Fiduciary Account Application 2013

What is the fiduciary account application?

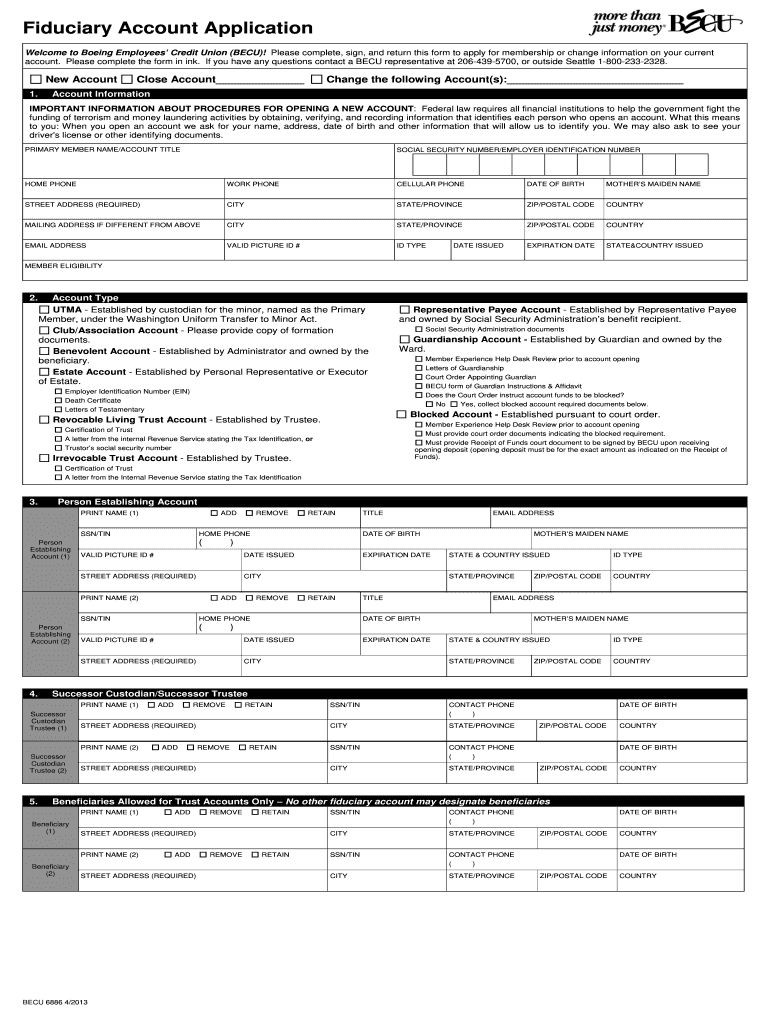

The fiduciary account application is a formal document used to establish a fiduciary account, which is typically managed by an individual or entity on behalf of another party. This type of account is often utilized for managing assets, funds, or properties for minors, incapacitated individuals, or trusts. The application outlines the responsibilities of the fiduciary and the terms under which the account will operate. It is essential for ensuring that the fiduciary acts in the best interest of the beneficiaries and complies with legal requirements.

Steps to complete the fiduciary account application

Completing the fiduciary account application involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including the details of the fiduciary and the beneficiaries. Next, fill out the application form, ensuring that all sections are completed accurately. It is important to review the form for any errors or omissions before submission. Once the form is complete, sign it where required and prepare it for submission according to the specified guidelines.

Required documents

When applying for a fiduciary account, certain documents are typically required to support the application. These may include:

- Proof of identity for the fiduciary and beneficiaries

- Legal documents establishing the fiduciary relationship, such as a trust agreement or court order

- Tax identification numbers for the fiduciary and beneficiaries

- Any additional documentation requested by the financial institution

Having these documents ready can facilitate a smoother application process.

Legal use of the fiduciary account application

The fiduciary account application must be used in accordance with applicable laws and regulations. This includes adhering to state-specific rules regarding fiduciary responsibilities and account management. It is crucial for fiduciaries to understand their legal obligations, which may involve regular reporting to beneficiaries or oversight by a court. Non-compliance with these legal requirements can result in penalties or legal action.

Application process & approval time

The application process for a fiduciary account typically involves submitting the completed application along with the required documents to the financial institution. Once submitted, the institution will review the application for completeness and compliance with their policies. Approval times can vary, but it generally takes anywhere from a few days to several weeks, depending on the institution's procedures and the complexity of the application.

Who issues the fiduciary account application?

The fiduciary account application is usually issued by financial institutions, such as banks or credit unions, that offer fiduciary account services. Each institution may have its own specific form and requirements, so it is important to obtain the correct application from the institution where the account will be held. This ensures that all necessary information and compliance measures are met.

Quick guide on how to complete what is a credit union fiduciary account 2013 2019 form

The optimal method to discover and endorse Fiduciary Account Application

On a corporate level, ineffective workflows surrounding document authorization can take up a signNow amount of work hours. Signing paperwork such as Fiduciary Account Application is an inherent aspect of operations across all sectors, which is why the effectiveness of each contract's lifecycle signNowly impacts the organization’s overall performance. With airSlate SignNow, endorsing your Fiduciary Account Application can be as straightforward and swift as possible. You will find on this platform the latest version of nearly any document. Even better, you can sign it instantly without the need for third-party software on your device or printing anything in physical form.

How to obtain and endorse your Fiduciary Account Application

- Explore our catalog by category or use the search box to find the document you require.

- View the form preview by clicking Learn more to confirm it’s the correct one.

- Click Get form to begin editing right away.

- Fill out your form and include any necessary details using the toolbar.

- When finished, click the Sign tool to endorse your Fiduciary Account Application.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload a photo of your signature.

- Click Done to complete editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess all you need to handle your documents efficiently. You can locate, complete, edit, and even distribute your Fiduciary Account Application within a single tab with no complications. Optimize your workflows by leveraging a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct what is a credit union fiduciary account 2013 2019 form

FAQs

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

What is the last day to fill out the admission form for undergraduate courses in DU 2019?

I am attaching a PDF Link in which the full information of Admission in DU for the session 2019–20 is given !http://du.ac.in/adm2019/pdf/Bull...For More, kindly visit the DU’s Official website !Home | University of Delhi

-

How is a CD account (an account you set up at a federal credit union) different from a savings or checking out at a bank, and does money put into a CD account get reported to Social Security?

By CD account I assume you mean Certificate of Deposit. Federal credit unions are not the only places that offer them. State and federal banks do, also.Certificate Of Deposit - CDA CD is a “savings security” with a fixed maturity date. In other words, one “buys” a CD with a maturity date of - 1 year, 2 years, or more. The agreement that one is making with a bank in obtaining a CD is that the money will remain in the CD until the maturity date, and if the money is taken out before the maturity date there will be a penalty - perhaps one month’s interest, for example, on a one-year CD. The total amount of the CD, including any interest earned, must be withdrawn - cancelling the CD. In return for allowing the bank or credit union to “hold onto” all of that money for 1, 2, or more years, the bank/credit union will pay you perhaps 2% interest on that money - available when the CD matures.A savings account is an interest-paying account at a bank (or credit union) with little or no penalties for withdrawal of any part of the balance in the account. So, if you have $2,000 in a savings account you can withdraw $100, or even the entire $2,000, plus interest. But if you leave just a few dollars in the savings account, it remains open. Back in to good ol’ days, savings accounts paid about 5% in annual interest (and in the hyperinflation days of J Carter’s administration it was sometimes three times or more than that amount). Nowadays, interest on a savings account can be zero, and sometimes as high as 7 hundredths of a percent (.0007) on the principal. You’re almost (and sometimes are) paying the bank for the privilege of keeping your money there. Still, it’s safer than sticking it under your mattress.Any interest that is earned on your deposited money is reported to the IRS (Internal Revenue Service). Social Security Admin. would obtain such information from the IRS. (well, the IRS would know how much you received from SSI and any bank). Your total income, when you are receiving Social Security payments, will never be less than what you presently receive exclusively from Social Security. In other words, if you receive $15,000 per year in SSI payments, no matter how much more you receive in investment income or salary payments, your annual income - even if you have to “repay” some of the SSI payments - will never be less than the SSI payment alone.I want to emphasize that last sentence, because I’ve met young-ish widows and retired people who are afraid to earn more than a pittance at a part-time job because they are afraid that they will “lose” income if they make more than the “maximum you can earn” provision of Social Security. The US government isn’t particularly generous to its poorest citizens, but it doesn’t penalize its retirees and widows by reducing the bare minimum income provided by Social Security.

