Oklahoma Form 512 E 2019

What is the Oklahoma Form 512 E

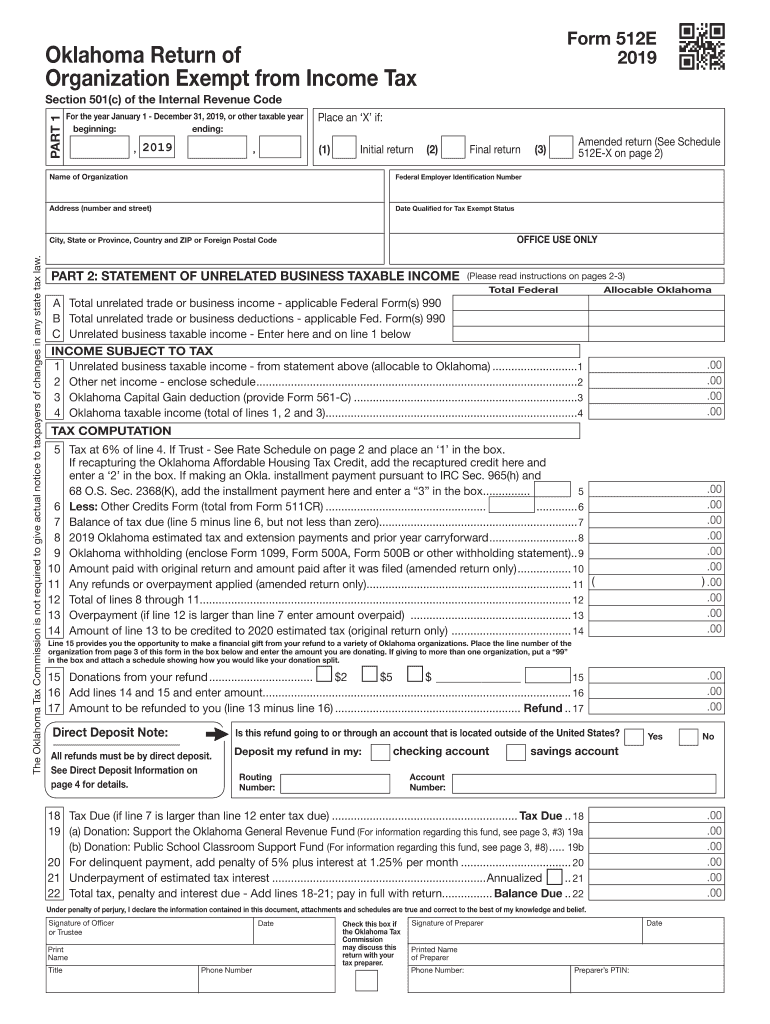

The Oklahoma Form 512 E is a tax document used by organizations that are exempt from income tax. This form is specifically designed for entities that qualify under the Oklahoma Tax Commission guidelines. It allows these organizations to report their financial activities and maintain compliance with state tax regulations. Understanding this form is crucial for ensuring that your organization remains in good standing with the Oklahoma Tax Commission.

How to use the Oklahoma Form 512 E

Using the Oklahoma Form 512 E involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Once the form is filled out, review it for any errors before submission. It is essential to follow the specific instructions provided by the Oklahoma Tax Commission to avoid any compliance issues.

Steps to complete the Oklahoma Form 512 E

Completing the Oklahoma Form 512 E can be broken down into a series of straightforward steps:

- Gather necessary documentation, including financial records and prior tax returns.

- Download the form from the Oklahoma Tax Commission website or access a fillable version online.

- Fill in the organization’s name, address, and other identifying information.

- Report income and expenses accurately, ensuring all figures are supported by documentation.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the Oklahoma Form 512 E

The Oklahoma Form 512 E is legally binding when completed and submitted in accordance with state regulations. Organizations must ensure compliance with the Oklahoma Tax Commission's requirements to maintain their tax-exempt status. This includes accurate reporting of financial activities and timely submission of the form. Failure to comply with these legal obligations may result in penalties or loss of tax-exempt status.

Key elements of the Oklahoma Form 512 E

Several key elements must be included when completing the Oklahoma Form 512 E:

- Organization Information: Name, address, and contact details.

- Financial Information: Detailed reporting of income and expenses.

- Signature: Authorized representative must sign and date the form.

- Attachments: Supporting documents that validate reported figures.

Form Submission Methods

The Oklahoma Form 512 E can be submitted through various methods to accommodate different preferences. Organizations may choose to file the form online using the Oklahoma Tax Commission's e-filing system, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate address provided by the Tax Commission. In-person submission is also an option for those who prefer direct interaction with tax officials.

Quick guide on how to complete 2018 oklahoma corporation income and franchise tax

Complete Oklahoma Form 512 E effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents rapidly and without any holdups. Manage Oklahoma Form 512 E on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric procedure today.

The simplest way to adjust and eSign Oklahoma Form 512 E without any hassle

- Obtain Oklahoma Form 512 E and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive details using tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Oklahoma Form 512 E and ensure clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 oklahoma corporation income and franchise tax

Create this form in 5 minutes!

How to create an eSignature for the 2018 oklahoma corporation income and franchise tax

How to create an eSignature for the 2018 Oklahoma Corporation Income And Franchise Tax in the online mode

How to generate an eSignature for the 2018 Oklahoma Corporation Income And Franchise Tax in Google Chrome

How to make an electronic signature for putting it on the 2018 Oklahoma Corporation Income And Franchise Tax in Gmail

How to generate an eSignature for the 2018 Oklahoma Corporation Income And Franchise Tax from your mobile device

How to create an electronic signature for the 2018 Oklahoma Corporation Income And Franchise Tax on iOS devices

How to create an eSignature for the 2018 Oklahoma Corporation Income And Franchise Tax on Android OS

People also ask

-

What is the Oklahoma Form 512E 2018 fillable and why do I need it?

The Oklahoma Form 512E 2018 fillable is a specific tax form used by individuals and businesses in Oklahoma to report income and calculate tax obligations. Filling out this form accurately is essential to ensure compliance with state tax laws and avoid penalties. By using an electronic fillable version, users can streamline the process and mitigate errors.

-

How can I complete the Oklahoma Form 512E 2018 fillable using airSlate SignNow?

With airSlate SignNow, completing the Oklahoma Form 512E 2018 fillable is simple and efficient. Users can easily upload the form, fill in the required fields, and eSign it directly within the platform. This feature saves time and reduces the hassle of paperwork.

-

Is there a cost associated with using the airSlate SignNow to fill out the Oklahoma Form 512E 2018 fillable?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different needs. Whether you're an individual or a business, you can choose a plan that fits your budget and access the tools necessary for completing the Oklahoma Form 512E 2018 fillable. A cost-effective solution ensures you have the features you need without overspending.

-

Are there any benefits to using airSlate SignNow for the Oklahoma Form 512E 2018 fillable?

Using airSlate SignNow to complete the Oklahoma Form 512E 2018 fillable provides multiple benefits, including enhanced accuracy, increased efficiency, and secure eSigning capabilities. The platform allows you to save time in the completion and filing process. You can also access your documents anytime, anywhere, ensuring you’re always up to date.

-

Can I collaborate with others when completing the Oklahoma Form 512E 2018 fillable?

Absolutely! airSlate SignNow facilitates collaboration by allowing multiple users to access and edit the Oklahoma Form 512E 2018 fillable simultaneously. This feature is particularly useful for teams or family members working together on tax documents, as it ensures that all input is consolidated in one place.

-

What integrations does airSlate SignNow offer that could assist in filing the Oklahoma Form 512E 2018 fillable?

airSlate SignNow integrates seamlessly with various platforms, including Google Drive, Dropbox, and Microsoft Office, enhancing your experience while completing the Oklahoma Form 512E 2018 fillable. These integrations allow you to import documents directly from your preferred cloud storage, making it easier to manage your files.

-

How secure is my information when using airSlate SignNow for the Oklahoma Form 512E 2018 fillable?

Security is a top priority for airSlate SignNow. When using the platform to fill out the Oklahoma Form 512E 2018 fillable, your data is encrypted and stored securely. Compliance with industry standards ensures that your personal and financial information remains protected throughout the process.

Get more for Oklahoma Form 512 E

Find out other Oklahoma Form 512 E

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application