Oxford House Behavior Contract Form

What is the Oxford House Behavior Contract

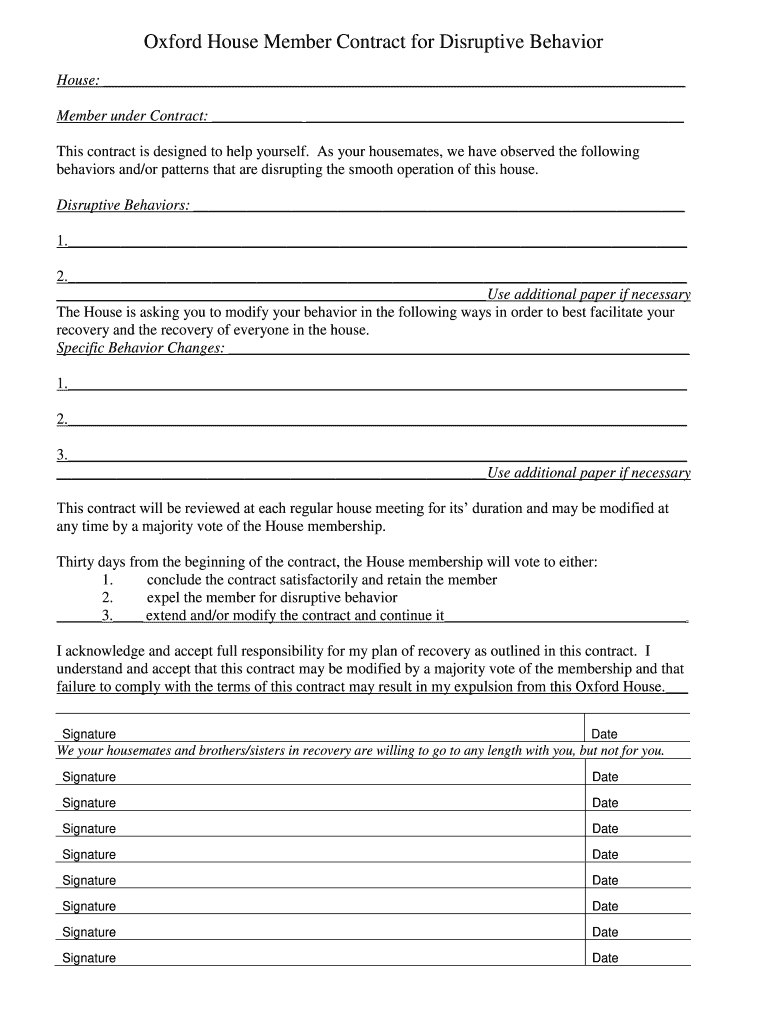

The Oxford House Behavior Contract is a formal agreement designed to outline the expectations and responsibilities of individuals residing in an Oxford House. This document serves to promote a supportive living environment that encourages accountability and positive behavior among house members. It typically includes guidelines on conduct, participation in house meetings, and compliance with house rules. The contract is essential for maintaining a harmonious community and ensuring that all members adhere to the principles of sobriety and mutual support.

How to obtain the Oxford House Behavior Contract

To obtain the Oxford House Behavior Contract, individuals can start by contacting their local Oxford House chapter. Each chapter may have its own specific version of the contract, tailored to its unique needs and regulations. Additionally, many chapters provide the contract in a downloadable format, such as a PDF, on their official websites. It is important to ensure that the correct version is used, as variations may exist based on state or local guidelines.

Steps to complete the Oxford House Behavior Contract

Completing the Oxford House Behavior Contract involves several key steps:

- Download the contract: Access the appropriate version of the Oxford House Behavior Contract in PDF format.

- Fill in personal information: Provide necessary details such as name, address, and contact information.

- Review house rules: Carefully read through the expectations and responsibilities outlined in the contract.

- Sign the contract: Ensure that all required signatures are provided, which may include co-signers or house representatives.

- Submit the contract: Return the completed contract to the designated house leader or administrator for processing.

Legal use of the Oxford House Behavior Contract

The Oxford House Behavior Contract is legally binding, provided it meets specific criteria under U.S. law. For the contract to be enforceable, it must be signed by all parties involved, and the terms must be clear and agreed upon. Electronic signatures are acceptable, as long as they comply with regulations such as the ESIGN Act and UETA. This legal recognition ensures that the contract can be upheld in a court of law if necessary, making it a crucial document for maintaining order within the house.

Key elements of the Oxford House Behavior Contract

Key elements of the Oxford House Behavior Contract typically include:

- Behavior expectations: Clear guidelines on acceptable and unacceptable behaviors within the house.

- Consequences for disruptive behavior: Outlines the repercussions for failing to adhere to the established rules.

- Participation requirements: Details regarding attendance at house meetings and involvement in community activities.

- Commitment to sobriety: A pledge to maintain sobriety and support fellow members in their recovery journey.

Eligibility Criteria

Eligibility for signing the Oxford House Behavior Contract generally requires individuals to be residents of an Oxford House. Prospective members must demonstrate a commitment to sobriety and a willingness to adhere to the house rules. Additionally, some chapters may have specific criteria based on state regulations or house policies, which should be reviewed before applying.

Quick guide on how to complete oxford house member contract for disruptive behavior oxfordhousekansas

Complete Oxford House Behavior Contract seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Oxford House Behavior Contract on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Oxford House Behavior Contract effortlessly

- Obtain Oxford House Behavior Contract and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Oxford House Behavior Contract and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

When filling out form I-864 for a Fiance(e) Visa, what is the difference between doing (1) co-sponsorship and (2) including a house member in co-payment of the minimum financial requirement (i.e., attaching the form I-864a to I-864)?

You don't do I-864 for a fiance visa. You do an I-134.

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

-

If I am neat, does that mean I am unusually messy (double negative=positive) or unusually neat (like it is unusual on how neat I am)? I am trying to fill out a form for my housing for college next year.

In this context, “unusually” means “extremely”. Unusual is not a negative, so the concept of a double negative does not apply.Unusually messy = you cannot see your bedroom floor due to the things strewn all over it. There might be some unfinished food under there somewhere, too…Messy = yeah, there’s a bunch of stuff laying around, but you can see the floor and tell where the furniture is.Neat = pretty much everything is put where it belongsUnusually neat = absolutely everything has a place and you would find it annoying and distracting to share a space with someone who was not the same way.

Create this form in 5 minutes!

How to create an eSignature for the oxford house member contract for disruptive behavior oxfordhousekansas

How to make an electronic signature for your Oxford House Member Contract For Disruptive Behavior Oxfordhousekansas online

How to generate an eSignature for your Oxford House Member Contract For Disruptive Behavior Oxfordhousekansas in Chrome

How to make an eSignature for putting it on the Oxford House Member Contract For Disruptive Behavior Oxfordhousekansas in Gmail

How to create an electronic signature for the Oxford House Member Contract For Disruptive Behavior Oxfordhousekansas from your smartphone

How to make an eSignature for the Oxford House Member Contract For Disruptive Behavior Oxfordhousekansas on iOS

How to generate an electronic signature for the Oxford House Member Contract For Disruptive Behavior Oxfordhousekansas on Android

People also ask

-

What are Oxford House forms and why are they important?

Oxford House forms are essential documents used in the management and operation of Oxford Houses, supporting sober living environments. These forms help ensure compliance, facilitate communication, and maintain organization within the house. By using airSlate SignNow, you can easily create, send, and eSign these critical documents, making your operations more efficient.

-

How can airSlate SignNow help with Oxford House forms?

airSlate SignNow simplifies the process of creating and managing Oxford House forms by providing an intuitive interface for document generation and electronic signatures. With our platform, you can streamline workflows, reduce paperwork, and enhance collaboration among house members. Plus, our real-time tracking ensures you never lose track of your important forms.

-

What features does airSlate SignNow offer for managing Oxford House forms?

airSlate SignNow offers several features ideal for handling Oxford House forms, including customizable templates, secure eSigning, and automated workflows. These tools help you save time and reduce errors while ensuring that all necessary forms are completed and signed promptly. Our platform is designed to cater specifically to the needs of communities like yours.

-

Is airSlate SignNow cost-effective for managing Oxford House forms?

Yes, airSlate SignNow is a cost-effective solution for managing Oxford House forms, offering various pricing plans to fit different budgets. The platform allows you to eliminate the costs associated with paper forms and manual processes. With our transparent pricing, you can access powerful features without breaking the bank, making it ideal for Oxford Houses.

-

Can I integrate airSlate SignNow with other tools for managing Oxford House forms?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing your ability to manage Oxford House forms. You can connect with tools like Google Drive, Dropbox, and various CRMs to streamline your document management processes. This ensures that all your important documents are easily accessible and manageable in one place.

-

What benefits do I gain by using airSlate SignNow for Oxford House forms?

Using airSlate SignNow for Oxford House forms provides numerous benefits, including enhanced efficiency, reduced operational costs, and improved accuracy. The ability to create and eSign forms electronically minimizes delays and keeps your house organized. Ultimately, these benefits lead to a smoother operation and better support for residents in a sober living environment.

-

Are there templates available for Oxford House forms in airSlate SignNow?

Yes, airSlate SignNow provides a variety of templates specifically designed for Oxford House forms. These templates can be customized to meet your unique needs, ensuring that all necessary information is captured accurately. Utilizing templates saves time and helps maintain consistency in your documentation efforts.

Get more for Oxford House Behavior Contract

Find out other Oxford House Behavior Contract

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free