Create this form in 5 minutes!

How to create an eSignature for the what is a credit union fiduciary account 2013 2019 form

How to make an electronic signature for your What Is A Credit Union Fiduciary Account 2013 2019 Form online

How to create an eSignature for the What Is A Credit Union Fiduciary Account 2013 2019 Form in Google Chrome

How to generate an electronic signature for putting it on the What Is A Credit Union Fiduciary Account 2013 2019 Form in Gmail

How to make an eSignature for the What Is A Credit Union Fiduciary Account 2013 2019 Form from your smartphone

How to create an electronic signature for the What Is A Credit Union Fiduciary Account 2013 2019 Form on iOS

How to make an eSignature for the What Is A Credit Union Fiduciary Account 2013 2019 Form on Android

People also ask

-

What is a BECU fiduciary account application?

The BECU fiduciary account application is a specific form that allows individuals to manage accounts on behalf of another person, typically in a professional capacity. This application ensures compliance with legal requirements and outlines the authority granted to the fiduciary. Using airSlate SignNow simplifies the process of signing and submitting this application.

-

How can I complete the BECU fiduciary account application quickly?

You can complete the BECU fiduciary account application quickly by utilizing airSlate SignNow's intuitive platform that allows for easy document editing and signing. The digital interface streamlines the completion of forms, reducing the time needed for paperwork. Plus, electronic signatures are legally binding, making the process efficient and secure.

-

What are the fees associated with the BECU fiduciary account application?

While the BECU fiduciary account application may not have direct fees, associated services may incur costs. Utilizing airSlate SignNow provides an affordable solution for document management and signature services, helping you avoid additional expenses related to traditional paperwork. Always check with BECU for any specific account-related fees.

-

What features does airSlate SignNow offer for the BECU fiduciary account application?

AirSlate SignNow offers several features to enhance the BECU fiduciary account application process. These include customizable templates, secure electronic signature options, and the ability to share documents with multiple signers. This ensures that you can complete your fiduciary tasks efficiently and securely.

-

What are the benefits of using airSlate SignNow for the BECU fiduciary account application?

Using airSlate SignNow for the BECU fiduciary account application provides numerous benefits, including increased efficiency and reduced paperwork errors. Additionally, the platform allows for real-time tracking of document status, so you know when your application is signed and submitted. This level of transparency helps streamline the fiduciary management process.

-

Can I integrate airSlate SignNow with other tools for my BECU fiduciary account application?

Yes, airSlate SignNow can be integrated with various tools to support the BECU fiduciary account application process. This includes integrations with CRMs, document storage systems, and more to create a seamless workflow. Such integrations facilitate easier document management and enhance overall efficiency.

-

Is the process of submitting the BECU fiduciary account application secure?

Absolutely, submitting the BECU fiduciary account application through airSlate SignNow is secure. The platform uses advanced encryption methods to protect sensitive information and ensure that your documents remain confidential. Trust in airSlate SignNow to handle your fiduciary needs with the highest security standards.

Get more for Fiduciary Account Application

- Find commonwealth of kentucky department of revenue forms amended employers return

- Kansas dept of dcf payment voucher form

- City of cincinnati annual reconciliation form

- Staff action plan opwdd form

- To prevent delays in processing your prior authorization request fill out this form in its entirety

- Superimposed major medical claim form osaunion osaunion

- Patient address please print form

- 638 columbus avenue 91st street mountsinai form

Find out other Fiduciary Account Application

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself