate SignNow, you have everything you require to manage your documentation efficiently. You can find, complete, edit, and even send your What Is A Credit Union Fiduciary Account Form in one tab without any complications. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct what is a credit union fiduciary account 2012 form

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How is a CD account (an account you set up at a federal credit union) different from a savings or checking out at a bank, and does money put into a CD account get reported to Social Security?

By CD account I assume you mean Certificate of Deposit. Federal credit unions are not the only places that offer them. State and federal banks do, also.Certificate Of Deposit - CDA CD is a “savings security” with a fixed maturity date. In other words, one “buys” a CD with a maturity date of - 1 year, 2 years, or more. The agreement that one is making with a bank in obtaining a CD is that the money will remain in the CD until the maturity date, and if the money is taken out before the maturity date there will be a penalty - perhaps one month’s interest, for example, on a one-year CD. The total amount of the CD, including any interest earned, must be withdrawn - cancelling the CD. In return for allowing the bank or credit union to “hold onto” all of that money for 1, 2, or more years, the bank/credit union will pay you perhaps 2% interest on that money - available when the CD matures.A savings account is an interest-paying account at a bank (or credit union) with little or no penalties for withdrawal of any part of the balance in the account. So, if you have $2,000 in a savings account you can withdraw $100, or even the entire $2,000, plus interest. But if you leave just a few dollars in the savings account, it remains open. Back in to good ol’ days, savings accounts paid about 5% in annual interest (and in the hyperinflation days of J Carter’s administration it was sometimes three times or more than that amount). Nowadays, interest on a savings account can be zero, and sometimes as high as 7 hundredths of a percent (.0007) on the principal. You’re almost (and sometimes are) paying the bank for the privilege of keeping your money there. Still, it’s safer than sticking it under your mattress.Any interest that is earned on your deposited money is reported to the IRS (Internal Revenue Service). Social Security Admin. would obtain such information from the IRS. (well, the IRS would know how much you received from SSI and any bank). Your total income, when you are receiving Social Security payments, will never be less than what you presently receive exclusively from Social Security. In other words, if you receive $15,000 per year in SSI payments, no matter how much more you receive in investment income or salary payments, your annual income - even if you have to “repay” some of the SSI payments - will never be less than the SSI payment alone.I want to emphasize that last sentence, because I’ve met young-ish widows and retired people who are afraid to earn more than a pittance at a part-time job because they are afraid that they will “lose” income if they make more than the “maximum you can earn” provision of Social Security. The US government isn’t particularly generous to its poorest citizens, but it doesn’t penalize its retirees and widows by reducing the bare minimum income provided by Social Security.

-

What value is to be filled in ITR, when total amount credited in account in one year and form 16 is differ? The TDS is common everywhere.

Assuming you don’t have any other source of income from that company, you claim the amount given in your form 16 under head Income Chargeable to tax.

Create this form in 5 minutes!

How to create an eSignature for the what is a credit union fiduciary account 2012 form

How to make an eSignature for the What Is A Credit Union Fiduciary Account 2012 Form in the online mode

How to generate an electronic signature for the What Is A Credit Union Fiduciary Account 2012 Form in Google Chrome

How to create an electronic signature for signing the What Is A Credit Union Fiduciary Account 2012 Form in Gmail

How to make an eSignature for the What Is A Credit Union Fiduciary Account 2012 Form from your smartphone

How to generate an electronic signature for the What Is A Credit Union Fiduciary Account 2012 Form on iOS

How to make an electronic signature for the What Is A Credit Union Fiduciary Account 2012 Form on Android OS

People also ask

-

What is a Credit Union Fiduciary Account Form used for?

A Credit Union Fiduciary Account Form is a document that allows individuals or entities to manage accounts on behalf of another party, such as a minor or a trust. This form is essential for ensuring that funds are handled properly and in accordance with the fiduciary's responsibilities. Understanding what a Credit Union Fiduciary Account Form entails can help you navigate the complexities of managing such accounts effectively.

-

How can I obtain a Credit Union Fiduciary Account Form?

You can obtain a Credit Union Fiduciary Account Form directly from your credit union's website or by visiting a local branch. Most credit unions provide easy access to these forms online, ensuring you can download or print them at your convenience. Knowing where to find the Credit Union Fiduciary Account Form is the first step in managing fiduciary responsibilities.

-

What features should I look for in a Credit Union Fiduciary Account Form?

When evaluating a Credit Union Fiduciary Account Form, look for clear sections outlining the fiduciary's responsibilities, the account holder's information, and signature requirements. Additionally, ensure that the form complies with local regulations and includes any necessary disclosures. A comprehensive form will help streamline the process of managing fiduciary accounts.

-

Are there any fees associated with using a Credit Union Fiduciary Account Form?

While the form itself is typically free to obtain, some credit unions may charge fees for maintaining fiduciary accounts or processing transactions. It's important to check with your credit union regarding any potential costs associated with using a Credit Union Fiduciary Account Form. Understanding these fees can help you budget effectively.

-

What are the benefits of using a Credit Union Fiduciary Account Form?

Using a Credit Union Fiduciary Account Form provides a structured way to manage funds on behalf of others, ensuring compliance with legal obligations. This form helps protect the interests of the beneficiaries and promotes transparency in financial transactions. The benefits of using a Credit Union Fiduciary Account Form also include simplifying the account management process.

-

Can I eSign a Credit Union Fiduciary Account Form?

Yes, many credit unions now allow you to electronically sign a Credit Union Fiduciary Account Form for convenience and efficiency. By using an eSignature solution like airSlate SignNow, you can quickly and securely sign documents from anywhere. This feature is especially beneficial for busy individuals managing fiduciary accounts.

-

What integrations are available for managing a Credit Union Fiduciary Account Form?

To enhance your experience, many eSignature solutions integrate with popular financial management tools and platforms. These integrations allow you to seamlessly manage your Credit Union Fiduciary Account Form alongside other financial documents. Choosing an eSignature service that offers robust integrations can streamline your workflow signNowly.

Get more for What Is A Credit Union Fiduciary Account Form

Find out other What Is A Credit Union Fiduciary Account Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors