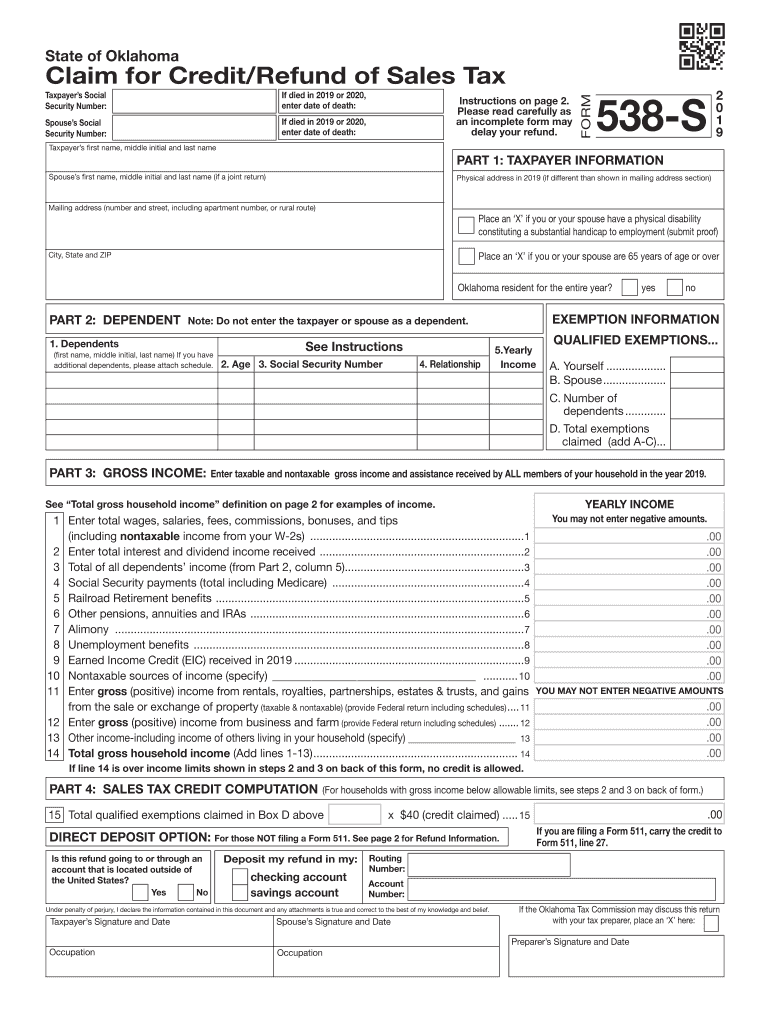

538 Form 2019

What is the 538 Form

The 538 Form, also known as the Oklahoma S Corporation Return, is a tax document used by S corporations operating in Oklahoma to report their income, deductions, and credits. This form is essential for ensuring compliance with state tax laws and is a key component in the overall tax filing process for S corporations. It allows businesses to accurately report their financial activities and determine their tax liability within the state.

How to use the 538 Form

To effectively use the 538 Form, businesses must gather all necessary financial information, including income, expenses, and any applicable deductions. The form requires detailed reporting of the corporation's financial activities for the tax year. Once completed, the form must be submitted to the Oklahoma Tax Commission, either electronically or via mail. Proper completion of the form ensures that the corporation meets its tax obligations and avoids potential penalties.

Steps to complete the 538 Form

Completing the 538 Form involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form with accurate financial data, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form electronically through the appropriate e-filing system or mail it to the Oklahoma Tax Commission.

Following these steps will help ensure that the form is completed correctly and submitted on time.

Legal use of the 538 Form

The legal use of the 538 Form is governed by Oklahoma state tax laws. It is crucial for S corporations to file this form accurately and on time to avoid legal repercussions, such as fines or audits. The form must be signed by an authorized representative of the corporation, and electronic signatures are acceptable under U.S. law, provided they comply with the relevant eSignature regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 538 Form typically align with the federal tax deadlines. S corporations must file their returns by the fifteenth day of the third month following the end of their fiscal year. For most corporations operating on a calendar year, this means the form is due by March 15. It is important to stay informed about any changes to these deadlines to ensure timely submission and compliance.

Required Documents

To complete the 538 Form, several documents are necessary:

- Financial statements, including profit and loss statements.

- Records of all income and expenses incurred during the tax year.

- Documentation for any credits or deductions claimed.

- Previous year’s tax returns for reference.

Having these documents ready will facilitate the accurate and efficient completion of the form.

Quick guide on how to complete survivors benefitssocial security administration

Finalize 538 Form effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Handle 538 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign 538 Form without hassle

- Locate 538 Form and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your amendments.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or disorganized documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 538 Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct survivors benefitssocial security administration

Create this form in 5 minutes!

How to create an eSignature for the survivors benefitssocial security administration

How to create an electronic signature for your Survivors Benefitssocial Security Administration in the online mode

How to make an electronic signature for the Survivors Benefitssocial Security Administration in Google Chrome

How to generate an eSignature for signing the Survivors Benefitssocial Security Administration in Gmail

How to create an eSignature for the Survivors Benefitssocial Security Administration right from your mobile device

How to create an eSignature for the Survivors Benefitssocial Security Administration on iOS devices

How to make an eSignature for the Survivors Benefitssocial Security Administration on Android OS

People also ask

-

What is the process to form to efile Oklahoma S Corp return using airSlate SignNow?

To form to efile Oklahoma S Corp return with airSlate SignNow, start by creating your S Corp documents using our templates. Once your documents are prepared, you can eSign them electronically, ensuring compliance and convenience. After eSigning, you can easily submit your return directly to the Oklahoma tax authorities.

-

What features does airSlate SignNow offer for filing an Oklahoma S Corp return?

airSlate SignNow offers a range of features that streamline the electronic filing of an Oklahoma S Corp return. These include customizable templates, secure eSigning, and integration with various accounting software. This ensures that your documents are not only filed efficiently but also securely.

-

How much does it cost to use airSlate SignNow for efiling an Oklahoma S Corp return?

airSlate SignNow provides competitive pricing for businesses looking to form to efile Oklahoma S Corp return. Our pricing plans are affordable and designed to fit various business needs, ensuring that you get the best value for your electronic filing requirements. Additionally, we offer a free trial to explore our features before making a commitment.

-

Can I integrate airSlate SignNow with other software for my Oklahoma S Corp return?

Yes, airSlate SignNow can be easily integrated with various accounting and tax software to help you form to efile Oklahoma S Corp return seamlessly. With our API and pre-built integrations, you can connect your existing systems to enhance your document management. This saves you time and reduces the chances of errors during filing.

-

How secure is the information when using airSlate SignNow for efiling?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive information such as an Oklahoma S Corp return. We implement advanced encryption and security protocols to protect your data during transmission and storage. This ensures that your documents remain confidential and secure throughout the efiling process.

-

What are the benefits of using airSlate SignNow for my Oklahoma S Corp return?

Using airSlate SignNow for your Oklahoma S Corp return provides several benefits, including time savings and enhanced accuracy. The intuitive interface simplifies the process of preparing and eFiling your return while ensuring that you remain compliant. Additionally, our eSigning feature expedites approvals, allowing you to focus on growing your business.

-

Is there customer support available when filing my Oklahoma S Corp return?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions about the process of forming to efile Oklahoma S Corp return. Our support team is available via live chat, email, or phone to ensure you receive the help you need when using our platform. We're committed to making your experience smooth and effective.

Get more for 538 Form

Find out other 538 Form

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form