Transient Occupancy Tax Return Form Sonoma County Sonoma County

What is the Transient Occupancy Tax Return Form Sonoma County

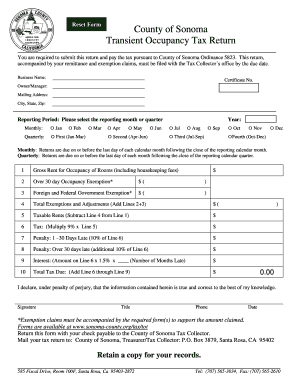

The Transient Occupancy Tax Return Form Sonoma County is a document used by property owners and operators in Sonoma County to report and remit the transient occupancy tax (TOT). This tax applies to individuals who rent lodging for a period of less than thirty days. The form collects essential information regarding the rental activity, including the total number of nights rented, the rental income earned, and the applicable tax rate. Proper completion of this form ensures compliance with local tax regulations and supports the funding of community services.

How to use the Transient Occupancy Tax Return Form Sonoma County

To use the Transient Occupancy Tax Return Form Sonoma County effectively, begin by gathering all relevant rental information, including the rental period, total income, and any exemptions that may apply. Fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for accuracy and ensure that the total tax due is correctly calculated. The form can then be submitted online or by mail, depending on the preferred submission method.

Steps to complete the Transient Occupancy Tax Return Form Sonoma County

Completing the Transient Occupancy Tax Return Form Sonoma County involves several key steps:

- Gather necessary documents, including rental agreements and income records.

- Fill in your personal and property information at the top of the form.

- Report the total number of nights rented and the total rental income earned.

- Calculate the transient occupancy tax based on the applicable rate.

- Sign and date the form to certify its accuracy.

- Submit the completed form by the specified deadline.

Legal use of the Transient Occupancy Tax Return Form Sonoma County

The legal use of the Transient Occupancy Tax Return Form Sonoma County is crucial for compliance with local tax laws. This form serves as an official record of rental activities and tax obligations. By submitting this form, property owners affirm that the information provided is accurate and complete. Failure to submit the form or inaccuracies in reporting can lead to penalties or fines, making it essential to understand the legal implications of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Transient Occupancy Tax Return Form Sonoma County are typically set quarterly. Property owners must submit the form by the last day of the month following the end of each quarter. For example, the deadlines are usually January 31 for the fourth quarter, April 30 for the first quarter, July 31 for the second quarter, and October 31 for the third quarter. It is important to stay informed about these dates to avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The Transient Occupancy Tax Return Form Sonoma County can be submitted through various methods to accommodate different preferences. Property owners have the option to submit the form online via the county's official website, which provides a convenient and efficient way to file. Alternatively, the form can be mailed to the appropriate county office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits individual needs.

Quick guide on how to complete transient occupancy tax return form sonoma county sonoma county

Complete Transient Occupancy Tax Return Form Sonoma County Sonoma county effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Transient Occupancy Tax Return Form Sonoma County Sonoma county on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Transient Occupancy Tax Return Form Sonoma County Sonoma county with ease

- Locate Transient Occupancy Tax Return Form Sonoma County Sonoma county and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Transient Occupancy Tax Return Form Sonoma County Sonoma county and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transient occupancy tax return form sonoma county sonoma county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Transient Occupancy Tax Return Form for Sonoma County?

The Transient Occupancy Tax Return Form Sonoma County is a document that lodging providers must complete to report and pay transient occupancy taxes. This form is essential for compliance with local regulations and helps ensure that the county accurately collects tax revenues. By using this form correctly, businesses avoid penalties and keep their operations smooth.

-

How do I complete the Transient Occupancy Tax Return Form Sonoma County?

To complete the Transient Occupancy Tax Return Form Sonoma County, gather all necessary information about your accommodations, occupancy rates, and tax amounts owed. You can fill out the form manually or use a digital solution like airSlate SignNow, which simplifies the eSignature process. Ensure to review your entries for accuracy before submission to avoid delays.

-

What are the deadlines for submitting the Transient Occupancy Tax Return Form Sonoma County?

The deadlines for submitting the Transient Occupancy Tax Return Form Sonoma County typically align with the county's fiscal reporting periods. Generally, forms must be submitted quarterly, with specific due dates outlined by the Sonoma County tax authority. Timely submissions are crucial to avoid late fees and penalties.

-

What features does airSlate SignNow offer for the Transient Occupancy Tax Return Form Sonoma County?

airSlate SignNow offers numerous features to expedite the submission of the Transient Occupancy Tax Return Form Sonoma County. These include eSigning capabilities, document tracking, and secure cloud storage. With airSlate, you can streamline your workflow, ensuring that your tax forms are completed and submitted accurately and on time.

-

Is there a fee to use the Transient Occupancy Tax Return Form Sonoma County through airSlate SignNow?

Yes, while airSlate SignNow provides a cost-effective solution for managing the Transient Occupancy Tax Return Form Sonoma County, there are associated fees depending on the subscription plan you choose. These fees grant access to various features that enhance your document signing and management experience. It's recommended to review the pricing details on the website to find the plan that best fits your needs.

-

Can I integrate airSlate SignNow with other software for filing the Transient Occupancy Tax Return Form Sonoma County?

Absolutely! airSlate SignNow is designed to integrate with a variety of software platforms, allowing seamless handling of the Transient Occupancy Tax Return Form Sonoma County. Whether you use accounting software or property management systems, integrations can enhance efficiency and reduce manual data entry, streamlining your tax filing process.

-

What benefits will using airSlate SignNow for the Transient Occupancy Tax Return Form Sonoma County provide?

Using airSlate SignNow to manage the Transient Occupancy Tax Return Form Sonoma County offers signNow benefits, including time savings, enhanced accuracy, and a reduced risk of errors. The platform's user-friendly interface allows for easy eSigning and document sharing, meaning your tax forms will be processed faster and more efficiently. Additionally, you can access your forms anytime, ensuring you never miss a deadline.

Get more for Transient Occupancy Tax Return Form Sonoma County Sonoma county

- Advance health care directive lawhelporg form

- Field 22 form

- Idaho advance directivedurable power of attorney for health care form

- Type street address form

- Field 4 9 form

- This article is for you to leave your homestead if you have one on the date of form

- Field 23 form

- Illinois will formcreate your own willus legal forms

Find out other Transient Occupancy Tax Return Form Sonoma County Sonoma county

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document